4225 N 68th Ave Unit 427 Phoenix, AZ 85033

Estimated Value: $150,023 - $256,000

--

Bed

1

Bath

792

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 4225 N 68th Ave Unit 427, Phoenix, AZ 85033 and is currently estimated at $183,006, approximately $231 per square foot. 4225 N 68th Ave Unit 427 is a home located in Maricopa County with nearby schools including Heatherbrae School, Desert Sands Middle School, and Trevor Browne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 19, 2009

Sold by

Nansen Mark L and Nansen Roberta J

Bought by

North 68Th 4225 Llc

Current Estimated Value

Purchase Details

Closed on

Feb 22, 2006

Sold by

Rapaport Michael

Bought by

Nansen Mary and Nansen Roberta

Purchase Details

Closed on

Dec 20, 2005

Sold by

Ricochet Properties Inc

Bought by

Rapaport Michael

Purchase Details

Closed on

Feb 22, 2005

Sold by

Kdn Properties Llc

Bought by

Ricochet Properties Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,250

Interest Rate

5.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 22, 2001

Sold by

Chavez Eddie M and Chavez Sandra L

Bought by

Nordstrom Kenneth and Nordstrom Diane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,000

Interest Rate

7.21%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| North 68Th 4225 Llc | -- | None Available | |

| Nansen Mary | $56,977 | Camelback Title Agency Llc | |

| Rapaport Michael | $52,000 | Camelback Title Agency Llc | |

| Ricochet Properties Inc | $162,500 | Guaranty Title Agency | |

| Nordstrom Kenneth | $21,000 | Stewart Title & Trust |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ricochet Properties Inc | $176,250 | |

| Previous Owner | Nordstrom Kenneth | $15,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $339 | $1,993 | -- | -- |

| 2024 | $347 | $1,898 | -- | -- |

| 2023 | $347 | $9,570 | $1,910 | $7,660 |

| 2022 | $327 | $7,400 | $1,480 | $5,920 |

| 2021 | $331 | $6,870 | $1,370 | $5,500 |

| 2020 | $314 | $6,100 | $1,220 | $4,880 |

| 2019 | $300 | $4,560 | $910 | $3,650 |

| 2018 | $312 | $3,300 | $660 | $2,640 |

| 2017 | $302 | $2,620 | $520 | $2,100 |

| 2016 | $289 | $2,420 | $480 | $1,940 |

| 2015 | $269 | $2,130 | $420 | $1,710 |

Source: Public Records

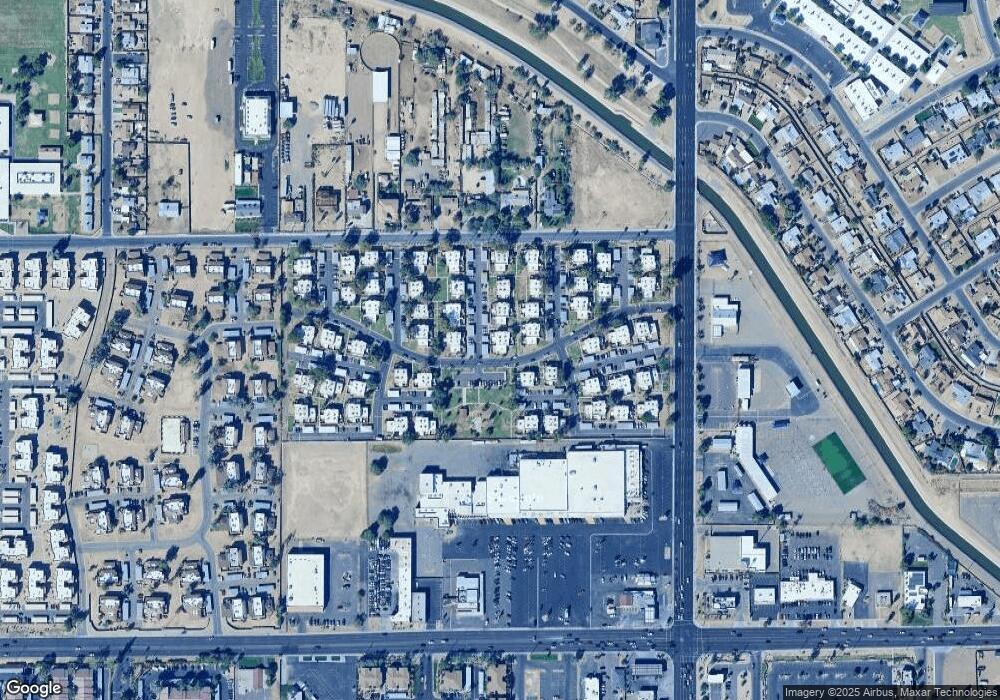

Map

Nearby Homes

- 4233 N 68th Ave Unit 430

- 4240 N 67th Ln Unit 420

- 4269 N 68th Ave

- 4268 N 68th Ave Unit 447

- 4255 N 68th Dr Unit 477

- 6842 W Devonshire Ave Unit 265

- 6866 W Indian School Rd Unit 1

- 4252 N 68th Ln Unit 512

- 4258 N 68th Ln Unit 510

- 6902 W Devonshire Ave Unit 1280

- 6530 W Turney Ave

- 6727 W Roma Ave

- 6821 W Campbell Ave

- 4425 N 70th Ave

- 6447 W Piccadilly Rd

- 3646 N 67th Ave Unit 67

- 3646 N 67th Ave Unit 96

- 3646 N 67th Ave Unit 29

- 3806 N 64th Dr

- 4109 N 71st Ln

- 4227 N 68th Ave

- 4229 N 68th Ave Unit 429

- 4231 N 68th Ave Unit 430

- 4237 N 68th Ave Unit 432

- 4230 N 67th Ln

- 4232 N 67th Ln Unit 424

- 4232 N 67th Ln

- 4238 N 67th Ln Unit 422

- 4239 N 68th Ave Unit 433

- 4241 N 68th Ave Unit 434

- 4234 N 67th Ln Unit 425

- 6754 W Devonshire Ave Unit 361

- 6756 W Devonshire Ave Unit 362

- 6752 W Devonshire Ave Unit 359

- 4226 N 68th Ave Unit 462

- 4236 N 67th Ln

- 4243 N 68th Ave Unit 458

- 4245 N 68th Ave Unit 435

- 4245 N 68th Ave Unit 345

- 4230 N 68th Ave Unit 461