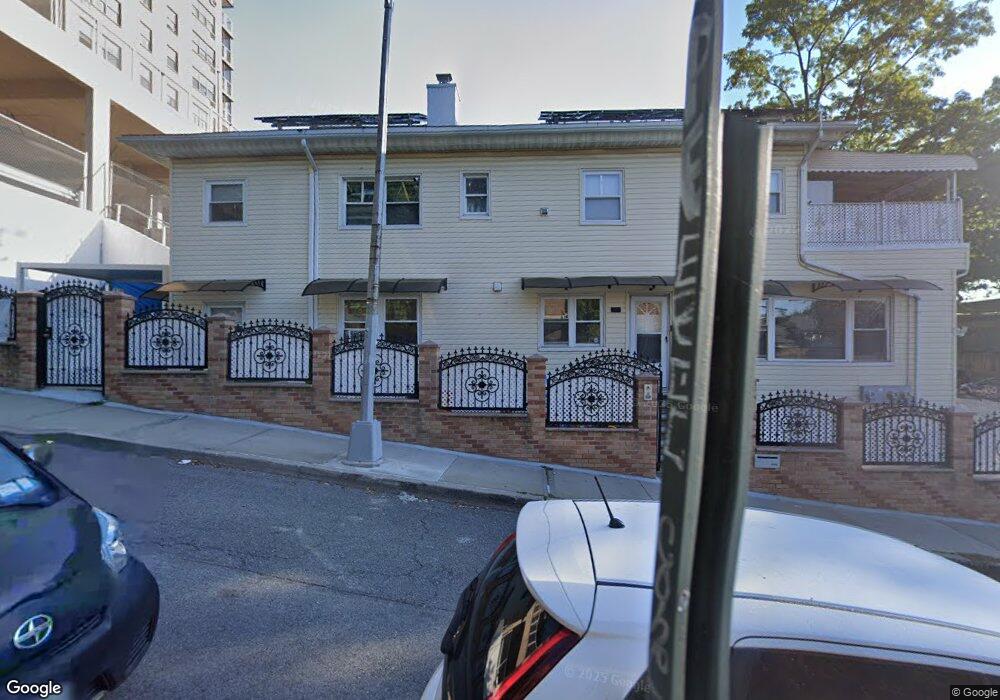

405 W 238th St Bronx, NY 10463

Fieldston NeighborhoodEstimated Value: $838,966 - $1,037,000

--

Bed

2

Baths

1,400

Sq Ft

$656/Sq Ft

Est. Value

About This Home

This home is located at 405 W 238th St, Bronx, NY 10463 and is currently estimated at $918,992, approximately $656 per square foot. 405 W 238th St is a home located in Bronx County with nearby schools including P.S. 81 - Robert J. Christen, John R Bonfield Elementary School, and Riverdale Kingsbridge Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2020

Sold by

405 West 238 Llc

Bought by

Erick Dobgima

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$598,000

Outstanding Balance

$529,083

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$389,909

Purchase Details

Closed on

Oct 30, 2017

Sold by

Osborne John and Osborne Velma

Bought by

405 West 238 Llc

Purchase Details

Closed on

Aug 1, 2006

Sold by

Arias Elvira

Bought by

Osbourne John and Osbourne Velma

Purchase Details

Closed on

Dec 22, 1998

Sold by

Nolan Barbara and Farrell Kathleen

Bought by

Arias Elvira

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Erick Dobgima | $747,500 | -- | |

| Erick Dobgima | $747,500 | -- | |

| 405 West 238 Llc | $610,000 | -- | |

| 405 West 238 Llc | $610,000 | -- | |

| Osbourne John | $525,000 | -- | |

| Osbourne John | $525,000 | -- | |

| Osbourne John | $525,000 | -- | |

| Osbourne John | $525,000 | -- | |

| Arias Elvira | $134,400 | Commonwealth Land Title Ins | |

| Arias Elvira | $134,400 | Commonwealth Land Title Ins | |

| Arias Elvira | $134,400 | Commonwealth Land Title Ins | |

| Arias Elvira | $134,400 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Erick Dobgima | $598,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,955 | $36,419 | $8,253 | $28,166 |

| 2024 | $6,955 | $34,628 | $8,275 | $26,353 |

| 2023 | $5,771 | $33,834 | $7,920 | $25,914 |

| 2022 | $5,609 | $43,440 | $11,040 | $32,400 |

| 2021 | $6,720 | $45,600 | $11,040 | $34,560 |

| 2020 | $6,424 | $50,400 | $11,040 | $39,360 |

| 2019 | $6,037 | $41,580 | $11,040 | $30,540 |

| 2018 | $5,450 | $28,195 | $7,629 | $20,566 |

| 2017 | $5,409 | $28,005 | $6,482 | $21,523 |

| 2016 | $5,009 | $26,608 | $6,652 | $19,956 |

| 2015 | $2,967 | $25,291 | $9,513 | $15,778 |

| 2014 | $2,967 | $24,048 | $10,859 | $13,189 |

Source: Public Records

Map

Nearby Homes

- 3816 Waldo Ave Unit 3D

- 3840 Greystone Ave Unit 2

- 3840 Greystone Ave Unit 4H

- 3840 Greystone Ave Unit BK

- 3840 Greystone Ave Unit 1K

- 3840 Greystone Ave Unit 5L

- 3840 Greystone Ave Unit 5O

- 3810 Greystone Ave Unit 106

- 3650 Waldo Ave

- 3636 Greystone Ave Unit 3L

- 3636 Greystone Ave Unit 6M

- 3875 Waldo Ave Unit 5M

- 3875 Waldo Ave Unit 11K

- 3875 Waldo Ave Unit 6K

- 3875 Waldo Ave Unit 2C

- 474 W 238th St Unit 6G

- 474 W 238th St Unit 6A

- 3607 Irwin Ave

- 3600 Fieldston Rd Unit 4F

- 3600 Fieldston Rd Unit 4K

- 405 W 238th St

- 405 W 238th St

- 405 W 238th St

- 405 W 238 St

- 3661 Irwin Ave

- 3659 Irwin Ave

- 3800 Irwin Ave

- 3660 Irwin Ave

- 3660 Irwin Ave Unit 1

- 320 W 238th St

- 320 W 238th St Unit 3

- 320 W 238th St Unit 1

- 3800 Waldo Ave Unit 3802

- 3800 Waldo Ave Unit 9F

- 3800 Waldo Ave Unit 4E

- 3800 Waldo Ave Unit 20D

- 3800 Waldo Ave Unit 8B

- 3800 Waldo Ave Unit 56

- 3800 Waldo Ave Unit 16E

- 3800 Waldo Ave Unit 12D