40W635 Old Mill Ct Elgin, IL 60124

Bowes NeighborhoodEstimated Value: $812,000 - $941,000

3

Beds

5

Baths

4,160

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 40W635 Old Mill Ct, Elgin, IL 60124 and is currently estimated at $894,602, approximately $215 per square foot. 40W635 Old Mill Ct is a home located in Kane County with nearby schools including Howard B. Thomas Grade School, Prairie Knolls Middle School, and Central Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 21, 2020

Sold by

Kemp Kevin L and The Kevin L Kemp Revocable Tru

Bought by

Kemp Kevin L and Kemp Pamela E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,000

Outstanding Balance

$310,298

Interest Rate

2.62%

Mortgage Type

New Conventional

Estimated Equity

$584,304

Purchase Details

Closed on

Oct 8, 2015

Sold by

Kemp Kevin L and Kemp Pamela E

Bought by

The Kevin L Kemp Revocable Trust and The Pamela E Kemp Revocable Trust

Purchase Details

Closed on

Aug 11, 2006

Sold by

Sierra Homes Inc

Bought by

Kemp Kevin L and Kemp Pamela E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$730,000

Interest Rate

6.83%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 12, 2004

Sold by

B & B Enterprises

Bought by

Ward David E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,000

Interest Rate

5.85%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kemp Kevin L | -- | Novas Title Company Llc | |

| The Kevin L Kemp Revocable Trust | -- | Attorney | |

| Kemp Kevin L | $962,000 | Chicago Title Insurance Co | |

| Ward David E | $115,000 | Chicago Title Insurance Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kemp Kevin L | $450,000 | |

| Previous Owner | Kemp Kevin L | $730,000 | |

| Previous Owner | Ward David E | $92,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $21,463 | $272,675 | $48,642 | $224,033 |

| 2023 | $20,666 | $246,653 | $44,000 | $202,653 |

| 2022 | $19,612 | $225,575 | $34,171 | $191,404 |

| 2021 | $19,442 | $217,926 | $33,012 | $184,914 |

| 2020 | $19,386 | $214,010 | $32,419 | $181,591 |

| 2019 | $19,329 | $211,243 | $32,000 | $179,243 |

| 2018 | $18,862 | $206,941 | $27,551 | $179,390 |

| 2017 | $18,367 | $199,343 | $26,853 | $172,490 |

| 2016 | $19,442 | $194,614 | $26,216 | $168,398 |

| 2015 | -- | $194,614 | $26,216 | $168,398 |

| 2014 | -- | $188,275 | $26,216 | $162,059 |

| 2013 | -- | $192,439 | $26,664 | $165,775 |

Source: Public Records

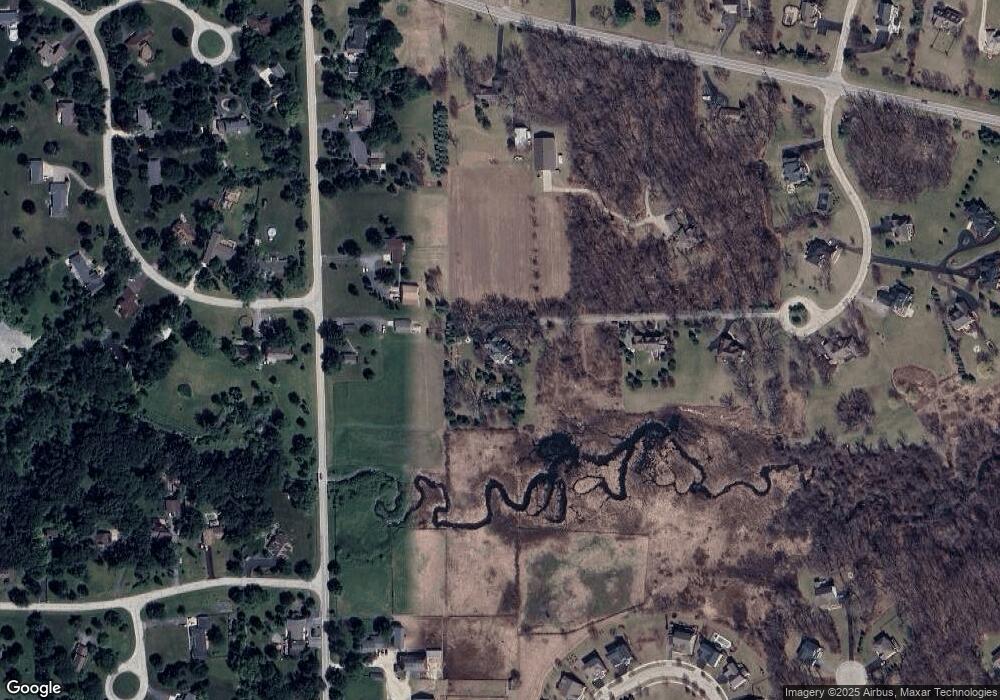

Map

Nearby Homes

- 4378 John Milton Rd

- 4375 Rudyard Kipling Rd

- 3858 Kingsmill Dr

- 41W591 Lenz Rd

- 10N800 Muirhead Rd

- 3646 Thornhill Dr

- 3660 Thornhill Dr

- 1216 Rockway Glen Ct

- 1146 Falcon Ridge Dr

- 9N601 Santa fe Trail

- 1127 Pine Valley Ct

- 10N874 Rippburger Rd

- Lot 10 Russinwood Ct

- Lot 8 Russinwood Ct

- 3539 Crosswater Ct

- 3587 Sandstone Cir

- Newcastle Plan at Ponds of Stony Creek - Phase II

- Windsor Plan at Ponds of Stony Creek - Phase II

- Bluestone Plan at Ponds of Stony Creek - Phase II

- Auburn Plan at Ponds of Stony Creek - Phase II

- 9N727 Crawford Rd

- 9N791 Crawford Rd

- 40W553 Old Mill Ct

- 40W565 Bowes Rd

- 40W565 Bowes Rd

- 40W565 Bowes Rd

- 40W785 Bowes Bend Dr

- Lot 3 Old Mill Ct

- 40W768 Bowes Bend Dr

- 40W651 Bowes Rd

- 9N849 Crawford Rd

- 40W800 Bowes Bend Dr

- 40W770 Creekwood Dr

- 3 Old Mill Ct

- 2 Old Mill Ct

- 4380 John Milton Rd

- 4382 John Milton Rd

- 9N899 Crawford Rd

- 40W798 Bending Ln

- 40W519 Bowes Rd