4235 Drake Ct Waldorf, MD 20603

Estimated Value: $300,000 - $325,000

--

Bed

2

Baths

1,220

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 4235 Drake Ct, Waldorf, MD 20603 and is currently estimated at $313,251, approximately $256 per square foot. 4235 Drake Ct is a home located in Charles County with nearby schools including C. Paul Barnhart Elementary School, Mattawoman Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 2, 2006

Sold by

Yates Larry A

Bought by

Grover Aditya K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Outstanding Balance

$123,808

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$189,443

Purchase Details

Closed on

May 25, 2006

Sold by

Yates Larry A

Bought by

Grover Aditya K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Outstanding Balance

$123,808

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$189,443

Purchase Details

Closed on

Sep 1, 2000

Sold by

Cox Christopher L and Cox Monica A

Bought by

Yates Larry A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grover Aditya K | $239,900 | -- | |

| Grover Aditya K | $239,900 | -- | |

| Yates Larry A | $98,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Grover Aditya K | $210,000 | |

| Closed | Grover Aditya K | $210,000 | |

| Closed | Yates Larry A | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,958 | $248,233 | -- | -- |

| 2024 | $3,491 | $240,600 | $90,000 | $150,600 |

| 2023 | $3,159 | $221,067 | $0 | $0 |

| 2022 | $2,922 | $201,533 | $0 | $0 |

| 2021 | $2,462 | $182,000 | $85,000 | $97,000 |

| 2020 | $2,462 | $170,167 | $0 | $0 |

| 2019 | $2,289 | $158,333 | $0 | $0 |

| 2018 | $2,095 | $146,500 | $75,000 | $71,500 |

| 2017 | $1,996 | $139,567 | $0 | $0 |

| 2016 | -- | $132,633 | $0 | $0 |

| 2015 | $1,882 | $125,700 | $0 | $0 |

| 2014 | $1,882 | $125,700 | $0 | $0 |

Source: Public Records

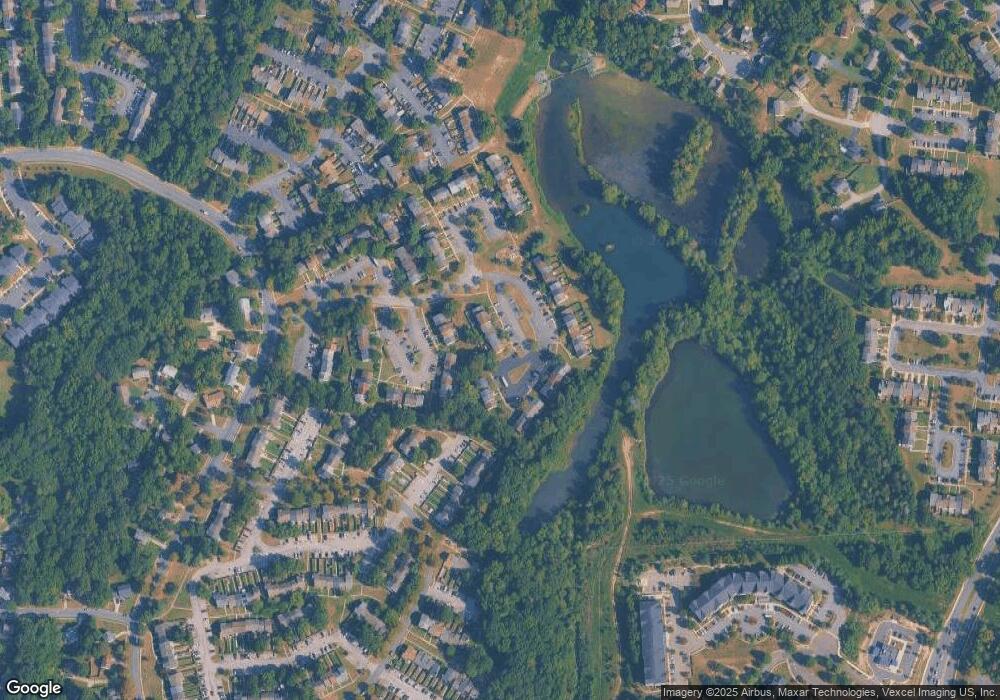

Map

Nearby Homes

- 4419 Eagle Ct

- 4362 Eagle Ct

- 4071 Bluebird Dr

- 4120 Lancaster Cir

- 4065 Bluebird Dr

- 4089 Bluebird Dr

- 4044 Bluebird Dr

- 4061 Bluebird Dr

- 4058 Bluebird Dr

- 11215 Heron Place

- 11207 Barnswallow Place

- 11124 Filberts Ct

- 4647 Grosbeak Place

- 11312 Golden Eagle Place

- 4229 Mockingbird Cir

- 11316 Golden Eagle Place

- 2930 Angel Place

- 10800 United Ct

- 4850 Magpie Ln

- 3959 Prickly St