421 W W Update, MI 48837

Estimated Value: $226,000 - $240,000

3

Beds

2

Baths

1,725

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 421 W W, Update, MI 48837 and is currently estimated at $233,685, approximately $135 per square foot. 421 W W is a home located in Eaton County with nearby schools including Wacousta Elementary School, Leon W. Hayes Middle School, and Grand Ledge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 3, 2014

Sold by

Baker Brent E and Baker Amy Elizabeth

Bought by

Brown Richard J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,207

Outstanding Balance

$78,275

Interest Rate

4.15%

Mortgage Type

New Conventional

Estimated Equity

$155,410

Purchase Details

Closed on

Aug 23, 2013

Sold by

Secretary Of Housing & Urban Development

Bought by

Baker Brent E

Purchase Details

Closed on

Apr 16, 2013

Sold by

Bank Of America Na

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

Feb 14, 2013

Sold by

Rapson John and Rapson Nancy

Bought by

Bank Of America Na

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown Richard J | $109,900 | None Available | |

| Baker Brent E | $33,000 | Diversified National Title A | |

| The Secretary Of Housing & Urban Develop | -- | None Available | |

| Bank Of America Na | $55,200 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown Richard J | $102,207 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,814 | $94,700 | $0 | $0 |

| 2024 | $2,536 | $88,100 | $0 | $0 |

| 2023 | $2,381 | $86,100 | $0 | $0 |

| 2022 | $3,393 | $80,900 | $0 | $0 |

| 2021 | $3,249 | $75,400 | $0 | $0 |

| 2020 | $3,208 | $72,200 | $0 | $0 |

| 2019 | $3,023 | $69,056 | $0 | $0 |

| 2018 | $2,634 | $61,000 | $0 | $0 |

| 2017 | $2,580 | $61,600 | $0 | $0 |

| 2016 | $1,890 | $60,100 | $0 | $0 |

| 2015 | -- | $58,500 | $0 | $0 |

| 2014 | -- | $58,300 | $0 | $0 |

| 2013 | -- | $57,300 | $0 | $0 |

Source: Public Records

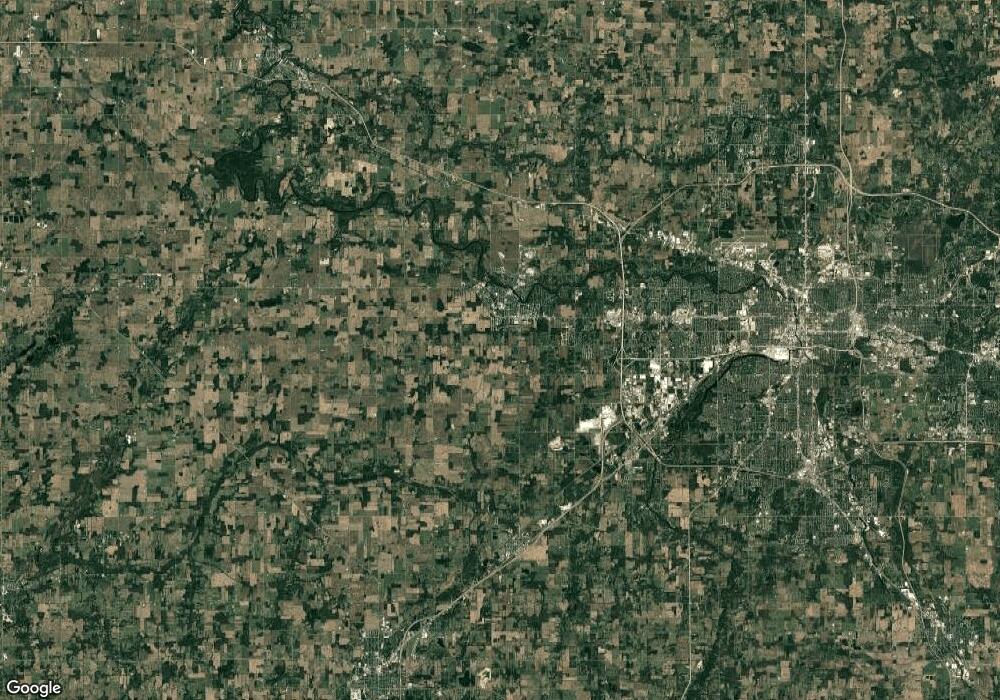

Map

Nearby Homes

- 420 West St

- 322 W Front St

- 209 Mineral St

- 702 W Main St

- 320 Clark St

- 839 Saint Johns Chase

- 218 Russell St

- 225 W Scott St

- 944 Pennine Ridge Way

- 213 High St

- 205 Bates St

- 521 Pleasant St

- 412 E Jefferson St

- 0 Saint Johns Chase

- 1000 Hawks Ridge

- 321 Lamson St

- 12931 Oneida Woods Trail

- 840 Belknap St

- 0 W Jefferson St

- 911 Belknap St