429 W Laurel Dr Unit A Salinas, CA 93906

Sherwood Gardens NeighborhoodEstimated Value: $288,709 - $408,000

1

Bed

1

Bath

682

Sq Ft

$499/Sq Ft

Est. Value

About This Home

This home is located at 429 W Laurel Dr Unit A, Salinas, CA 93906 and is currently estimated at $340,427, approximately $499 per square foot. 429 W Laurel Dr Unit A is a home located in Monterey County with nearby schools including Henry F. Kammann Elementary School, Boronda Meadows Elementary School, and Harden Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 10, 2012

Sold by

Storelli Charles and Storelli Samantha

Bought by

Storelli Charles F and Strorelli Samantha L

Current Estimated Value

Purchase Details

Closed on

Apr 15, 2011

Sold by

Storelli Charles and Storelli Samantha

Bought by

C & S Investments Revocable Trust

Purchase Details

Closed on

Sep 14, 2009

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Gmac Mortgage Llc

Purchase Details

Closed on

Sep 10, 2009

Sold by

Gmac Mortgage Llc

Bought by

Storelli Charles and Storelli Samantha

Purchase Details

Closed on

Jun 29, 2009

Sold by

Imatani Leonardo P

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Jul 27, 2006

Sold by

City View Brentwood Gardens 280 Lp

Bought by

Imatani Leonardo P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,800

Interest Rate

6.57%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Storelli Charles F | -- | Old Republic Company | |

| C & S Investments Revocable Trust | -- | None Available | |

| Gmac Mortgage Llc | -- | Fidelity National Title Co | |

| Storelli Charles | $63,000 | Fidelity National Title Co | |

| Federal Home Loan Mortgage Corporation | $138,253 | First American Title Ins Co | |

| Imatani Leonardo P | $299,500 | Ctc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Imatani Leonardo P | $59,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $955 | $79,711 | $18,974 | $60,737 |

| 2024 | $955 | $78,149 | $18,602 | $59,547 |

| 2023 | $923 | $76,618 | $18,238 | $58,380 |

| 2022 | $890 | $75,117 | $17,881 | $57,236 |

| 2021 | $855 | $73,645 | $17,531 | $56,114 |

| 2020 | $832 | $72,891 | $17,352 | $55,539 |

| 2019 | $824 | $71,462 | $17,012 | $54,450 |

| 2018 | $813 | $70,062 | $16,679 | $53,383 |

| 2017 | $814 | $68,689 | $16,352 | $52,337 |

| 2016 | $814 | $67,343 | $16,032 | $51,311 |

| 2015 | $821 | $66,333 | $15,792 | $50,541 |

| 2014 | $768 | $65,034 | $15,483 | $49,551 |

Source: Public Records

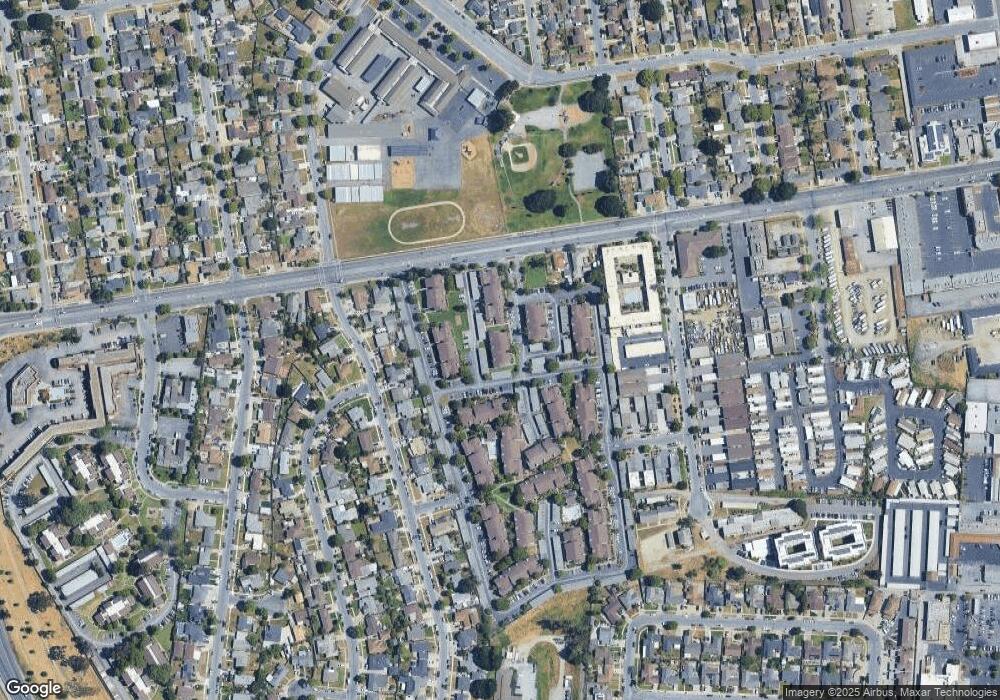

Map

Nearby Homes

- 1170 Tyler St

- 1221 Parkside St

- 1043 Heather Dr

- 217 Iris Dr

- 221 Tapadero St

- 684 Alvarado Ct

- 344 Pueblo Dr

- 1103 Sherman Dr

- 108 Gardenia Dr

- 572 Inca Way

- 730 N Main St

- 1515 Aragon Cir

- 15 Saint Francis Way

- 1421 Amador Cir

- 1518 Duran Cir

- 1868 Cherokee Dr Unit 1

- 1521 Ebro Cir

- 1867 Cherokee Dr Unit 1

- 1883 Cherokee Dr Unit 3

- 1443 Parsons Ave

- 429 W Laurel Dr Unit I

- 429 W Laurel Dr

- 429 W Laurel Dr Unit H

- 429 W Laurel Dr Unit E

- 429 W Laurel Dr Unit B

- 429 W Laurel Dr Unit 1

- 429 W Laurel Dr Unit J

- 429 W Laurel Dr Unit F

- 429 W Laurel Dr Unit L

- 429 W Laurel Dr Unit K

- 429 W Laurel Dr Unit G

- 429 W Laurel Dr Unit D17

- 429 W Laurel Dr Unit C

- 427 W Laurel Dr

- 427 W Laurel Dr Unit C

- 427 W Laurel Dr Unit G

- 427 W Laurel Dr Unit I

- 427 W Laurel Dr Unit J

- 427 W Laurel Dr Unit A

- 427 W Laurel Dr Unit L