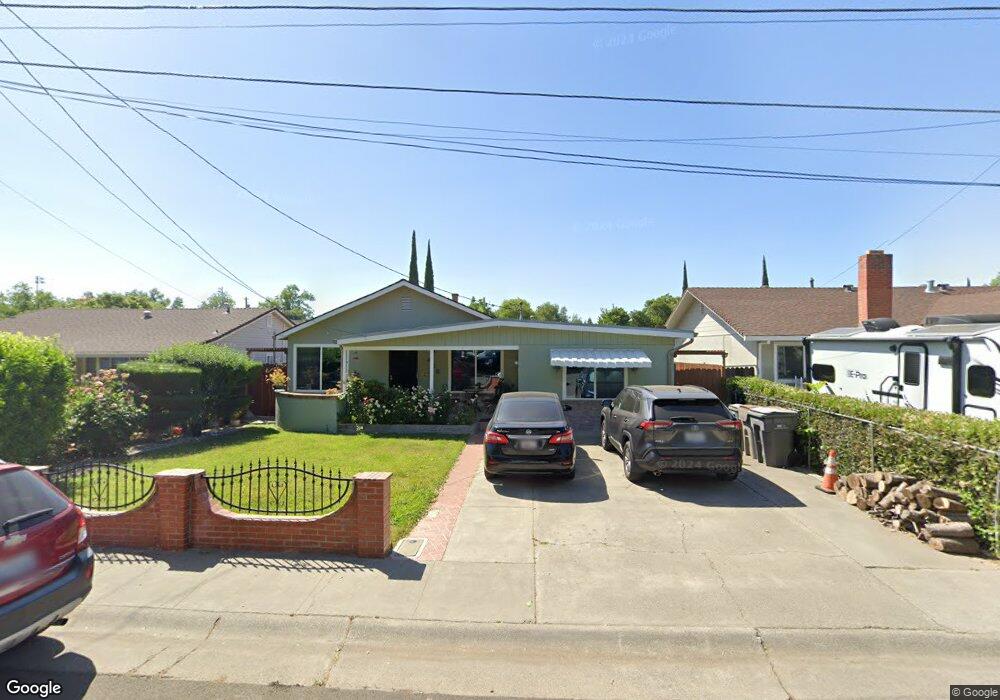

426 Edwards St Winters, CA 95694

Estimated Value: $416,000 - $555,000

3

Beds

2

Baths

1,417

Sq Ft

$331/Sq Ft

Est. Value

About This Home

This home is located at 426 Edwards St, Winters, CA 95694 and is currently estimated at $469,411, approximately $331 per square foot. 426 Edwards St is a home located in Yolo County with nearby schools including Winters Middle School and Winters High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2023

Sold by

Diaz Hernando M and Diaz Norma L

Bought by

Sanchez-Trinidad Jocelyn Magdalena and Sanchez Edwin Miguel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$389,500

Outstanding Balance

$380,458

Interest Rate

6.71%

Mortgage Type

New Conventional

Estimated Equity

$88,953

Purchase Details

Closed on

Jun 5, 1998

Sold by

Mcgowan Lawrence M and Mcgowan Benny D

Bought by

Diaz Hernando M and Diaz Norma L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,500

Interest Rate

7.11%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanchez-Trinidad Jocelyn Magdalena | $410,000 | Placer Title | |

| Diaz Hernando M | $110,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sanchez-Trinidad Jocelyn Magdalena | $389,500 | |

| Previous Owner | Diaz Hernando M | $104,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,984 | $418,200 | $122,400 | $295,800 |

| 2023 | $4,984 | $168,792 | $53,700 | $115,092 |

| 2022 | $2,010 | $165,484 | $52,648 | $112,836 |

| 2021 | $1,983 | $162,240 | $51,616 | $110,624 |

| 2020 | $1,875 | $160,577 | $51,087 | $109,490 |

| 2019 | $1,876 | $157,430 | $50,086 | $107,344 |

| 2018 | $1,824 | $154,344 | $49,104 | $105,240 |

| 2017 | $1,775 | $151,319 | $48,142 | $103,177 |

| 2016 | $1,676 | $148,353 | $47,199 | $101,154 |

| 2015 | $1,629 | $146,126 | $46,491 | $99,635 |

| 2014 | $1,629 | $143,265 | $45,581 | $97,684 |

Source: Public Records

Map

Nearby Homes

- 624 Snapdragon St

- 812 Taylor St

- 953 Kennedy Dr

- 0 E Baker St

- 750 W Main St

- 771 Graf Way

- 832 Jackson St

- 980 Degener St

- 794 W Main St

- 1077 Martin St

- 0 Winters Rd Unit 325006408

- 701 Niemann St

- 225 Creekside Way

- 1158 Ramos Dr

- 115 Almond Dr

- 0 E Grant Ave

- 27643 County Road 88

- 27852 County Road 90

- 9192 Boyce Rd

- 26300 California 128

Your Personal Tour Guide

Ask me questions while you tour the home.