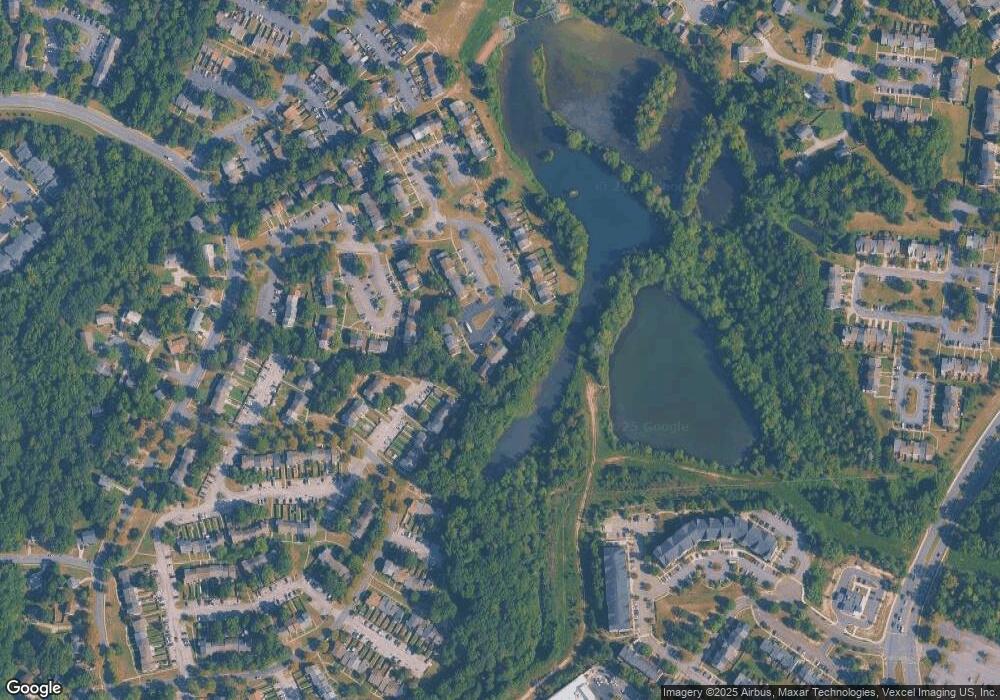

4246 Drake Ct Waldorf, MD 20603

Estimated Value: $241,000 - $326,000

3

Beds

3

Baths

1,840

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 4246 Drake Ct, Waldorf, MD 20603 and is currently estimated at $302,797, approximately $164 per square foot. 4246 Drake Ct is a home located in Charles County with nearby schools including C. Paul Barnhart Elementary School, Mattawoman Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2011

Sold by

Federal National Mortgage Association

Bought by

N And N Investments Inc

Current Estimated Value

Purchase Details

Closed on

Jun 15, 2011

Sold by

Fannie Mae

Bought by

N&N Investments Inc

Purchase Details

Closed on

Apr 30, 2010

Sold by

Rougier Margarete M

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jan 4, 2005

Sold by

Smith Karen

Bought by

Rougier Margarete M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,500

Interest Rate

5.62%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| N And N Investments Inc | $86,625 | -- | |

| N&N Investments Inc | $86,625 | First American Title Ins Co | |

| N And N Investments Inc | $86,625 | -- | |

| Federal National Mortgage Association | $203,645 | -- | |

| Rougier Margarete M | $175,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rougier Margarete M | $157,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $245,767 | -- | -- |

| 2024 | $3,239 | $234,600 | $90,000 | $144,600 |

| 2023 | $3,190 | $223,233 | $0 | $0 |

| 2022 | $3,057 | $211,867 | $0 | $0 |

| 2021 | $2,688 | $200,500 | $85,000 | $115,500 |

| 2020 | $2,688 | $187,733 | $0 | $0 |

| 2019 | $2,501 | $174,967 | $0 | $0 |

| 2018 | $2,298 | $162,200 | $75,000 | $87,200 |

| 2017 | $2,188 | $154,300 | $0 | $0 |

| 2016 | -- | $146,400 | $0 | $0 |

| 2015 | -- | $138,500 | $0 | $0 |

| 2014 | -- | $138,500 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 4071 Bluebird Dr

- 4065 Bluebird Dr

- 4089 Bluebird Dr

- 4120 Lancaster Cir

- 4061 Bluebird Dr

- 4419 Eagle Ct

- 4044 Bluebird Dr

- 4058 Bluebird Dr

- 4362 Eagle Ct

- 11215 Heron Place

- 11207 Barnswallow Place

- 11124 Filberts Ct

- 4647 Grosbeak Place

- 4229 Mockingbird Cir

- 11312 Golden Eagle Place

- 11316 Golden Eagle Place

- 2930 Angel Place

- 10800 United Ct

- 4850 Magpie Ln

- 5113 Garibaldi Place