4155 S Semoran Blvd Unit 13 Orlando, FL 32822

South Semoran NeighborhoodEstimated Value: $125,000 - $161,000

2

Beds

2

Baths

1,214

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 4155 S Semoran Blvd Unit 13, Orlando, FL 32822 and is currently estimated at $148,907, approximately $122 per square foot. 4155 S Semoran Blvd Unit 13 is a home located in Orange County with nearby schools including McCoy Elementary School, Liberty Middle School, and Colonial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2013

Sold by

Investor Trustee Services Llc

Bought by

Pouladian Abraham

Current Estimated Value

Purchase Details

Closed on

Oct 10, 2012

Sold by

Match Point Investments Properties Llc

Bought by

Investor Trustee Services Llc

Purchase Details

Closed on

Dec 23, 2011

Sold by

Galeano Erika and Galeano Gilbert

Bought by

Match Point Investment Properties Llc

Purchase Details

Closed on

Mar 17, 2006

Sold by

Avalon Development Orange County Llc

Bought by

Galeano Gilbert and Galeano Erika

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,192

Interest Rate

7.5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pouladian Abraham | $600,000 | Attorney | |

| Investor Trustee Services Llc | $35,000 | Southeast Professional Title | |

| Match Point Investment Properties Llc | $27,000 | Attorney | |

| Galeano Gilbert | $169,000 | Equity Land Title Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Galeano Gilbert | $135,192 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,172 | $104,526 | -- | -- |

| 2024 | $1,955 | $104,526 | -- | -- |

| 2023 | $1,955 | $133,500 | $26,700 | $106,800 |

| 2022 | $1,714 | $109,300 | $21,860 | $87,440 |

| 2021 | $1,499 | $85,000 | $17,000 | $68,000 |

| 2020 | $1,296 | $72,800 | $14,560 | $58,240 |

| 2019 | $1,258 | $66,800 | $13,360 | $53,440 |

| 2018 | $1,155 | $59,500 | $11,900 | $47,600 |

| 2017 | $1,072 | $54,600 | $10,920 | $43,680 |

| 2016 | $970 | $45,700 | $9,140 | $36,560 |

| 2015 | $898 | $40,300 | $8,060 | $32,240 |

| 2014 | $908 | $40,300 | $8,060 | $32,240 |

Source: Public Records

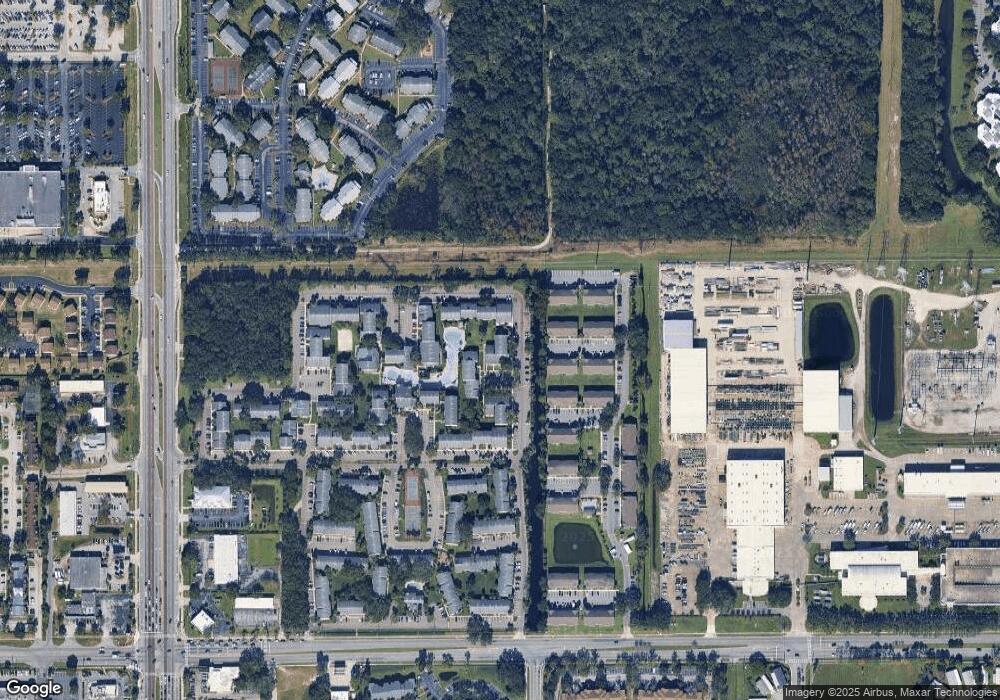

Map

Nearby Homes

- 4113 S Semoran Blvd Unit 2

- 4217 S Semoran Blvd Unit 4

- 4203 S Semoran Blvd Unit 6

- 4223 S Semoran Blvd Unit 9

- 4149 S Semoran Blvd Unit 10

- 4213 S Semoran Blvd Unit 3

- 4267 S Semoran Blvd Unit 2

- 4136 Pershing Pointe Place Unit 5

- 4100 Pershing Pointe Place Unit 5

- 4211 S Semoran Blvd Unit 1

- 4226 Pershing Pointe Place Unit 5

- 4160 Pershing Pointe Place Unit 1

- 4351 S Semoran Blvd Unit 5

- 4403 S Semoran Blvd Unit 3

- 4409 S Semoran Blvd Unit 3

- 4409 S Semoran Blvd

- 4419 S Semoran Blvd Unit 7

- 4572 Commander Dr Unit 1227

- 4536 Commander Dr Unit 1522

- 3807 S Semoran Blvd

- 4155 S Semoran Blvd Unit 18-1

- 4155 S Semoran Blvd Unit 11

- 4155 S Semoran Blvd Unit 100

- 4155 S Semoran Blvd Unit 140

- 4155 S Semoran Blvd Unit 2

- 4155 S Semoran Blvd Unit 3

- 4155 S Semoran Blvd Unit 9

- 4155 S Semoran Blvd Unit 7

- 4155 S Semoran Blvd Unit 5

- 4155 S Semoran Blvd Unit 4

- 4155 S Semoran Blvd Unit 12

- 4155 S Semoran Blvd Unit 1811

- 4155 S Semoran Blvd Unit 10

- 4155 S Semoran Blvd Unit 6

- 4155 S Semoran Blvd Unit 14

- 4155 S Semoran Blvd Unit 80

- 4205 S Semoran Blvd Unit 19-1

- 4205 S Semoran Blvd Unit 19-8

- 4205 S Semoran Blvd Unit 5

- 4205 S Semoran Blvd Unit 9