430 Creston Rd Paso Robles, CA 93446

Estimated Value: $647,000 - $720,000

3

Beds

2

Baths

1,568

Sq Ft

$432/Sq Ft

Est. Value

About This Home

This home is located at 430 Creston Rd, Paso Robles, CA 93446 and is currently estimated at $676,899, approximately $431 per square foot. 430 Creston Rd is a home located in San Luis Obispo County with nearby schools including Winifred Pifer Elementary School, Daniel Lewis Middle School, and Paso Robles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2010

Sold by

Polakoff Jacqueline Mercon

Bought by

Sepulveda Scott G and Jones Ronald R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,209

Outstanding Balance

$136,038

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$540,861

Purchase Details

Closed on

Sep 21, 1999

Sold by

Gedayloo Teymoor and Gedayloo Helen

Bought by

Polakoff Jacqueline Mercon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,200

Interest Rate

7.75%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sepulveda Scott G | $210,000 | Fidelity National Title Co | |

| Polakoff Jacqueline Mercon | $151,500 | Cuesta Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sepulveda Scott G | $207,209 | |

| Previous Owner | Polakoff Jacqueline Mercon | $151,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,855 | $269,033 | $89,675 | $179,358 |

| 2024 | $2,806 | $263,759 | $87,917 | $175,842 |

| 2023 | $2,806 | $258,589 | $86,194 | $172,395 |

| 2022 | $2,763 | $253,519 | $84,504 | $169,015 |

| 2021 | $2,714 | $248,549 | $82,848 | $165,701 |

| 2020 | $2,677 | $246,001 | $81,999 | $164,002 |

| 2019 | $2,637 | $241,179 | $80,392 | $160,787 |

| 2018 | $2,600 | $236,451 | $78,816 | $157,635 |

| 2017 | $2,443 | $231,816 | $77,271 | $154,545 |

| 2016 | $2,394 | $227,271 | $75,756 | $151,515 |

| 2015 | $2,384 | $223,859 | $74,619 | $149,240 |

| 2014 | $2,299 | $219,475 | $73,158 | $146,317 |

Source: Public Records

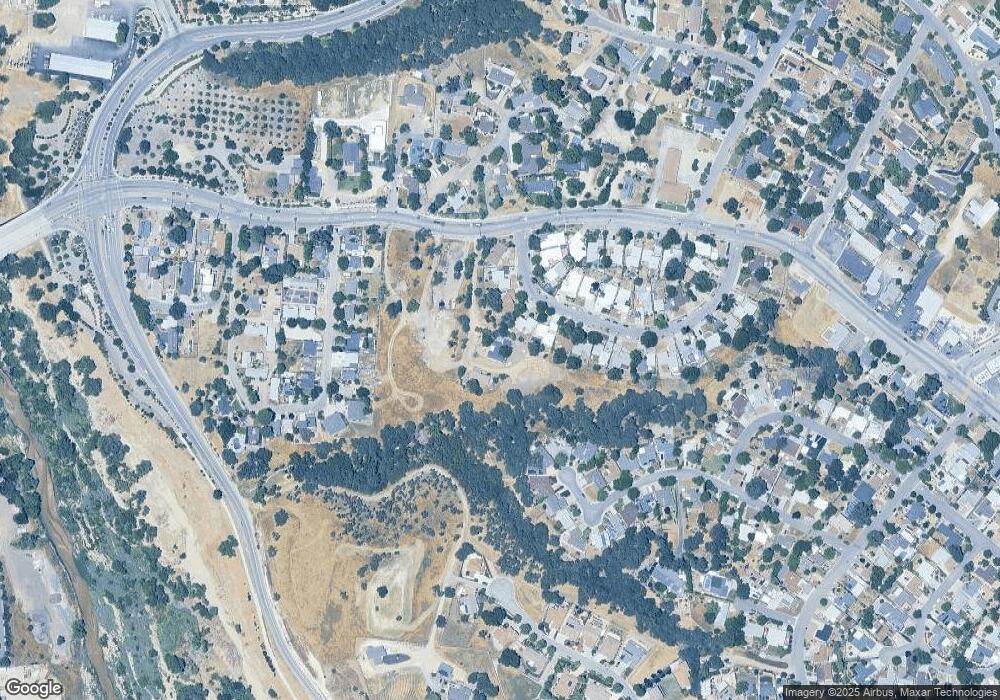

Map

Nearby Homes

- 420 Creston Rd

- 105 Capitol Hill Dr

- 714 Tanner Dr Unit A6

- 714 Tanner Dr Unit 6A

- 616 Trigo Ln

- 616 Jackson Dr

- 506 Navajo Ave

- 419 Cherokee Ct

- 147 Via Camelia

- 845 Creston Rd

- 1446 Park St

- 1612 Skyview Dr

- 0 Orchard Dr

- 0 Riverside Ave Unit PI25181393

- 945 Creston Rd

- 13625 California 46

- 1545 Park St

- 1803 Pine St

- 828 Spring St

- 1810 Park St