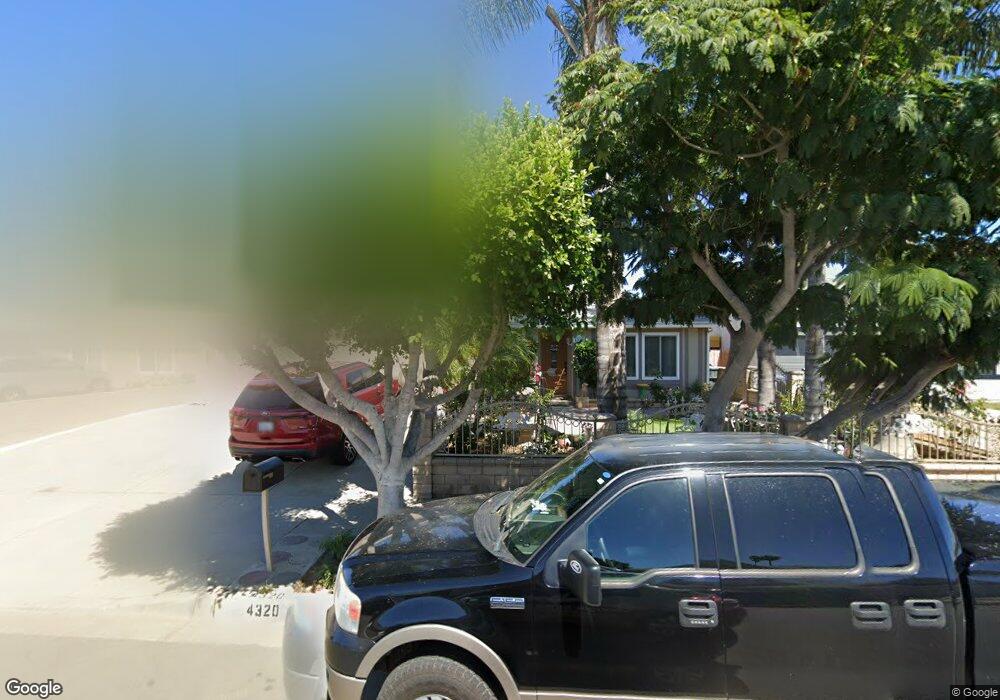

4320 Justin Way Oxnard, CA 93033

Pleasant Valley Estates NeighborhoodEstimated Value: $699,486 - $738,000

4

Beds

2

Baths

1,615

Sq Ft

$449/Sq Ft

Est. Value

About This Home

This home is located at 4320 Justin Way, Oxnard, CA 93033 and is currently estimated at $725,622, approximately $449 per square foot. 4320 Justin Way is a home located in Ventura County with nearby schools including Julien Hathaway Elementary School and Channel Islands High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 10, 2024

Sold by

Rosales Armando T and Rosales Cristina

Bought by

Armando And Cristina Rosales Living Trust and Rosales

Current Estimated Value

Purchase Details

Closed on

Apr 9, 1997

Sold by

Rosales Armando T and Rosales Cristina

Bought by

Rosales Armando T and Rosales Cristina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,297

Interest Rate

7.66%

Purchase Details

Closed on

Jul 8, 1996

Sold by

Rosales Andres T

Bought by

Rosales Armondo T and Rosales Cristina

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Armando And Cristina Rosales Living Trust | -- | None Listed On Document | |

| Rosales Armando T | $7,000 | First American Title Ins Co | |

| Rosales Armondo T | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rosales Armando T | $20,297 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,445 | $293,781 | $117,510 | $176,271 |

| 2024 | $3,445 | $288,021 | $115,206 | $172,815 |

| 2023 | $3,242 | $282,374 | $112,947 | $169,427 |

| 2022 | $3,174 | $276,838 | $110,733 | $166,105 |

| 2021 | $3,212 | $271,410 | $108,561 | $162,849 |

| 2020 | $3,269 | $268,629 | $107,449 | $161,180 |

| 2019 | $3,170 | $263,363 | $105,343 | $158,020 |

| 2018 | $3,053 | $258,200 | $103,278 | $154,922 |

| 2017 | $2,952 | $253,138 | $101,253 | $151,885 |

| 2016 | $2,811 | $248,175 | $99,268 | $148,907 |

| 2015 | $2,853 | $244,449 | $97,778 | $146,671 |

| 2014 | $2,800 | $239,662 | $95,863 | $143,799 |

Source: Public Records

Map

Nearby Homes

- 411 E Bard Rd

- 4160 Petit Dr Unit 39

- 320 Columbia Place Unit 46

- 360 Ibsen Place Unit 129

- 300 Ibsen Place Unit 132

- 4910 Justin Way

- 840 Morro Way

- 3631 La Costa Place

- 4731 Hamilton Ave

- 4340 Highland Ave

- 5117 Jefferson Square

- 5222 Longfellow Way

- 5204 Columbus Place

- 5225 Columbus Place

- 4614 Concord Way

- 1630 Nelson Place

- 5302 Barrymore Dr

- 404 Vine Place

- 167 Hughes Dr

- 1036 Cheyenne Way

- 4330 Justin Way

- 4310 Justin Way

- 628 Yale Place

- 4340 Justin Way

- 4300 Justin Way

- 4245 Frost Dr

- 4255 Frost Dr

- 4321 Justin Way

- 4331 Justin Way

- 4235 Frost Dr

- 624 Yale Place

- 4301 Frost Dr

- 4311 Justin Way

- 4350 Justin Way

- 4250 Justin Way

- 4341 Justin Way

- 4311 Frost Dr

- 4400 Justin Way

- 4240 Justin Way

- 4421 Clover Dr