4157 Barnes Meadow Rd SW Smyrna, GA 30082

Estimated Value: $778,039 - $901,000

6

Beds

5

Baths

4,533

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 4157 Barnes Meadow Rd SW, Smyrna, GA 30082 and is currently estimated at $829,760, approximately $183 per square foot. 4157 Barnes Meadow Rd SW is a home located in Cobb County with nearby schools including Deerwood Elementary School, Russell Elementary School, and Floyd Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 4, 2011

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Eaddy Lisa D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$356,250

Outstanding Balance

$243,542

Interest Rate

4.76%

Mortgage Type

New Conventional

Estimated Equity

$586,218

Purchase Details

Closed on

Oct 5, 2010

Sold by

Bac Home Loans Servicing Lp

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Jan 30, 2006

Sold by

Arnold Noel K

Bought by

Arnold Noel K and Arnold Tara G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,220

Interest Rate

5.7%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eaddy Lisa D | $375,000 | -- | |

| Federal Home Loan Mortgage Corporation | -- | -- | |

| Bac Home Loans Servicing Lp | $353,115 | -- | |

| Arnold Noel K | $572,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Eaddy Lisa D | $356,250 | |

| Previous Owner | Arnold Noel K | $127,220 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,869 | $294,364 | $46,000 | $248,364 |

| 2024 | $8,875 | $294,364 | $46,000 | $248,364 |

| 2023 | $8,875 | $294,364 | $46,000 | $248,364 |

| 2022 | $7,564 | $249,232 | $40,000 | $209,232 |

| 2021 | $6,632 | $218,528 | $40,000 | $178,528 |

| 2020 | $6,158 | $202,912 | $40,000 | $162,912 |

| 2019 | $6,158 | $202,912 | $40,000 | $162,912 |

| 2018 | $6,158 | $202,912 | $40,000 | $162,912 |

| 2017 | $5,577 | $193,972 | $38,000 | $155,972 |

| 2016 | $5,577 | $193,972 | $38,000 | $155,972 |

| 2015 | $5,714 | $193,972 | $38,000 | $155,972 |

| 2014 | $4,456 | $149,988 | $0 | $0 |

Source: Public Records

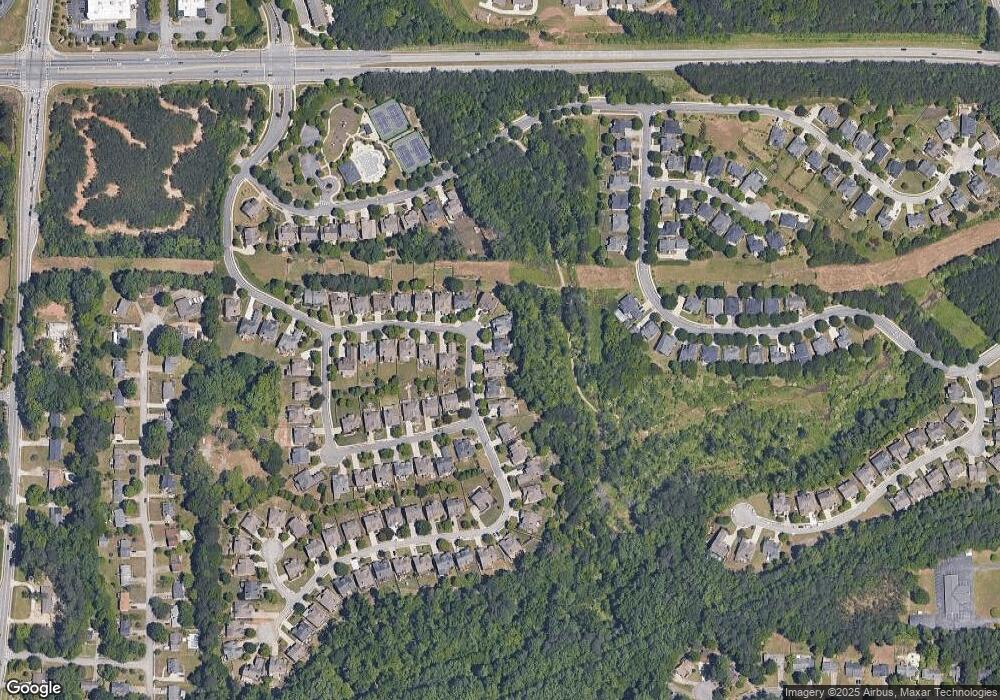

Map

Nearby Homes

- 4055 Hill House Rd SW

- 589 Lawton Bridge Rd SW

- 4187 Alaina Cir Unit 18

- 3869 Merryweather Trail

- 620 Gregory Manor Dr SW

- 3966 Covey Flush Ct SW Unit 20

- 3937 Covey Flush Ct SW Unit 25

- 3898 High Dove Way SW Unit 12

- 3933 Covey Flush Ct SW Unit 25

- 3951 Covered Bridge Rd SW

- 347 Covered Bridge Place SW

- 4066 Covered Bridge Rd SW

- 895 Tyrell Dr

- 482 Majestic Oaks Place

- 936 Tyrell Dr

- 4487 S Springwood Dr SW

- 835 Tranquil Dr

- 3712 Auldyn Dr

- 4161 Barnes Meadow Rd SW

- 4153 Barnes Meadow Rd SW

- 4165 Barnes Meadow Rd SW

- 4149 Barnes Meadow Rd SW

- 4145 Barnes Meadow Rd SW

- 4140 Barnes Meadow Rd SW

- 4169 Barnes Meadow Rd SW

- 4136 Barnes Meadow Rd SW Unit 87

- 4136 Barnes Meadow Rd SW

- 4136 Barnes Meadow Rd SW Unit 4136

- 4170 Barnes Meadow Rd SW

- 4141 Barnes Meadow Rd SW Unit 4141

- 4141 Barnes Meadow Rd SW

- 4173 Barnes Meadow Rd SW

- 692 Longshadow Trail SW

- 4132 Barnes Meadow Rd SW Unit 1

- 4137 Barnes Meadow Rd SW

- 4177 Barnes Meadow Rd SW Unit 1

- 696 Longshadow Trail SW

- 4174 Barnes Meadow Rd SW