4307 Cron Way Bakersfield, CA 93311

Southern Oaks NeighborhoodEstimated Value: $496,000 - $632,000

3

Beds

2

Baths

2,482

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 4307 Cron Way, Bakersfield, CA 93311 and is currently estimated at $550,708, approximately $221 per square foot. 4307 Cron Way is a home located in Kern County with nearby schools including Old River Elementary School, Earl Warren Junior High School, and Stockdale High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 14, 2003

Sold by

Stuart Thomas Inc

Bought by

Ramirez Raul G and Ramirez Georgina V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 20, 2003

Sold by

Castle & Cooke California Inc

Bought by

Stuart Thomas Inc and Lenox Homes

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramirez Raul G | $260,500 | Commonwealth Title | |

| Stuart Thomas Inc | -- | Fidelity Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ramirez Raul G | $208,000 | |

| Previous Owner | Stuart Thomas Inc | $208,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,096 | $370,215 | $92,406 | $277,809 |

| 2024 | $5,027 | $362,957 | $90,595 | $272,362 |

| 2023 | $5,027 | $355,841 | $88,819 | $267,022 |

| 2022 | $4,833 | $348,865 | $87,078 | $261,787 |

| 2021 | $4,698 | $342,025 | $85,371 | $256,654 |

| 2020 | $5,173 | $338,519 | $84,496 | $254,023 |

| 2019 | $4,947 | $338,519 | $84,496 | $254,023 |

| 2018 | $4,742 | $325,376 | $81,216 | $244,160 |

| 2017 | $4,835 | $318,997 | $79,624 | $239,373 |

| 2016 | $4,545 | $312,743 | $78,063 | $234,680 |

| 2015 | $4,505 | $308,046 | $76,891 | $231,155 |

| 2014 | $4,345 | $302,012 | $75,385 | $226,627 |

Source: Public Records

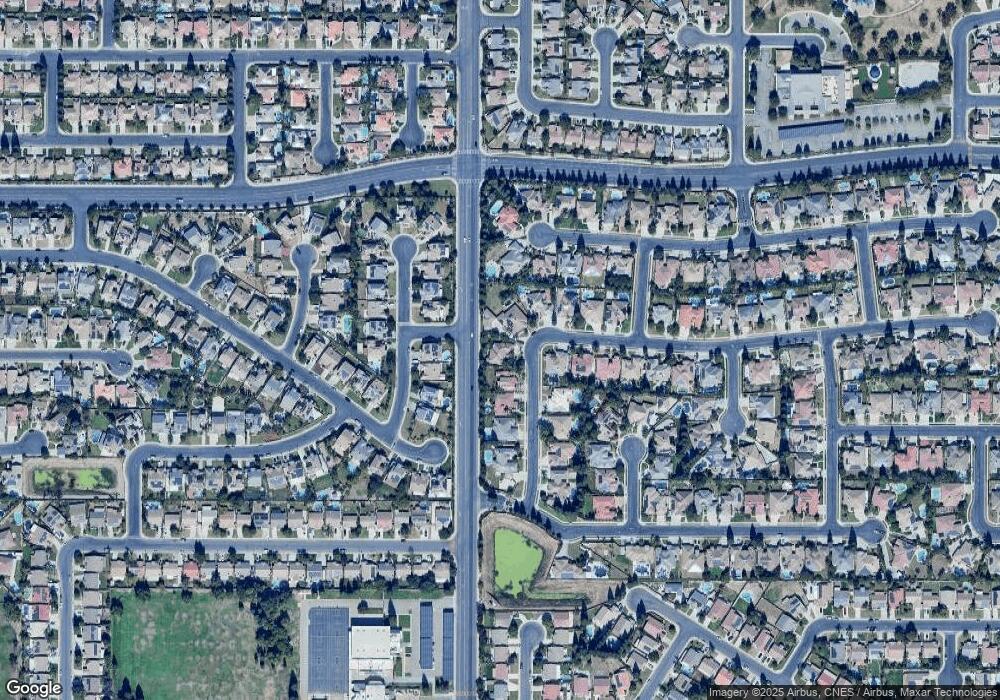

Map

Nearby Homes

- 4400 Cron Way

- 4300 Keyes Ct

- 4008 Desert Springs Way

- 3912 Cornerstone Way

- 10126 Pyramid Peak Dr Unit 5

- 3809 Wensley Ct

- 9813 Fitzgerald Dr

- 9918 Casa Del Sol Dr

- 10214 Pepperwood Dr

- 3808 Killarney Ct

- 10908 Delusion Dr

- 10609 Camino El Canon

- 11009 Mirage Dr

- 10213 Single Oak Dr

- 3905 Dos Lagos Dr

- 9902 Rancho Verde Dr

- 8727 Scintilla Ave Unit 2031W

- 8726 Scintilla Ave Unit 2019W

- 8306 March Violets Ave Unit 135

- 8114 March Violets Ave

- 4311 Cron Way

- 4303 Cron Way

- 4315 Cron Way

- 10309 Skiles Dr

- 10312 Skiles Dr

- 4300 Boulder Pass Dr

- 4304 Boulder Pass Dr

- 4401 Cron Way

- 4314 Cron Way

- 4210 Boulder Pass Dr

- 4308 Boulder Pass Dr

- 10308 Skiles Dr

- 10305 Skiles Dr

- 10409 Barnes Dr

- 4206 Boulder Pass Dr

- 10405 Barnes Dr

- 10304 Skiles Dr

- 4312 Boulder Pass Dr

- 4202 Boulder Pass Dr

- 10301 Skiles Dr