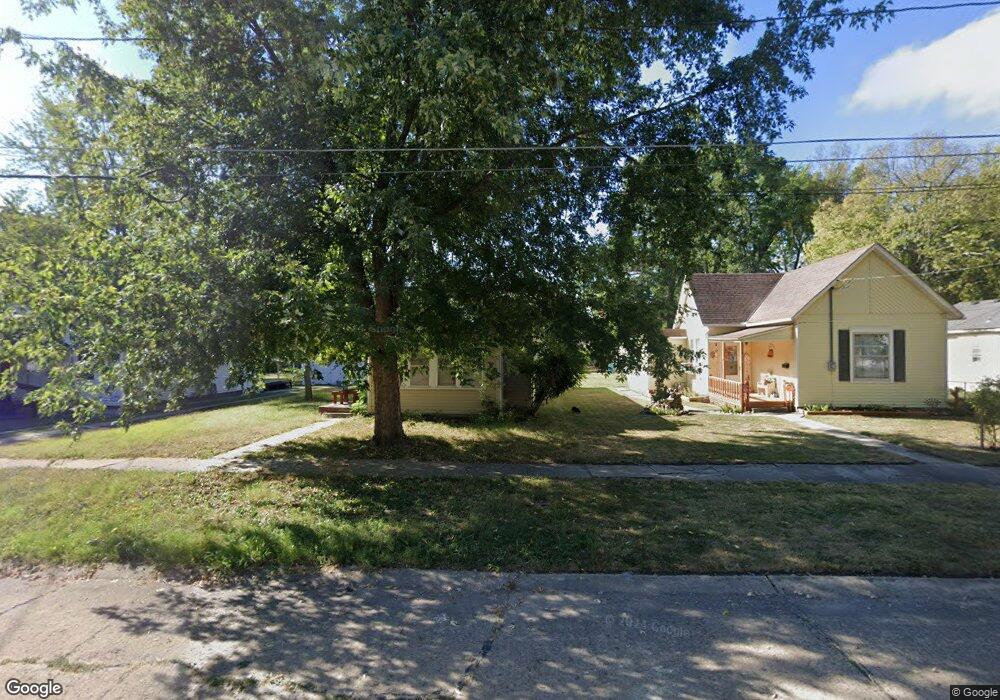

411 Martin Ave Osawatomie, KS 66064

Estimated Value: $156,000 - $160,000

2

Beds

1

Bath

1,000

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 411 Martin Ave, Osawatomie, KS 66064 and is currently estimated at $158,207, approximately $158 per square foot. 411 Martin Ave is a home located in Miami County with nearby schools including Swenson Early Childhood Education Center, Trojan Elementary School, and Osawatomie Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 10, 2024

Sold by

Zimmerman Christine Louise and Zimmerman Joshua Earl

Bought by

Zimmerman Living Trust and Zimmerman

Current Estimated Value

Purchase Details

Closed on

Nov 9, 2021

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Zimmerman Christine Louise and Zimmerman Joshua Earl

Purchase Details

Closed on

Nov 1, 2021

Sold by

Quicken Loans Llc

Bought by

Quicken Loans Llc

Purchase Details

Closed on

Jan 20, 2009

Sold by

Meyer Angela Lea and Meyer Joseph C

Bought by

Noble Karen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,300

Interest Rate

4.91%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zimmerman Living Trust | -- | None Listed On Document | |

| Zimmerman Christine Louise | $75,000 | None Listed On Document | |

| Quicken Loans Llc | -- | None Listed On Document | |

| Noble Karen M | -- | Landmark Title Co Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Noble Karen M | $36,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,138 | $17,235 | $783 | $16,452 |

| 2024 | $3,038 | $16,733 | $702 | $16,031 |

| 2023 | $3,014 | $16,123 | $660 | $15,463 |

| 2022 | $2,469 | $12,581 | $845 | $11,736 |

| 2021 | $2,353 | $0 | $0 | $0 |

| 2020 | $1,874 | $0 | $0 | $0 |

| 2019 | $1,576 | $0 | $0 | $0 |

| 2018 | $1,448 | $0 | $0 | $0 |

| 2017 | $1,415 | $0 | $0 | $0 |

| 2016 | -- | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

| 2013 | -- | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1110 5th St

- 500 Chestnut St

- 818 3rd St

- 140 Matney Dr

- 304 Pacific Ave

- 144 Pacific Ave

- 507 Brown Ave

- 1312 6th St

- 716 Chestnut Ave

- 714 Chestnut Ave

- 300 Brown Ave

- 711 Pacific Ave

- 217 Brown Ave

- 901 Chestnut Ave

- 805 Chestnut Ave

- 137 E Pacific Ave

- 124 E Pacific Ave

- 726 Pacific Ave

- 721 Pacific Ave

- 720 Brown St