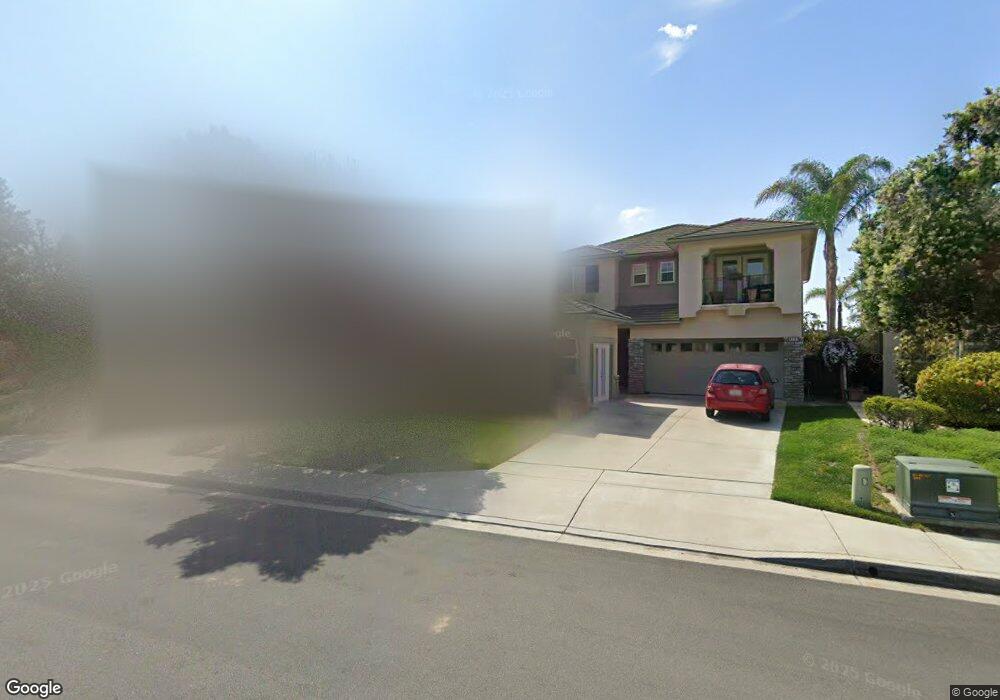

4291 Corte Langostino Unit 6 San Diego, CA 92130

Carmel Valley NeighborhoodEstimated Value: $2,260,078 - $2,559,000

5

Beds

3

Baths

2,827

Sq Ft

$875/Sq Ft

Est. Value

About This Home

This home is located at 4291 Corte Langostino Unit 6, San Diego, CA 92130 and is currently estimated at $2,472,270, approximately $874 per square foot. 4291 Corte Langostino Unit 6 is a home located in San Diego County with nearby schools including Carmel Valley Middle School, Torrey Hills High School, and Torrey Pines High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2022

Sold by

Kang Lee Yuan and Kang Diana I

Bought by

Yuan Kang Lee And Diana I Padgett 2022 Trust

Current Estimated Value

Purchase Details

Closed on

Nov 20, 2001

Sold by

Va

Bought by

Mallari Michael and Ramirez Mallari Reyme

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$480,000

Interest Rate

6.57%

Purchase Details

Closed on

Nov 6, 2001

Sold by

Mallari Michael and Ramirez Mallari Reyme

Bought by

Lee Yuan Kang and Padgett Diana I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$480,000

Interest Rate

6.57%

Purchase Details

Closed on

Jul 8, 1999

Sold by

Presley Torrey Ii Associates L L C

Bought by

Va

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,320

Interest Rate

7.69%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yuan Kang Lee And Diana I Padgett 2022 Trust | -- | None Listed On Document | |

| Lee Yuan Kang | -- | Ward & Thorn Ap Lc | |

| Mallari Michael | -- | Fidelity National Title | |

| Lee Yuan Kang | $605,000 | -- | |

| Va | $453,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lee Yuan Kang | $480,000 | |

| Previous Owner | Va | $112,320 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,575 | $893,749 | $443,181 | $450,568 |

| 2024 | $11,575 | $876,226 | $434,492 | $441,734 |

| 2023 | $11,346 | $859,046 | $425,973 | $433,073 |

| 2022 | $11,179 | $842,203 | $417,621 | $424,582 |

| 2021 | $10,836 | $825,690 | $409,433 | $416,257 |

| 2020 | $10,903 | $817,224 | $405,235 | $411,989 |

| 2019 | $10,731 | $801,201 | $397,290 | $403,911 |

| 2018 | $10,275 | $785,492 | $389,500 | $395,992 |

| 2017 | $10,119 | $770,091 | $381,863 | $388,228 |

| 2016 | $9,855 | $754,992 | $374,376 | $380,616 |

| 2015 | $9,737 | $743,652 | $368,753 | $374,899 |

| 2014 | $9,579 | $729,086 | $361,530 | $367,556 |

Source: Public Records

Map

Nearby Homes

- 4261 Corte Langostino

- 10495 Abalone Landing Terrace

- 4289 Calle Isabelino

- 11325 Carmel Creek Rd

- 3767 Torrey View Ct

- 11280 Carmel Creek Rd

- 3738 Ruette San Raphael

- 11649 Thistle Hill Place

- 10553 Gaylemont Ln Unit 5

- 0 Arroyo Sorrento Place Unit 250030141

- 3854-56 Via Del Mar

- 4 Via Del Mar

- 3 Via Del Mar

- 3811 Via Del Mar

- 5231 Setting Sun Way

- 10140 Wateridge Cir Unit 124

- 10794 Spur Point Ct

- 10292 Wateridge Cir Unit 253

- 0 Magee Rd Unit IG25221588

- 10941 Derrydown Way Unit 10

- 4285 Corte Langostino

- 4297 Corte Langostino

- 4299 Corte Langostino

- 4279 Corte Langostino

- 4273 Corte Langostino

- 4267 Corte Langostino

- 4292 Corte Langostino

- 4286 Corte Langostino

- 4296 Corte Langostino

- 4274 Corte Langostino

- 10861 Corte de Marin Unit 101

- 4313 Calle Mejillones

- 4255 Corte Langostino

- 10857 Corte de Marin

- 10849 Corte de Marin

- 4279 Calle Mejillones

- 10922 Corte Mejillones

- 10853 Corte de Marin Unit 99

- 10930 Corte Mejillones

- 10938 Corte Mejillones