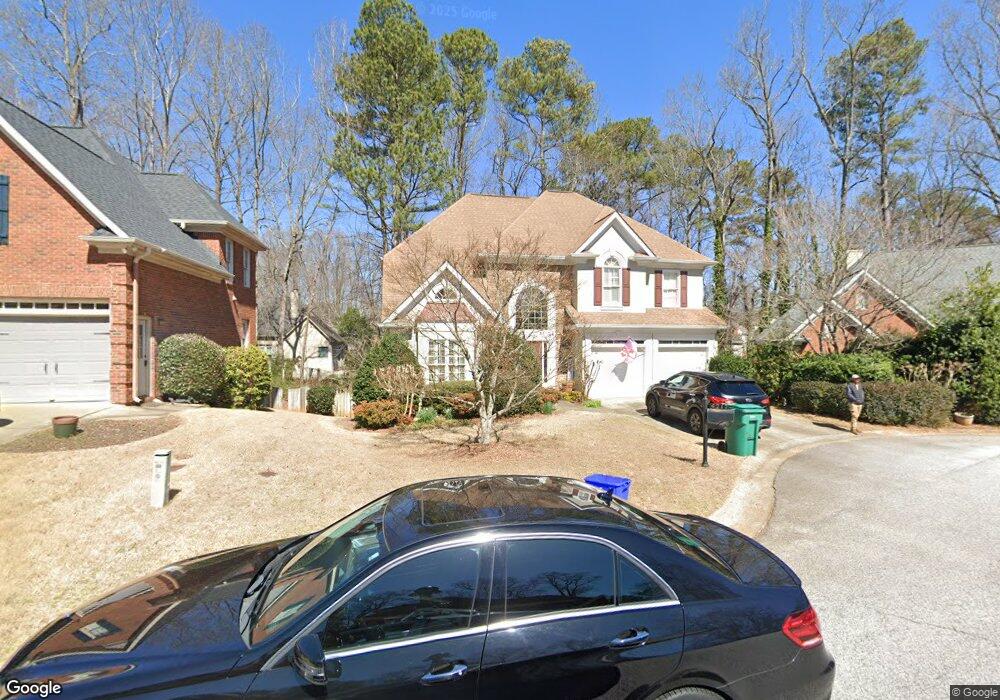

4217 Terrace Ct SE Unit 1 Smyrna, GA 30082

Estimated Value: $600,000 - $750,000

4

Beds

3

Baths

2,368

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 4217 Terrace Ct SE Unit 1, Smyrna, GA 30082 and is currently estimated at $684,553, approximately $289 per square foot. 4217 Terrace Ct SE Unit 1 is a home located in Cobb County with nearby schools including King Springs Elementary School, Griffin Middle School, and Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 27, 2006

Sold by

Miller Craig E and Miller Stefanie

Bought by

Geary Timothy E and Geary Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Outstanding Balance

$143,417

Interest Rate

6.33%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$541,136

Purchase Details

Closed on

Sep 30, 1997

Sold by

Redden Properties Inc

Bought by

Miller Craig E and Miller Stefanie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,750

Interest Rate

7.31%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Geary Timothy E | $385,000 | -- | |

| Miller Craig E | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Geary Timothy E | $250,000 | |

| Previous Owner | Miller Craig E | $213,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,185 | $252,416 | $80,000 | $172,416 |

| 2024 | $1,185 | $252,416 | $80,000 | $172,416 |

| 2023 | $1,033 | $244,808 | $80,000 | $164,808 |

| 2022 | $4,378 | $178,900 | $36,000 | $142,900 |

| 2021 | $4,401 | $178,900 | $36,000 | $142,900 |

| 2020 | $4,401 | $178,900 | $36,000 | $142,900 |

| 2019 | $4,173 | $166,952 | $32,000 | $134,952 |

| 2018 | $3,642 | $142,432 | $32,000 | $110,432 |

| 2017 | $3,417 | $142,432 | $32,000 | $110,432 |

| 2016 | $2,692 | $114,288 | $32,000 | $82,288 |

| 2015 | $2,757 | $114,288 | $32,000 | $82,288 |

| 2014 | $2,783 | $114,288 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 4222 Terrace Ct SE

- 3538 S Sherwood Rd SE Unit 5

- 1522 Grace Meadows Ln SE

- 3654 Lake Dr SE

- 550 Micayne Cir SE Unit 1

- 3568 Lake Dr SE

- 538 Micayne Cir SE Unit 3

- 3462 S Sherwood Rd SE

- 629 Dunton Cir SE

- 3844 Lake Dr SE

- 436 Concord Rd SE

- 3375 Emerson St SE

- 3933 N Cooper Lake Rd SE

- 3941 Lake Dr SE

- 1024 Magnolia Dr SE

- 3543 S Cobb Dr SE

- 3244 Hampton Ct SE

- 4215 Terrace Ct SE Unit 1

- 4219 Terrace Ct SE Unit 1

- 2220 Austin Lake Dr SE Unit 1

- 4213 Terrace Ct SE

- 2218 Austin Lake Dr SE

- 2222 Austin Lake Dr SE Unit 1

- 4211 Terrace Ct SE Unit 1

- 4216 Terrace Ct SE Unit 1

- 2216 Austin Lake Dr SE

- 4220 Terrace Ct SE

- 6204 Traymore Trace SE Unit 2

- 4214 Terrace Ct SE

- 6206 Traymore Trace SE

- 4209 Terrace Ct SE

- 0 Terrace Ct SE Unit 3198708

- 0 Terrace Ct SE Unit 7397436

- 0 Terrace Ct SE Unit 7360131

- 2224 Austin Lake Dr SE

- 4212 Terrace Ct SE