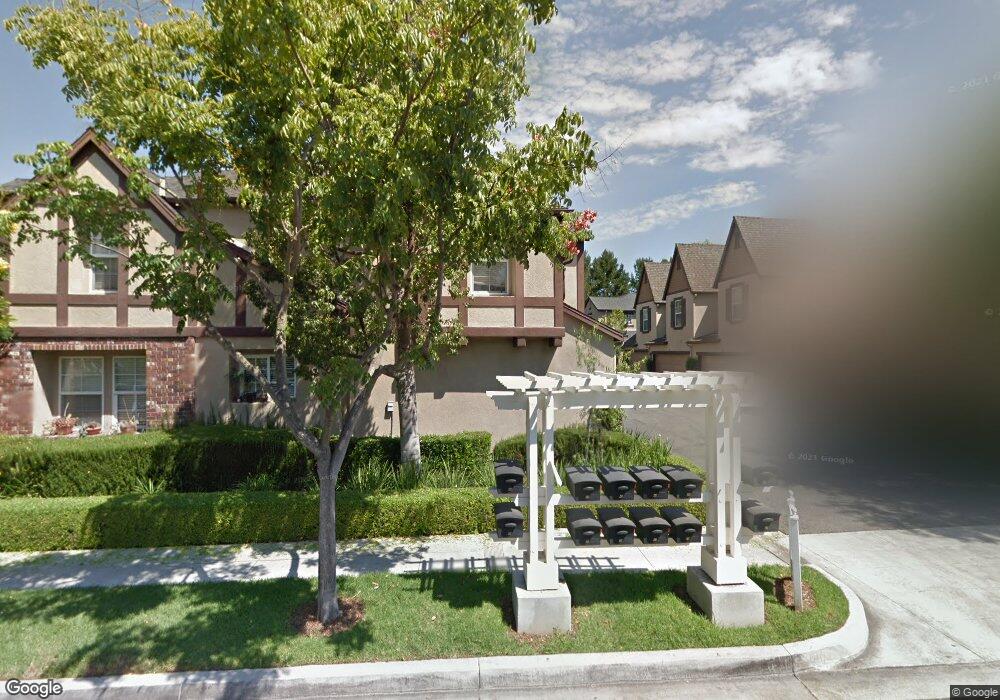

41 Three Vines Ct Unit 1902 Ladera Ranch, CA 92694

Estimated Value: $763,515 - $847,000

2

Beds

2

Baths

1,252

Sq Ft

$648/Sq Ft

Est. Value

About This Home

This home is located at 41 Three Vines Ct Unit 1902, Ladera Ranch, CA 92694 and is currently estimated at $810,879, approximately $647 per square foot. 41 Three Vines Ct Unit 1902 is a home located in Orange County with nearby schools including Chaparral Elementary School, Ladera Ranch Middle School, and Tesoro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2023

Sold by

Hughes Jon D and Hughes Tamara K

Bought by

Hughes Living Trust and Hughes

Current Estimated Value

Purchase Details

Closed on

Apr 16, 2004

Sold by

Babakhanian Armen and Babakhanian Estineh

Bought by

Hughes Jon D and Hughes Tamara K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$354,400

Interest Rate

5.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 20, 2002

Sold by

Babakhanian Armen

Bought by

Babakhanian Armen and Babakhanian Estineh

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,000

Interest Rate

5.87%

Purchase Details

Closed on

Jan 17, 2001

Sold by

Centex Homes

Bought by

Babkhanian Armen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,150

Interest Rate

7.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hughes Living Trust | -- | None Listed On Document | |

| Hughes Jon D | $443,000 | First American Title Co | |

| Babakhanian Armen | -- | Landsafe Title | |

| Babkhanian Armen | $213,000 | Benefit Land Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hughes Jon D | $354,400 | |

| Previous Owner | Babakhanian Armen | $173,000 | |

| Previous Owner | Babkhanian Armen | $170,150 | |

| Closed | Babkhanian Armen | $21,250 | |

| Closed | Babakhanian Armen | $43,000 | |

| Closed | Hughes Jon D | $66,450 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,559 | $629,847 | $428,270 | $201,577 |

| 2024 | $7,559 | $617,498 | $419,873 | $197,625 |

| 2023 | $6,778 | $541,460 | $380,137 | $161,323 |

| 2022 | $6,670 | $530,844 | $372,684 | $158,160 |

| 2021 | $6,569 | $520,436 | $365,377 | $155,059 |

| 2020 | $6,484 | $515,100 | $361,630 | $153,470 |

| 2019 | $6,558 | $505,000 | $354,539 | $150,461 |

| 2018 | $6,606 | $505,000 | $354,539 | $150,461 |

| 2017 | $5,965 | $434,000 | $283,539 | $150,461 |

| 2016 | $5,675 | $406,000 | $255,539 | $150,461 |

| 2015 | $5,758 | $406,000 | $255,539 | $150,461 |

| 2014 | $5,643 | $386,575 | $236,114 | $150,461 |

Source: Public Records

Map

Nearby Homes

- 9 Three Vines Ct

- 9 Paverstone Ln

- 28 Albany St Unit 77

- 12 Roycroft Ct

- 30 Savannah Ln

- 518 Afterglow Dr

- 2 Aryshire Ln

- 5232 Solace Dr

- 5257 Solace Dr

- 346 Hazel Dr

- 18811 Volta Rd

- 5104 Solace Dr

- 5273 Solace Dr

- 246 Sunstone Place

- 129 Sklar St Unit 34

- 15 Whitworth St

- 29 Maybeck Ln

- 19 Vinca Ct

- 36 Amesbury Ct

- 62 Iron Horse Trail

- 78 Three Vines Ct Unit 1

- 78 Three Vines Ct

- 60 Three Vines Ct Unit 1501

- 61 Three Vines Ct

- 57 Three Vines Ct

- 20 Three Vines Ct

- 55 Three Vines Ct Unit 1303

- 53 Three Vines Ct Unit 1302

- 35 Three Vines Ct

- 59 Three Vines Ct

- 45 Three Vines Ct

- 51 Three Vines Ct Unit 1301

- 47 Three Vines Ct

- 39 Three Vines Ct Unit 1901

- 37 Three Vines Ct

- 33 Three Vines Ct Unit 2104

- 31 Three Vines Ct

- 29 Three Vines Ct

- 27 Three Vines Ct

- 54 3 Vines Ct