Estimated Value: $84,000 - $128,421

3

Beds

1

Bath

969

Sq Ft

$113/Sq Ft

Est. Value

About This Home

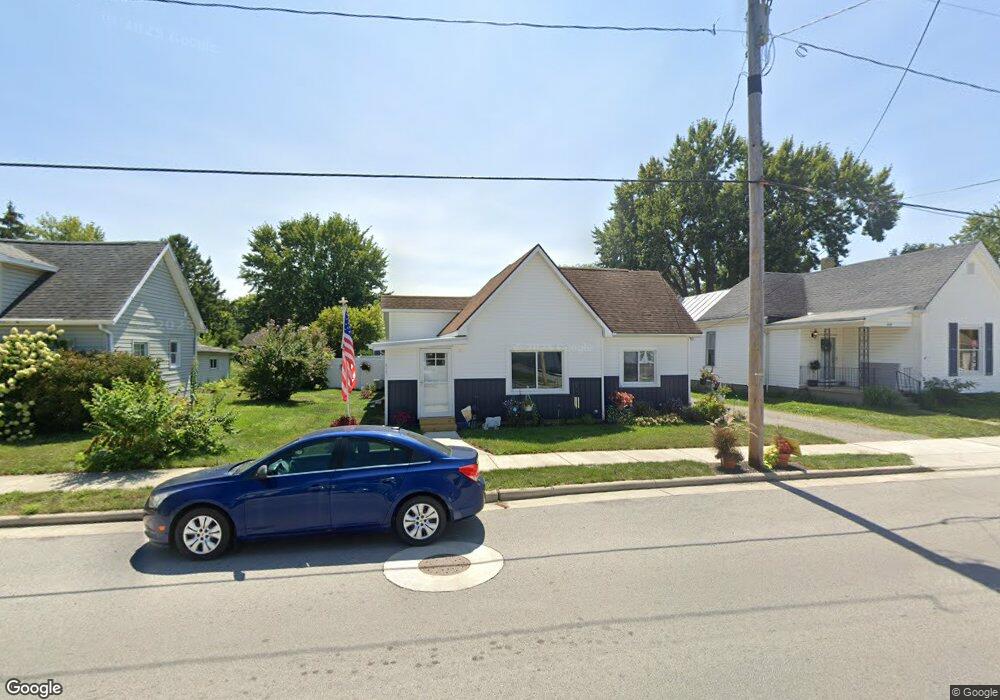

This home is located at 423 W Main St, Cairo, OH 45820 and is currently estimated at $109,355, approximately $112 per square foot. 423 W Main St is a home located in Allen County with nearby schools including Bath Elementary School, Bath Middle School, and Bath High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2022

Sold by

Woods Patrick K and Woods Laura

Bought by

Woods Patrick K and Woods Laura

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,575

Interest Rate

4.72%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 24, 2010

Sold by

Secretary Of Housing & Urban Development

Bought by

Woods Patrick K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,450

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 17, 2009

Sold by

Phillips Richard M and Phillips Leyna L

Bought by

The Huntington National Bank

Purchase Details

Closed on

Oct 14, 2009

Sold by

The Huntington National Bank

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

May 26, 1994

Sold by

Conrad Velma A

Bought by

Krendl Kurt A and Krendl Kelly K

Purchase Details

Closed on

Aug 1, 1980

Bought by

Conrad Velma A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Woods Patrick K | -- | Pearl Law Offices Llc | |

| Woods Patrick K | $20,000 | None Available | |

| The Huntington National Bank | $32,000 | Attorney | |

| The Secretary Of Housing & Urban Develop | -- | Attorney | |

| Krendl Kurt A | $25,500 | -- | |

| Conrad Velma A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Woods Patrick K | $91,575 | |

| Previous Owner | Woods Patrick K | $20,450 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,298 | $31,120 | $3,570 | $27,550 |

| 2023 | $1,000 | $21,070 | $2,520 | $18,550 |

| 2022 | $1,867 | $21,070 | $2,520 | $18,550 |

| 2021 | $1,683 | $21,070 | $2,520 | $18,550 |

| 2020 | $952 | $17,650 | $2,420 | $15,230 |

| 2019 | $952 | $17,650 | $2,420 | $15,230 |

| 2018 | $991 | $17,650 | $2,420 | $15,230 |

| 2017 | $835 | $15,550 | $2,420 | $13,130 |

| 2016 | $783 | $15,550 | $2,420 | $13,130 |

| 2015 | $1,632 | $15,550 | $2,420 | $13,130 |

| 2014 | $1,632 | $15,790 | $2,280 | $13,510 |

| 2013 | $1,417 | $15,790 | $2,280 | $13,510 |

Source: Public Records

Map

Nearby Homes

- 513 W Main St

- 201 Wall St

- 634 W Main St

- 102 W Main St

- 3270 Bonnieview Dr

- 0 Fraunfelter Unit 307817

- 0 N Eastown Rd Unit 1034495

- 108 Highland Lakes Dr

- 3263 Shiloh Dr

- 3137 Thorndyke Dr

- 2878 Autumn Lake Dr

- 475 Kenmore St

- 520 Kenmore St

- 0 N Dixie Hwy Unit 300253

- 2718 Carolyn Dr

- 13347 Ohio 12

- 2630 Carolyn Dr

- 1743 Sherry Lee Dr

- 11059 Ottawa Rd

- 1705 Karen St