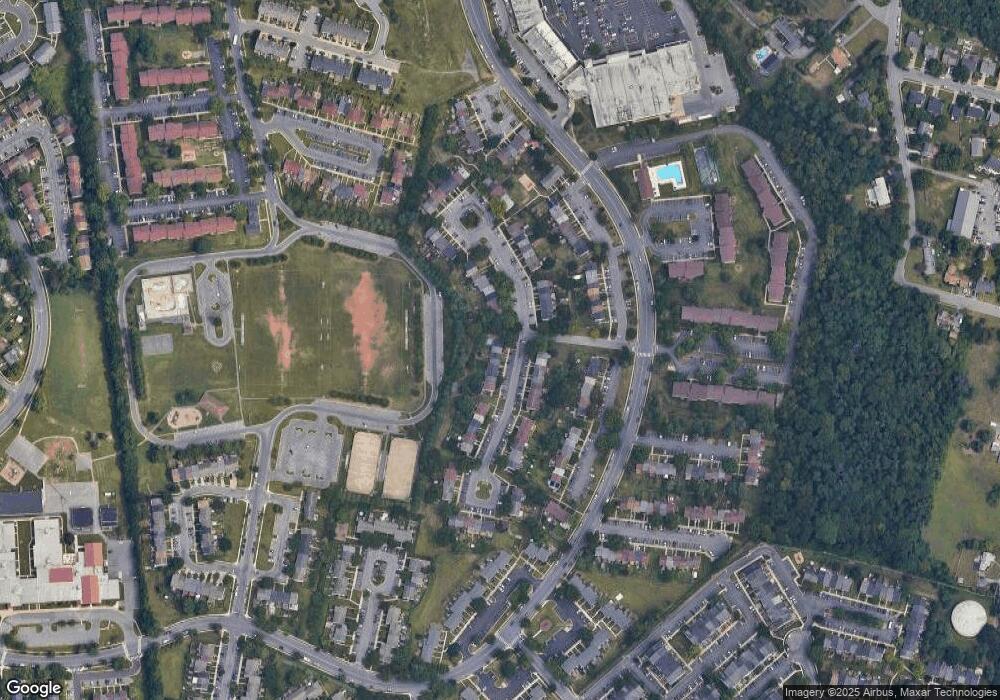

43 S Pendleton Ct Unit 14D Frederick, MD 21703

Frederick Heights/Overlook Neighborhood

3

Beds

3

Baths

--

Sq Ft

436

Sq Ft Lot

About This Home

This home is located at 43 S Pendleton Ct Unit 14D, Frederick, MD 21703. 43 S Pendleton Ct Unit 14D is a home located in Frederick County with nearby schools including Hillcrest Elementary School, West Frederick Middle School, and Frederick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2011

Sold by

Pokorny Cheryl and Lowe Valerie

Bought by

Vallejos Gabriela L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,027

Outstanding Balance

$99,986

Interest Rate

4.25%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 31, 2004

Sold by

Brink Sean and Brink Tina

Bought by

Barksdale Garry A

Purchase Details

Closed on

Aug 27, 2004

Sold by

Brink Sean and Brink Tina

Bought by

Barksdale Garry A

Purchase Details

Closed on

Jun 30, 2004

Sold by

Bryant Thomas F

Bought by

Brink Sean and Brink Tina

Purchase Details

Closed on

Jun 28, 2004

Sold by

Bryant Thomas F

Bought by

Brink Sean and Brink Tina

Purchase Details

Closed on

Jan 8, 2002

Sold by

Fogle'S Associates

Bought by

Bryant Thomas F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vallejos Gabriela L | $148,800 | None Available | |

| Barksdale Garry A | $187,250 | -- | |

| Barksdale Garry A | $187,250 | -- | |

| Brink Sean | $140,000 | -- | |

| Brink Sean | $140,000 | -- | |

| Bryant Thomas F | $88,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vallejos Gabriela L | $145,027 | |

| Closed | Bryant Thomas F | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,233 | $215,000 | $60,000 | $155,000 |

| 2024 | $3,233 | $206,667 | $0 | $0 |

| 2023 | $3,028 | $198,333 | $0 | $0 |

| 2022 | $2,880 | $190,000 | $55,000 | $135,000 |

| 2021 | $2,648 | $183,000 | $0 | $0 |

| 2020 | $2,599 | $176,000 | $0 | $0 |

| 2019 | $2,448 | $169,000 | $30,000 | $139,000 |

| 2018 | $2,581 | $144,667 | $0 | $0 |

| 2017 | $1,781 | $169,000 | $0 | $0 |

| 2016 | $2,078 | $96,000 | $0 | $0 |

| 2015 | $2,078 | $96,000 | $0 | $0 |

| 2014 | $2,078 | $96,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1217 Dahlia Ln

- 578 Boysenberry Ln

- 607 Himes Ave Unit 102

- 111 Lauren Ct

- 615 Himes Ave Unit 108

- 615 Himes Ave Unit 106

- 401 Linden Ave

- 617 Himes Ave

- 591 Winterspice Dr

- 1236C Danielle Dr

- 525 Beebe Ct

- 1008 Inkberry Way

- 116 Whiskey Creek Cir

- 1339 Orchard Way

- 514 Ellison Ct

- 512 Ellison Ct

- 713 Northside Dr

- 710 Wyngate Dr

- 500 Bradley Ct Unit 4B

- 597 Primus Ct

- 43 S Pendleton Ct

- 39 S Pendleton Ct

- 37 S Pendleton Ct

- 35 S Pendleton Ct

- 35 S Pendleton Ct Unit 14H

- 49 N Pendleton Ct

- 47 N Pendleton Ct

- 33 S Pendleton Ct

- 45 N Pendleton Ct

- 31 S Pendleton Ct

- 43 N Pendleton Ct

- 41 N Pendleton Ct

- 29 S Pendleton Ct

- 39 N Pendleton Ct

- 40 N Pendleton Ct

- 2 S Pendleton Ct

- 4 S Pendleton Ct

- 35 N Pendleton Ct

- 6 S Pendleton Ct