4192 La Concetta Dr Yorba Linda, CA 92886

Estimated Value: $1,288,000 - $1,460,000

3

Beds

3

Baths

2,274

Sq Ft

$609/Sq Ft

Est. Value

About This Home

This home is located at 4192 La Concetta Dr, Yorba Linda, CA 92886 and is currently estimated at $1,385,099, approximately $609 per square foot. 4192 La Concetta Dr is a home located in Orange County with nearby schools including Lakeview Elementary School, Yorba Linda Middle School, and El Dorado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 24, 2003

Sold by

Ungureanu Jacob and Ungureanu Camelia

Bought by

Sprout Matthew D and Sprout Kathleen H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,000

Outstanding Balance

$161,788

Interest Rate

5.85%

Estimated Equity

$1,223,311

Purchase Details

Closed on

Mar 28, 2000

Sold by

Raymond Morales

Bought by

Ungureanu Jacob and Ungureanu Camelia

Purchase Details

Closed on

Dec 1, 1998

Sold by

La Concetta Trust #4192

Bought by

Morales Raymond

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

6.82%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Jul 23, 1998

Sold by

Robert Roman and Robert Gloria L

Bought by

La Concetta Trust #4192

Purchase Details

Closed on

Mar 27, 1998

Sold by

Robert Roman and Robert Gloria L

Bought by

La Concetta Drive Trust #4192

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sprout Matthew D | $480,000 | American Title Co | |

| Ungureanu Jacob | -- | Fidelity National Title Ins | |

| Morales Raymond | $280,000 | Fidelity National Title Ins | |

| La Concetta Trust #4192 | $176,250 | -- | |

| La Concetta Drive Trust #4192 | $208,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sprout Matthew D | $384,000 | |

| Previous Owner | Morales Raymond | $224,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,781 | $695,192 | $512,070 | $183,122 |

| 2024 | $7,781 | $681,561 | $502,029 | $179,532 |

| 2023 | $7,641 | $668,198 | $492,186 | $176,012 |

| 2022 | $7,566 | $655,097 | $482,536 | $172,561 |

| 2021 | $7,430 | $642,252 | $473,074 | $169,178 |

| 2020 | $7,335 | $635,667 | $468,223 | $167,444 |

| 2019 | $7,075 | $623,203 | $459,042 | $164,161 |

| 2018 | $6,986 | $610,984 | $450,041 | $160,943 |

| 2017 | $6,872 | $599,004 | $441,216 | $157,788 |

| 2016 | $6,733 | $587,259 | $432,564 | $154,695 |

| 2015 | $6,651 | $578,438 | $426,066 | $152,372 |

| 2014 | $6,453 | $567,108 | $417,720 | $149,388 |

Source: Public Records

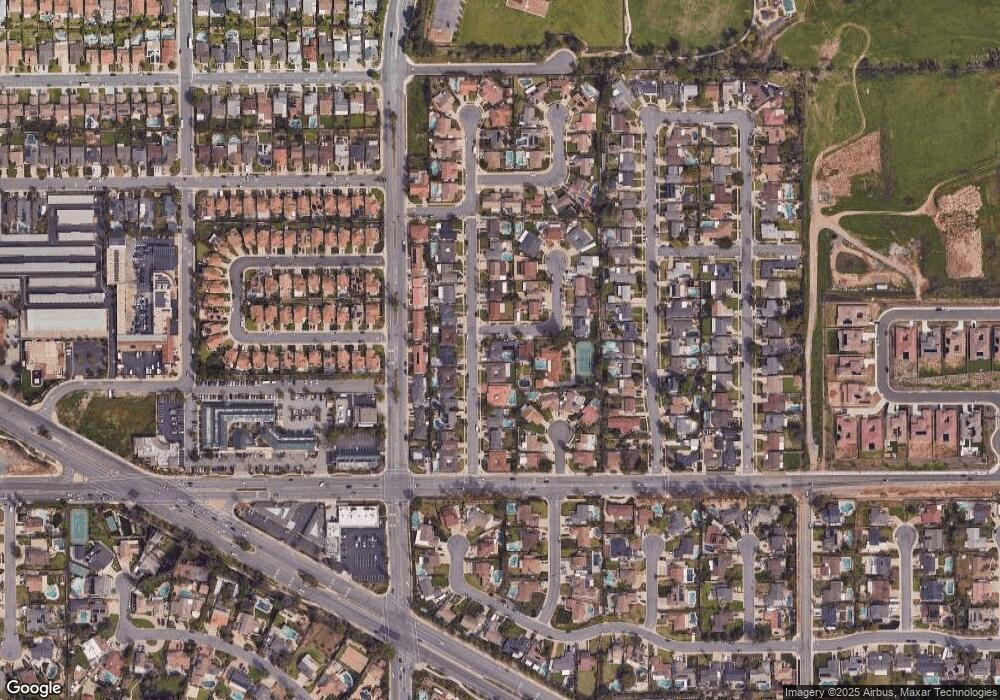

Map

Nearby Homes

- 4302 Eureka Ave

- 18141 Bastanchury Rd

- 18118 Joel Brattain Dr

- 3744 Lake Grove Dr Unit 21

- 16942 Lake Park Way

- 16950 Lake Park Way Unit 7

- 17781 Lerene Dr

- 18211 Joel Brattain Dr

- 17284 Coriander Ct

- 17411 Bramble Ct

- 16959 Lake Knoll Ln Unit 109

- 3699 Lake Grove Dr Unit 46

- 3708 Lake Crest Dr

- 3678 Lake Crest Dr Unit 41

- 3738 Lakeside Dr Unit 75

- 4845 Eisenhower Ct

- 16742 Lake Park Way

- 17175 Sweet Bay Ct

- 3731 Lake Side Dr

- 4781 Kona Kove Way

- 4202 La Concetta Dr

- 17582 Pacific Ave

- 4162 La Concetta Dr

- 4222 La Concetta Dr

- 4201 La Concetta Dr

- 4181 La Concetta Dr

- 17592 Pacific Ave

- 4152 La Concetta Dr

- 4211 La Concetta Dr

- 4171 La Concetta Dr

- 4151 Ricardo Dr

- 4232 La Concetta Dr

- 4221 Trix Cir

- 4221 La Concetta Dr

- 4231 Trix Cir

- 4151 La Concetta Dr

- 4142 La Concetta Dr

- 4172 Valley View Ave

- 4162 Valley View Ave

- 4141 Ricardo Dr