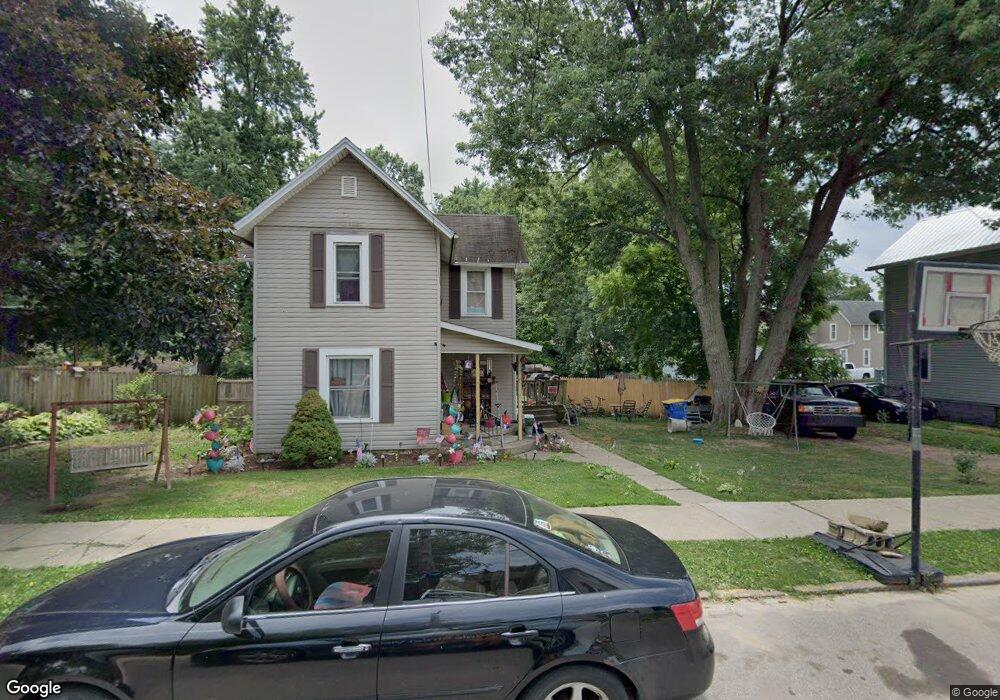

417 E 4th St Ashland, OH 44805

Estimated Value: $65,000 - $116,000

3

Beds

1

Bath

1,204

Sq Ft

$78/Sq Ft

Est. Value

About This Home

This home is located at 417 E 4th St, Ashland, OH 44805 and is currently estimated at $93,362, approximately $77 per square foot. 417 E 4th St is a home located in Ashland County with nearby schools including Ashland High School, Ashland County Community Academy, and St. Edward Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2024

Sold by

Tanner Perry F B and Tanner Cheryl L

Bought by

Finley-Kilgore Kimberly J and Kilgore Brandin L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,350

Outstanding Balance

$52,479

Interest Rate

7.03%

Mortgage Type

New Conventional

Estimated Equity

$40,883

Purchase Details

Closed on

Jul 30, 2008

Sold by

Tanner Perry

Bought by

Tanner Perry F B and Tanner Cheryl L

Purchase Details

Closed on

Jun 7, 2000

Sold by

Hochstetler Michelle

Bought by

Tanner Perry

Purchase Details

Closed on

May 10, 1993

Bought by

Hochstetler Michelle

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Finley-Kilgore Kimberly J | $55,000 | None Listed On Document | |

| Finley-Kilgore Kimberly J | $55,000 | None Listed On Document | |

| Tanner Perry F B | -- | -- | |

| Tanner Perry | $38,500 | -- | |

| Hochstetler Michelle | $30,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Finley-Kilgore Kimberly J | $53,350 | |

| Closed | Finley-Kilgore Kimberly J | $53,350 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $815 | $22,960 | $3,040 | $19,920 |

| 2024 | $815 | $22,960 | $3,040 | $19,920 |

| 2023 | $815 | $22,960 | $3,040 | $19,920 |

| 2022 | $937 | $20,880 | $2,770 | $18,110 |

| 2021 | $941 | $20,880 | $2,770 | $18,110 |

| 2020 | $893 | $20,880 | $2,770 | $18,110 |

| 2019 | $741 | $16,010 | $3,890 | $12,120 |

| 2018 | $747 | $16,010 | $3,890 | $12,120 |

| 2017 | $783 | $16,010 | $3,890 | $12,120 |

| 2016 | $783 | $16,010 | $3,890 | $12,120 |

| 2015 | $776 | $16,010 | $3,890 | $12,120 |

| 2013 | $969 | $19,660 | $3,910 | $15,750 |

Source: Public Records

Map

Nearby Homes

- 410 E 9th St

- 726 E 7th St

- 945 Virginia Ave

- 917 Union St

- 426 Diamond St

- 102 E Liberty St

- 219 W Washington St

- 416-418 Carroll St

- 150 College Ave

- 120 High St

- 1319 Cleveland Ave

- 703 Grant St

- 711 Grant St

- 1109 Eastern Ave

- 1210 Cottage St

- 1471 Troy Rd

- 1520 Orange Rd Unit 22

- 1520 Orange Rd

- 1499 Troy Rd

- 1218 Myers Ave