4130 Glenlake Terrace NW Unit 2 Kennesaw, GA 30144

Estimated Value: $454,000 - $491,000

4

Beds

3

Baths

2,320

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 4130 Glenlake Terrace NW Unit 2, Kennesaw, GA 30144 and is currently estimated at $470,794, approximately $202 per square foot. 4130 Glenlake Terrace NW Unit 2 is a home located in Cobb County with nearby schools including Pitner Elementary School, Palmer Middle School, and Shiloh Hills Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2007

Sold by

Sutcliffe Geoff L and Sutcliffe Michele N

Bought by

Arjona Katie A and Arjona Michael O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,703

Outstanding Balance

$144,707

Interest Rate

6.05%

Mortgage Type

New Conventional

Estimated Equity

$326,087

Purchase Details

Closed on

Apr 11, 2003

Sold by

Roth James L and Roth Helen C

Bought by

Sutcliffe Geoff L and Sutcliffe Michele N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,200

Interest Rate

5.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 28, 1994

Sold by

Ryland Group

Bought by

Roth James L Helen C M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,950

Interest Rate

7.1%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Arjona Katie A | $239,900 | -- | |

| Sutcliffe Geoff L | $194,000 | -- | |

| Roth James L Helen C M | $168,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Arjona Katie A | $232,703 | |

| Previous Owner | Sutcliffe Geoff L | $155,200 | |

| Previous Owner | Roth James L Helen C M | $159,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,225 | $174,676 | $38,000 | $136,676 |

| 2024 | $4,228 | $174,676 | $38,000 | $136,676 |

| 2023 | $3,686 | $174,676 | $38,000 | $136,676 |

| 2022 | $2,967 | $115,548 | $24,000 | $91,548 |

| 2021 | $2,967 | $115,548 | $24,000 | $91,548 |

| 2020 | $2,784 | $107,192 | $20,000 | $87,192 |

| 2019 | $2,784 | $107,192 | $20,000 | $87,192 |

| 2018 | $2,607 | $99,112 | $20,000 | $79,112 |

| 2017 | $2,219 | $86,712 | $20,000 | $66,712 |

| 2016 | $2,220 | $86,712 | $20,000 | $66,712 |

| 2015 | $1,966 | $75,564 | $16,000 | $59,564 |

| 2014 | $1,983 | $75,564 | $0 | $0 |

Source: Public Records

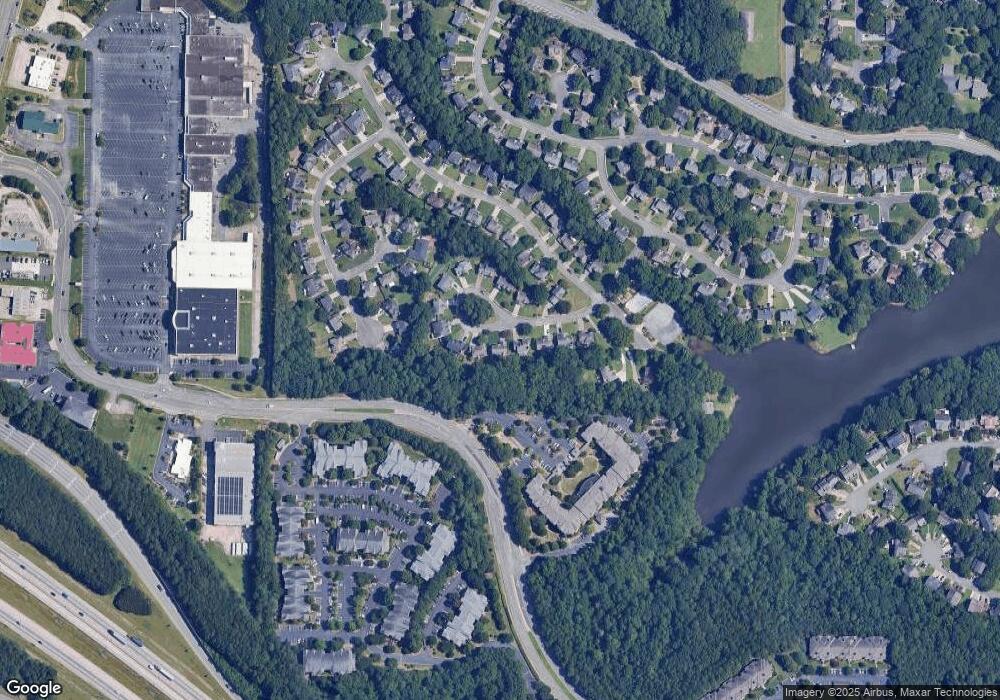

Map

Nearby Homes

- 3981 Bear Ridge Place NW

- 4223 Glenlake Pkwy NW

- 1393 Halpern Ln NW

- 459 Current Ct NE

- 4414 Declan Dr NW

- 1036 Wooten Lake Rd NW

- 1009 Brentmoor Ln NW

- 1172 Rockmart Cir NW

- 4342 White Surrey Dr NW

- 4646 Adams Ln NW

- 4164 Little Springs NW

- 4313 Deep Springs Ct NW

- 4315 Deep Springs Ct NW

- 1282 Shiloh Trail E

- 1281 Parkwood Chase NW

- 4284 Windy Gap Ct NW

- 4134 Glenlake Terrace NW Unit 2

- 4126 Glenlake Terrace NW

- 4126 Glenlake Terrace NW Unit 56

- 4126 NW Glenlake Terrace Terrace NW Unit 56

- 4122 Glenlake Terrace NW

- 4135 Glenlake Terrace NW

- 4142 Glenlake Terrace NW Unit 2

- 4131 Glenlake Terrace NW

- 4118 Glenlake Terrace NW

- 4115 Glenlake Terrace NW

- 0 Glenlake Terrace NW Unit 7281793

- 0 Glenlake Terrace NW Unit 8732457

- 0 Glenlake Terrace NW Unit 8641578

- 0 Glenlake Terrace NW Unit 7472215

- 0 Glenlake Terrace NW Unit 8035495

- 0 Glenlake Terrace NW Unit 8223107

- 4145 Glenlake Terrace NW Unit 2

- 4127 Glenlake Terrace NW Unit 2

- 4005 Glenlake Trace NW

- 4146 Glenlake Terrace NW Unit 53