4168 Monk Rd Placerville, CA 95667

Estimated Value: $674,000 - $750,000

4

Beds

2

Baths

2,014

Sq Ft

$352/Sq Ft

Est. Value

About This Home

This home is located at 4168 Monk Rd, Placerville, CA 95667 and is currently estimated at $709,925, approximately $352 per square foot. 4168 Monk Rd is a home located in El Dorado County with nearby schools including Indian Creek Elementary School, Herbert C. Green Middle School, and Union Mine High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2024

Sold by

Mitchell Weston J and Mitchell Stephanie

Bought by

Mitchell Family Revocable Living Trust and Mitchell

Current Estimated Value

Purchase Details

Closed on

Aug 27, 2001

Sold by

Mitchell Weston J

Bought by

Mitchell Weston J and Mitchell Stephanie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Interest Rate

7.09%

Purchase Details

Closed on

Nov 29, 1993

Sold by

Mitchell Weston J and Mitchell Wes J

Bought by

Mitchell Weston J and Mitchell Quincey Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,800

Interest Rate

6.74%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mitchell Family Revocable Living Trust | -- | None Listed On Document | |

| Mitchell Weston J | -- | Fidelity National Title Co | |

| Mitchell Weston J | -- | Fidelity National Title Co | |

| Mitchell Weston J | -- | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mitchell Weston J | $208,000 | |

| Previous Owner | Mitchell Weston J | $210,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,275 | $419,179 | $222,969 | $196,210 |

| 2024 | $4,275 | $410,961 | $218,598 | $192,363 |

| 2023 | $4,188 | $402,904 | $214,312 | $188,592 |

| 2022 | $4,125 | $395,005 | $210,110 | $184,895 |

| 2021 | $4,067 | $387,261 | $205,991 | $181,270 |

| 2020 | $4,011 | $383,291 | $203,879 | $179,412 |

| 2019 | $3,947 | $375,777 | $199,882 | $175,895 |

| 2018 | $3,837 | $368,410 | $195,963 | $172,447 |

| 2017 | $3,767 | $361,187 | $192,121 | $169,066 |

| 2016 | $3,725 | $354,105 | $188,354 | $165,751 |

| 2015 | $3,533 | $348,788 | $185,526 | $163,262 |

| 2014 | $3,533 | $341,958 | $181,893 | $160,065 |

Source: Public Records

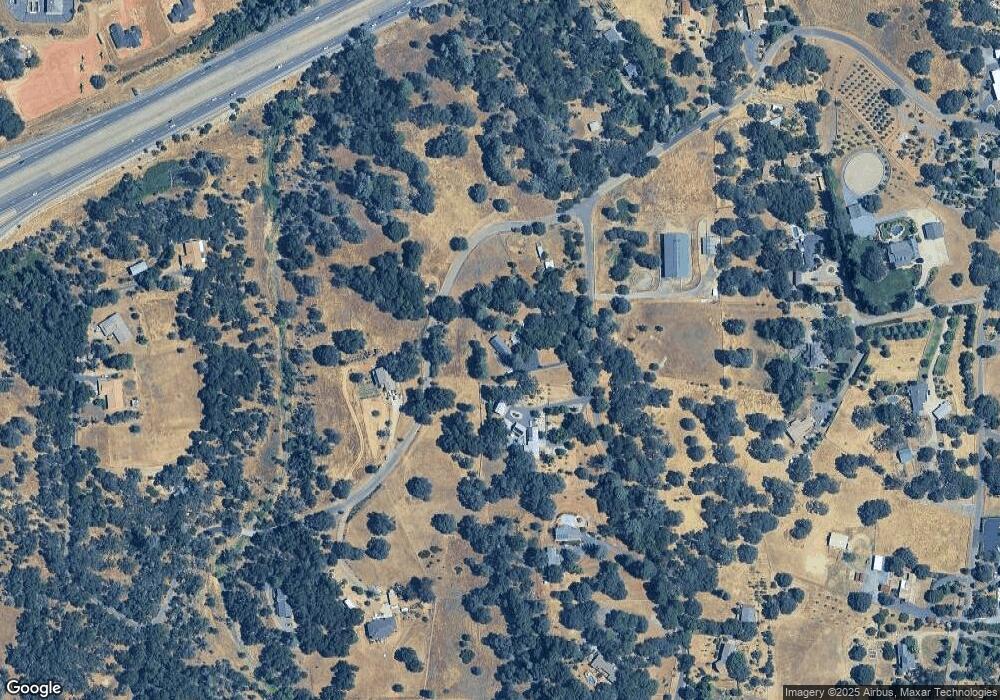

Map

Nearby Homes

- 4460 Fawn St

- 5520 Mother Lode Dr

- 4121 Shingle Springs Dr

- 4700 Old French Town Rd Unit 8

- 4700 Old French Town Rd Unit 64

- 5117 Cutty Sark Ln

- 0 Cutty Sark Ct

- 2 Shinn Ranch Rd

- 3 Shinn Ranch Rd

- 4241 Ascot Ln

- 2660 Sleepy Hollow Dr

- 2580 Golden Fawn Trail

- 0 Echo Ln Unit 226012331

- 5772 Dragon Springs Rd

- 4627 El Dorado Rd

- 5200 Deerwood Dr

- 4117 El Dorado Rd

- 5825 Dragon Springs Rd

- 3390 Morel Way

- 2131 Cabiao Rd

- 4200 Monk Rd

- 4420 Studebaker Rd

- 4230 Monk Rd

- 4461 Studebaker Rd

- 5505 Ralston Way

- 5541 Ralston Way

- 4321 Studebaker Rd

- 5543 Ralston Way

- 4421 Hope Ln

- 4330 Studebaker Rd

- 4501 Studebaker Rd

- 4260 Monk Rd

- 4241 Monk Rd

- 4431 Hope Ln

- 4461 Hope Ln

- 4320 Studebaker Rd

- 1 Reservation Rd

- 0 Reservation Rd

- 4280 Monk Rd

- 5555 Ralston Way

Your Personal Tour Guide

Ask me questions while you tour the home.