431 Leeward Trail Unit 194 Woodbury, MN 55129

Estimated Value: $230,000 - $241,000

2

Beds

2

Baths

1,086

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 431 Leeward Trail Unit 194, Woodbury, MN 55129 and is currently estimated at $236,046, approximately $217 per square foot. 431 Leeward Trail Unit 194 is a home located in Washington County with nearby schools including Lake Elmo Elementary School, Oak-Land Middle School, and Stillwater Area High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 29, 2017

Sold by

Farrington Morgyn A

Bought by

Nicholas Connor B and Nicholas Libesth A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$141,432

Outstanding Balance

$118,857

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$117,189

Purchase Details

Closed on

Jun 17, 2016

Sold by

Lindholm Eric J and Lindholm Sarah

Bought by

Farrington Morgyn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,200

Interest Rate

3.61%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 26, 2003

Sold by

Bauman Kimberly and Bauman Cory A

Bought by

Lindholm Eric J

Purchase Details

Closed on

May 29, 2001

Sold by

Grimm Tate

Bought by

Swanson Kimberly and Bauman Cory A

Purchase Details

Closed on

Apr 29, 1998

Sold by

Pulte Homes Of Minnesota Corp

Bought by

Grimm Tate

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nicholas Connor B | $150,000 | Partners Title Llc | |

| Farrington Morgyn A | $134,900 | Partners Title Llc | |

| Lindholm Eric J | $148,500 | -- | |

| Swanson Kimberly | $125,000 | -- | |

| Grimm Tate | $81,335 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nicholas Connor B | $141,432 | |

| Previous Owner | Farrington Morgyn A | $128,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,878 | $211,200 | $67,500 | $143,700 |

| 2023 | $1,878 | $220,700 | $80,000 | $140,700 |

| 2022 | $1,612 | $192,100 | $65,000 | $127,100 |

| 2021 | $1,496 | $169,900 | $57,500 | $112,400 |

| 2020 | $1,414 | $164,400 | $59,000 | $105,400 |

| 2019 | $1,330 | $156,500 | $49,000 | $107,500 |

| 2018 | $1,236 | $140,900 | $42,500 | $98,400 |

| 2017 | $1,132 | $132,600 | $40,000 | $92,600 |

| 2016 | $1,458 | $121,000 | $30,000 | $91,000 |

| 2015 | $1,388 | $121,600 | $25,000 | $96,600 |

| 2013 | -- | $106,500 | $25,200 | $81,300 |

Source: Public Records

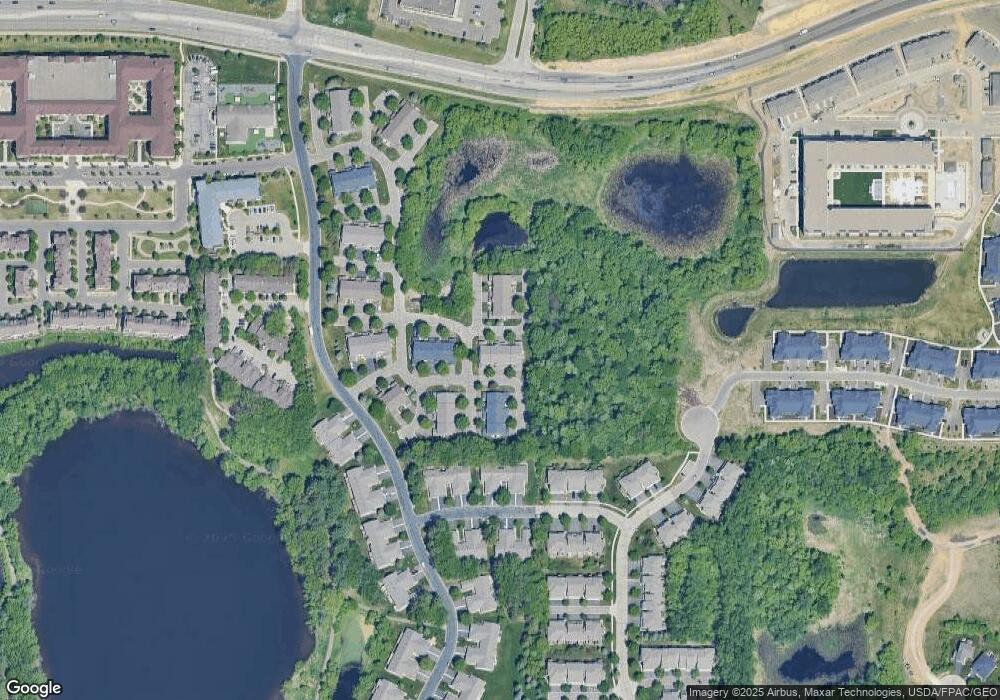

Map

Nearby Homes

- 497 Leeward Trail

- 769 Lake Ridge Dr

- 585 Markgrafs Lake Bay

- 10035 City Walk Dr Unit 103

- 10894 Retreat Ln

- 10447 Kilbirnie Rd

- 880 Drew Dr

- 10695 Brookview Rd

- 1076 Bonnieview Cir

- 9851 Moonbeam Ln

- 9770 Moonbeam Ln

- 9726 Moonbeam Ln

- 1096 Woodbury Dr

- 10791 3rd Street Place N

- 1050 Wyncrest Ct

- 1346 Clearwater Dr

- 10601 Watersedge Ln

- 9903 5th Street Ln N

- 9925 5th Street Ln N

- 10171 Stony Creek Dr

- 445 Leeward Trail

- 433 Leeward Trail

- 435 Leeward Trail

- 451 Leeward Trail Unit 189

- 429 Leeward Trail Unit 193

- 449 Leeward Trail Unit 190

- 447 Leeward Trail Unit 191

- 399 Leeward Trail

- 401 Leeward Trail

- 469 Leeward Trail

- 467 Leeward Trail

- 465 Leeward Trail Unit 184

- 461 Leeward Trail Unit 182

- 403 Leeward Trail

- 405 Leeward Trail Unit 197

- 393 Leeward Trail Unit 202

- 391 Leeward Trail Unit 201

- 471 Leeward Trail Unit 186

- 459 Leeward Trail

- 463 Leeward Trail