4212 N 69th Ln Unit 1349 Phoenix, AZ 85033

Estimated Value: $178,815 - $231,000

Studio

3

Baths

1,264

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 4212 N 69th Ln Unit 1349, Phoenix, AZ 85033 and is currently estimated at $205,704, approximately $162 per square foot. 4212 N 69th Ln Unit 1349 is a home located in Maricopa County with nearby schools including Heatherbrae School, Desert Sands Middle School, and Trevor Browne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2018

Sold by

Wholesale Land And Homes Llc

Bought by

Marquez Reydecel and Marquez Diada Linda

Current Estimated Value

Purchase Details

Closed on

Dec 31, 2017

Sold by

Huerta Olga

Bought by

Wholesale Land Homes Llc

Purchase Details

Closed on

Mar 16, 2006

Sold by

Huerta Daniel

Bought by

Huerta Olga

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,400

Interest Rate

8.85%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 20, 2001

Sold by

Kaufer William E

Bought by

Kaufer Virginia G

Purchase Details

Closed on

Feb 14, 2000

Sold by

Hud

Bought by

Kaufer William E and Kaufer Virginia G

Purchase Details

Closed on

Nov 30, 1999

Sold by

Abmont Gerald and Abmont Dorothy A

Bought by

Chase Mtg Company West

Purchase Details

Closed on

Nov 10, 1999

Sold by

Chase Mtg Company West

Bought by

Hud

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marquez Reydecel | -- | None Available | |

| Wholesale Land Homes Llc | $40,000 | None Available | |

| Huerta Olga | -- | Lawyers Title Insurance Corp | |

| Huerta Olga | $108,000 | Lawyers Title Insurance Corp | |

| Kaufer Virginia G | -- | -- | |

| Wilkerson Karen Brown | -- | -- | |

| Kaufer William E | -- | First Southwestern Title | |

| Chase Mtg Company West | $50,202 | -- | |

| Hud | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Huerta Olga | $86,400 | |

| Previous Owner | Huerta Olga | $21,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $477 | $2,728 | -- | -- |

| 2024 | $475 | $2,598 | -- | -- |

| 2023 | $475 | $11,630 | $2,320 | $9,310 |

| 2022 | $448 | $8,810 | $1,760 | $7,050 |

| 2021 | $453 | $7,920 | $1,580 | $6,340 |

| 2020 | $429 | $6,950 | $1,390 | $5,560 |

| 2019 | $411 | $5,610 | $1,120 | $4,490 |

| 2018 | $427 | $3,950 | $790 | $3,160 |

| 2017 | $413 | $3,360 | $670 | $2,690 |

| 2016 | $436 | $3,080 | $610 | $2,470 |

| 2015 | $329 | $2,580 | $510 | $2,070 |

Source: Public Records

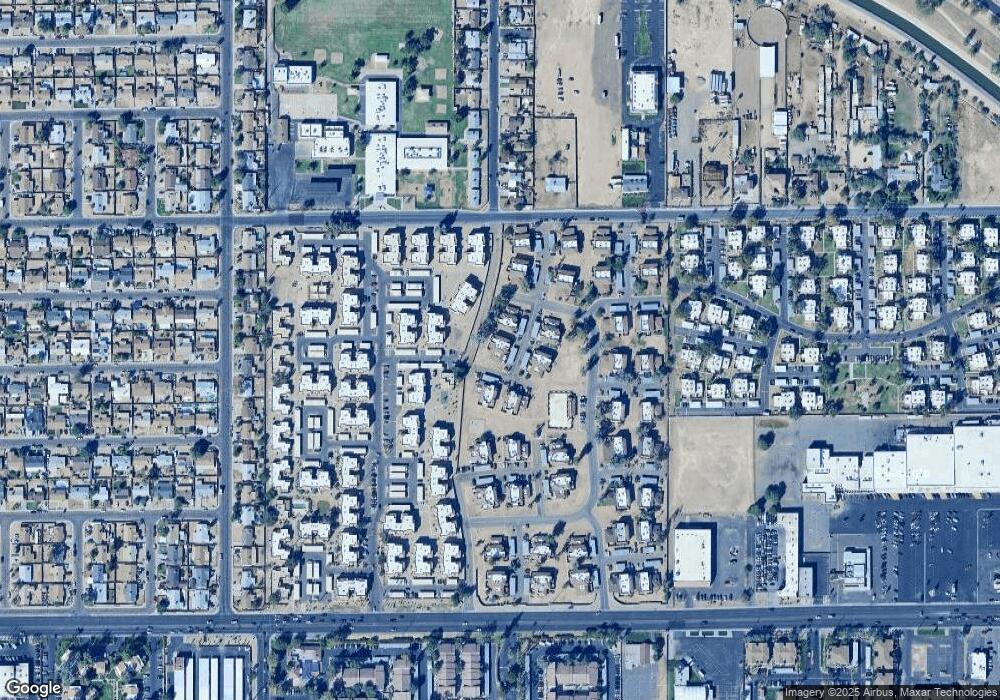

Map

Nearby Homes

- 6935 W Devonshire Ave Unit 1359

- 4219 N 69th Ln Unit 1321

- 4112 N 69th Dr Unit 1229

- 4242 N 69th Ln Unit 1333

- 6855 W Devonshire Ave Unit 291

- 6841 W Devonshire Ave

- 6866 W Indian School Rd Unit 1

- 6842 W Devonshire Ave Unit 265

- 6817 W Devonshire Ave Unit 311

- 6806 W Devonshire Ave

- 4268 N 68th Ave Unit 447

- 7125 W Heatherbrae Dr

- 4233 N 68th Ave Unit 430

- 7136 W Westview Dr

- 4109 N 72nd Dr

- 4316 N 72nd Ave

- 7150 W Montecito Ave

- 3646 N 69th Ave Unit 36

- 3646 N 69th Ave Unit 59

- 3645 N 69th Ave Unit 99

- 4212 N 69th Ln Unit 1351

- 4212 N 69th Ln Unit 1348

- 4212 N 69th Ln Unit 1352

- 4212 N 69th Ln Unit 1350

- 4212 N 69th Ln

- 4256 N 68th Ln

- 4220 N 69th Ln Unit 5

- 4220 N 69th Ln Unit 1345

- 4220 N 69th Ln Unit 1343

- 4220 N 69th Ln Unit 1346

- 4220 N 69th Ln Unit 1344

- 4220 N 69th Ln Unit 1347

- 4211 N 69th Ln

- 4211 N 69th Ln Unit 1314

- 4211 N 69th Ln Unit 1315

- 4211 N 69th Ln Unit 1316

- 4211 N 69th Ln Unit 1317

- 4211 N 69th Ln Unit 1313

- 4219 N 69th Ln Unit 5

- 4219 N 69th Ln Unit 4