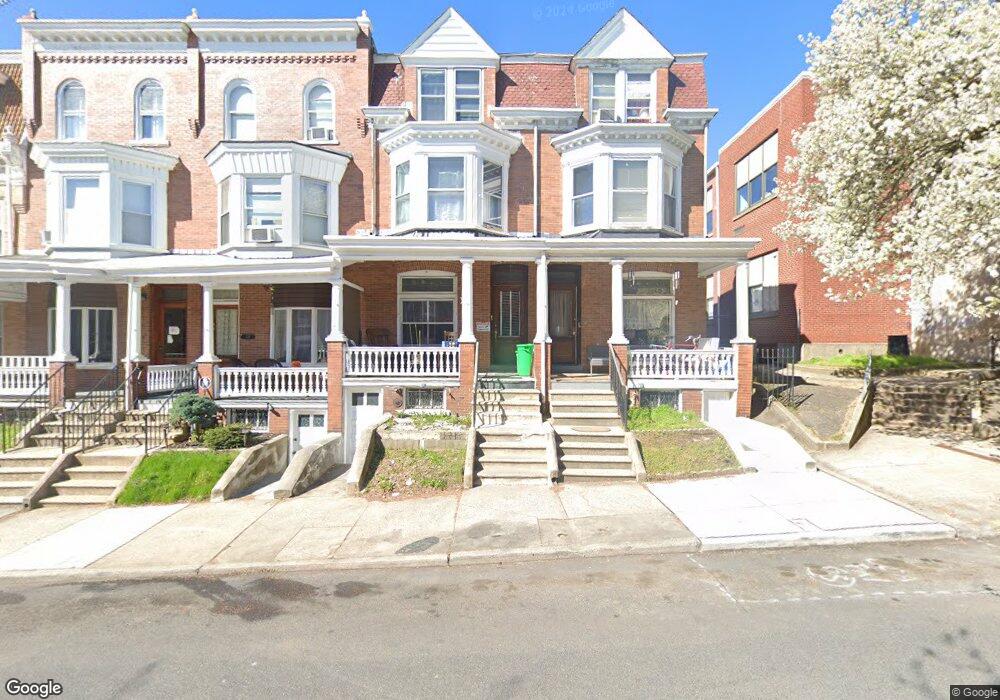

422 N 9th St Allentown, PA 18102

Center City NeighborhoodEstimated Value: $131,000 - $248,000

3

Beds

1

Bath

1,987

Sq Ft

$105/Sq Ft

Est. Value

About This Home

This home is located at 422 N 9th St, Allentown, PA 18102 and is currently estimated at $209,078, approximately $105 per square foot. 422 N 9th St is a home located in Lehigh County with nearby schools including Huntington Elementary School, Castle Dale School, and Roosevelt Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2005

Sold by

Habitat For Humanity Of The Lehigh Valle

Bought by

Dawoad El Tagani A and Abdalla Marya A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,000

Outstanding Balance

$21,825

Interest Rate

5.66%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$187,253

Purchase Details

Closed on

May 1, 2003

Sold by

Allentown Community Revitalization Corp

Bought by

Habitat For Humanity Lehigh Valley Inc

Purchase Details

Closed on

Feb 1, 2001

Sold by

Heffelfinger Ronald O and Heffelfinger Joanne M

Bought by

Allentown Community Revitalization Corp

Purchase Details

Closed on

Dec 2, 1985

Sold by

Pfeifley Sr Fred E and Pfeifley Edna

Bought by

Heffelfinger Ronald O and Jo Ann M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dawoad El Tagani A | $65,000 | -- | |

| Habitat For Humanity Lehigh Valley Inc | $75,407 | -- | |

| Allentown Community Revitalization Corp | -- | -- | |

| Heffelfinger Ronald O | $46,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dawoad El Tagani A | $69,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,903 | $90,500 | $5,700 | $84,800 |

| 2024 | $2,903 | $90,500 | $5,700 | $84,800 |

| 2023 | $2,903 | $90,500 | $5,700 | $84,800 |

| 2022 | $2,800 | $90,500 | $84,800 | $5,700 |

| 2021 | $2,743 | $90,500 | $5,700 | $84,800 |

| 2020 | $2,671 | $90,500 | $5,700 | $84,800 |

| 2019 | $2,627 | $90,500 | $5,700 | $84,800 |

| 2018 | $2,457 | $90,500 | $5,700 | $84,800 |

| 2017 | $2,394 | $90,500 | $5,700 | $84,800 |

| 2016 | -- | $90,500 | $5,700 | $84,800 |

| 2015 | -- | $90,500 | $5,700 | $84,800 |

| 2014 | -- | $90,500 | $5,700 | $84,800 |

Source: Public Records

Map

Nearby Homes

- 938 W Gordon St

- 417 Fulton St

- 514 N Hazel St

- 427 N Lumber St

- 247 N 10th St

- 516 N Lumber St

- 513 N Howard St

- 515 N Lumber St Unit 3

- 436 N Hall St

- 816 W Allen St

- 737 W Liberty St

- 612 N 10th St

- 1042 W Allen St

- 1035 W Turner St

- 1010 W Tilghman St

- 520 N 7th St

- 1141 Emmett St

- 622 N Silk St

- 140 N 11th St

- 1144 W Allen St