4202 Foxrun Dr Chino Hills, CA 91709

South Chino Hills NeighborhoodEstimated Value: $1,033,928 - $1,131,000

4

Beds

3

Baths

2,276

Sq Ft

$481/Sq Ft

Est. Value

About This Home

This home is located at 4202 Foxrun Dr, Chino Hills, CA 91709 and is currently estimated at $1,095,482, approximately $481 per square foot. 4202 Foxrun Dr is a home located in San Bernardino County with nearby schools including Michael G. Wickman Elementary School, Robert O. Townsend Junior High School, and Chino Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2001

Sold by

Allizadeh James J

Bought by

Dykier Donald M and Dykier Renee N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Outstanding Balance

$93,093

Interest Rate

6.89%

Estimated Equity

$1,002,389

Purchase Details

Closed on

Jan 26, 1999

Sold by

Miles W Hugh

Bought by

Allizadeh James J and Allizadeh Julie K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$261,250

Interest Rate

7.12%

Purchase Details

Closed on

Nov 16, 1995

Sold by

M J Brock & Sons Inc

Bought by

Miles W Hugh and Miles Nancy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,450

Interest Rate

7.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dykier Donald M | $319,500 | Chicago Title Co | |

| Allizadeh James J | $275,000 | First American Title | |

| Miles W Hugh | $236,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dykier Donald M | $255,000 | |

| Previous Owner | Allizadeh James J | $261,250 | |

| Previous Owner | Miles W Hugh | $188,450 | |

| Closed | Dykier Donald M | $44,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,217 | $542,400 | $168,504 | $373,896 |

| 2024 | $7,217 | $531,765 | $165,200 | $366,565 |

| 2023 | $7,032 | $521,338 | $161,961 | $359,377 |

| 2022 | $6,910 | $505,232 | $158,784 | $346,448 |

| 2021 | $6,779 | $495,326 | $155,671 | $339,655 |

| 2020 | $7,310 | $490,247 | $154,075 | $336,172 |

| 2019 | $7,182 | $480,634 | $151,054 | $329,580 |

| 2018 | $7,032 | $471,210 | $148,092 | $323,118 |

| 2017 | $6,906 | $461,970 | $145,188 | $316,782 |

| 2016 | $6,542 | $452,912 | $142,341 | $310,571 |

| 2015 | $6,415 | $446,109 | $140,203 | $305,906 |

| 2014 | $6,292 | $437,371 | $137,457 | $299,914 |

Source: Public Records

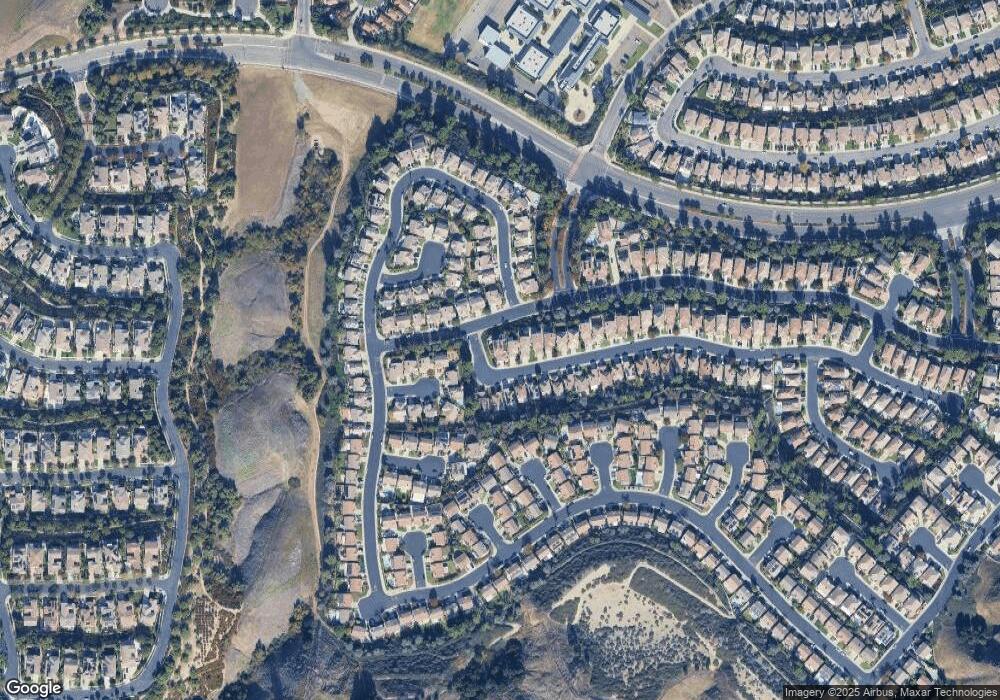

Map

Nearby Homes

- 4395 Saint Andrews Dr

- 16340 Willowmist Ct

- 16349 Misty Hill Dr

- 16051 Augusta Dr

- 16410 Argent Rd

- 0 Ravine Ln Unit TR24122915

- 0 0 Unit PW22250791

- 15892 Tanberry Dr

- 4936 Highview St

- 4949 Highview St

- 15849 Tanberry Dr

- 3966 Laurel Ct

- 3474 Autumn Ave

- 15944 Silver Springs Dr

- 16143 Lantern Ln

- 16107 Lantern Ln

- 18409 Errol Way

- 2476 Collinas

- 4441 Los Serranos Blvd

- 3741 Aspen Ln

- 4208 Foxrun Dr

- 4214 Foxrun Dr

- 4220 Foxrun Dr

- 4213 Foxrun Dr

- 4219 Foxrun Dr

- 4207 Foxrun Dr

- 4226 Foxrun Dr

- 4192 Golden Glen Dr

- 4198 Golden Glen Dr

- 4176 Glenhaven Ct

- 4201 Foxrun Dr

- 4172 Glenhaven Ct

- 4225 Foxrun Dr

- 4231 Foxrun Dr

- 4182 Golden Glen Dr

- 4177 Glenhaven Ct

- 4232 Foxrun Dr

- 16299 Wind Forest Way

- 4237 Foxrun Dr

- 16290 Wind Forest Way