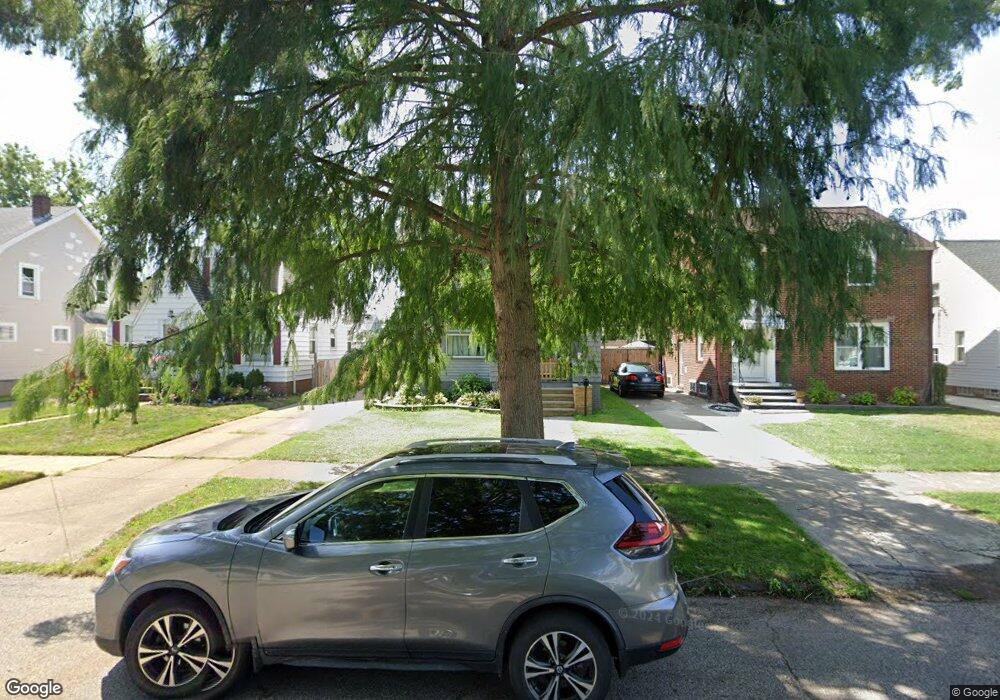

4052 W 160th St Cleveland, OH 44135

Kamm's Corners NeighborhoodEstimated Value: $191,395 - $255,000

3

Beds

2

Baths

1,200

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 4052 W 160th St, Cleveland, OH 44135 and is currently estimated at $226,849, approximately $189 per square foot. 4052 W 160th St is a home located in Cuyahoga County with nearby schools including Artemus Ward School, Almira Academy, and Benjamin Franklin.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2009

Sold by

Stone Stanley and Stone Livia

Bought by

Smith Lara E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,953

Outstanding Balance

$70,966

Interest Rate

4.92%

Mortgage Type

FHA

Estimated Equity

$155,883

Purchase Details

Closed on

May 19, 2000

Sold by

Mahon David M and Mahon Debra A

Bought by

Stone Stanley A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,443

Interest Rate

8.21%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 13, 1990

Sold by

Bartsche Charles E

Bought by

Bartsche Joanne T

Purchase Details

Closed on

Dec 1, 1980

Sold by

Charles E Bartsche

Bought by

Bartsche Charles E

Purchase Details

Closed on

Jul 22, 1977

Sold by

Bartsche Charles E and Bartsche Lillian

Bought by

Bartsche Charles E

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bartsche Charles E and Bartsche Lillian

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Lara E | $113,000 | Chicago Title Insurance Co | |

| Stone Stanley A | $111,000 | Insignia Title Agency Ltd | |

| Bartsche Joanne T | -- | -- | |

| Bartsche Charles E | -- | -- | |

| Charles E Bartsche | $26,700 | -- | |

| Bartsche Charles E | -- | -- | |

| Bartsche Charles E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Lara E | $110,953 | |

| Previous Owner | Stone Stanley A | $111,443 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,768 | $57,470 | $12,215 | $45,255 |

| 2023 | $3,380 | $44,560 | $9,870 | $34,690 |

| 2022 | $3,360 | $44,560 | $9,870 | $34,690 |

| 2021 | $3,327 | $44,560 | $9,870 | $34,690 |

| 2020 | $2,960 | $34,270 | $7,600 | $26,670 |

| 2019 | $2,737 | $97,900 | $21,700 | $76,200 |

| 2018 | $2,727 | $34,270 | $7,600 | $26,670 |

| 2017 | $2,898 | $35,150 | $6,690 | $28,460 |

| 2016 | $2,876 | $35,150 | $6,690 | $28,460 |

| 2015 | $2,625 | $35,150 | $6,690 | $28,460 |

| 2014 | $2,625 | $31,960 | $6,090 | $25,870 |

Source: Public Records

Map

Nearby Homes

- 4096 W 161st St

- 4049 W 157th St

- 15804 Chatfield Ave

- 3942 W 160th St

- 3918 W 160th St

- 4267 W 162nd St

- 17202 Melgrave Ave

- 16312 Laverne Ave

- 16701 Elsienna Ave

- 17301 Bradgate Ave

- 17408 Elsienna Ave

- 17705 Susan Ave

- 15617 Leigh Ellen Ave

- 17706 Susan Ave

- 15617 Mina Ave

- 3726 W 169th St

- 14513 Mission Rd

- 14511 Saint James Ave

- 4413 W 173rd St

- 14434 Cleminshaw Rd

- 4056 W 160th St

- 4048 W 160th St

- 4060 W 160th St

- 4044 W 160th St

- 4064 W 160th St

- 4053 W 161st St

- 4040 W 160th St

- 4057 W 161st St

- 4049 W 161st St

- 4061 W 161st St

- 4045 W 161st St

- 4068 W 160th St

- 4036 W 160th St

- 4063 W 161st St

- 4041 W 161st St

- 4053 W 160th St

- 4057 W 160th St

- 4049 W 160th St

- 4061 W 160th St

- 4045 W 160th St