4311 Okeechobee Blvd Unit 41 West Palm Beach, FL 33409

Estimated Value: $79,072 - $280,000

2

Beds

2

Baths

840

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 4311 Okeechobee Blvd Unit 41, West Palm Beach, FL 33409 and is currently estimated at $160,768, approximately $191 per square foot. 4311 Okeechobee Blvd Unit 41 is a home located in Palm Beach County with nearby schools including Egret Lake Elementary School, Bear Lakes Middle School, and Palm Beach Lakes Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2021

Sold by

Sabol Cary P and 4311 Okeechobee Blvd

Bought by

George Richard and George Faith

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Outstanding Balance

$15,950

Interest Rate

3.1%

Mortgage Type

Stand Alone Second

Estimated Equity

$144,818

Purchase Details

Closed on

Dec 22, 2015

Sold by

Graeve Chris

Bought by

Sabol Cary P

Purchase Details

Closed on

Jun 11, 2015

Sold by

County Of Palm Beach

Bought by

The 4311 Okeechobee Blvd #41 Land Trust and Graeve Chris

Purchase Details

Closed on

Jul 5, 2005

Sold by

Guzman Alberto

Bought by

Wilches Milton

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,053

Interest Rate

5.59%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 16, 2001

Sold by

Gerald F Minor M and Marilyn Minor M

Bought by

Guzman Alberto

Purchase Details

Closed on

Jan 23, 2001

Sold by

Pr Paggy A White

Bought by

Minor Gerald F and Minor Marilyn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| George Richard | $60,000 | Attorney | |

| Sabol Cary P | -- | Attorney | |

| The 4311 Okeechobee Blvd #41 Land Trust | $16,000 | None Available | |

| Wilches Milton | $60,000 | Home Title America Inc | |

| Guzman Alberto | $33,000 | -- | |

| Minor Gerald F | $15,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | George Richard | $40,000 | |

| Previous Owner | Wilches Milton | $55,053 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,547 | $61,280 | -- | -- |

| 2023 | $1,523 | $56,739 | $0 | $0 |

| 2022 | $1,390 | $51,581 | $0 | $0 |

| 2021 | $1,106 | $43,400 | $43,400 | $0 |

| 2020 | $1,137 | $38,902 | $28,000 | $10,902 |

| 2019 | $1,315 | $56,121 | $44,800 | $11,321 |

| 2018 | $1,090 | $38,629 | $27,563 | $11,066 |

| 2017 | $1,041 | $38,079 | $26,250 | $11,829 |

| 2016 | $972 | $33,592 | $0 | $0 |

| 2015 | $752 | $12,104 | $0 | $0 |

| 2014 | $634 | $11,004 | $0 | $0 |

Source: Public Records

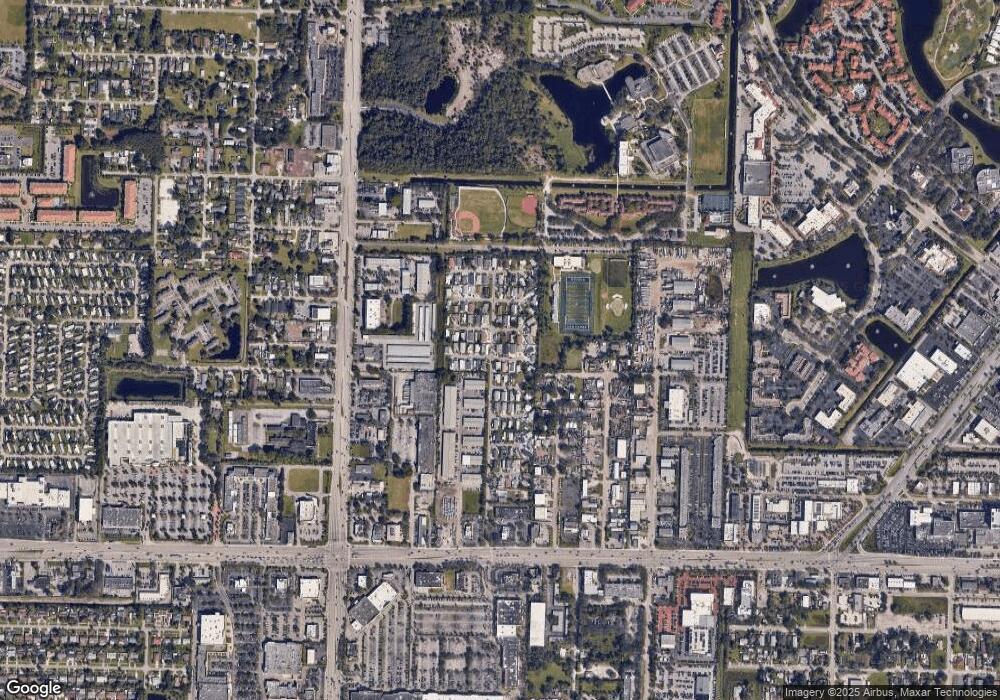

Map

Nearby Homes

- 4311 Okeechobee Blvd

- 4311 Okeechobee Blvd Unit 20

- 4562 Old Military Trail

- 4578 Iris St

- 4647 Marguerita Dr

- 4679 Martha Louise Dr

- 4896 Alberta Ave

- 4290 Woodstock Dr Unit D

- 4296 Woodstock Dr Unit A

- 1865 Donnell Rd

- 4793 Badger Rd

- 4838 Badger Ave

- 2364 47th 1er N Lot Unit 191

- 4208 Glenmoor Dr

- 4106 Glenmoor Dr

- 4102 Glenmoor Dr

- 3204 Glenmoor Dr Unit 3204

- 5102 Glenmoor Dr

- 6104 Glenmoor Dr

- 4889 Alberta Ave

- 4311 Okeechobee Blvd Unit 15

- 4311 Okeechobee Blvd Unit 86

- 4311 Okeechobee Blvd Unit 87

- 4311 Okeechobee Blvd Unit 134

- 4311 Okeechobee Blvd Unit 16

- 4311 Okeechobee Blvd Unit 48

- 4311 Okeechobee Blvd Unit 43

- 4311 Okeechobee Blvd Unit 38

- 4311 Okeechobee Blvd Unit 125

- 4311 Okeechobee Blvd Unit 96

- 4311 Okeechobee Blvd Unit 135

- 4311 Okeechobee Blvd Unit 80

- 4311 Okeechobee Blvd Unit 35

- 4311 Okeechobee Blvd Unit 30

- 4311 Okeechobee Blvd Unit 45

- 4401 Annette St Unit 3

- 2422 N Military Trail

- 2190 Zip Code Place

- 4438 Marguerita Dr

- 2373 N Military Trail