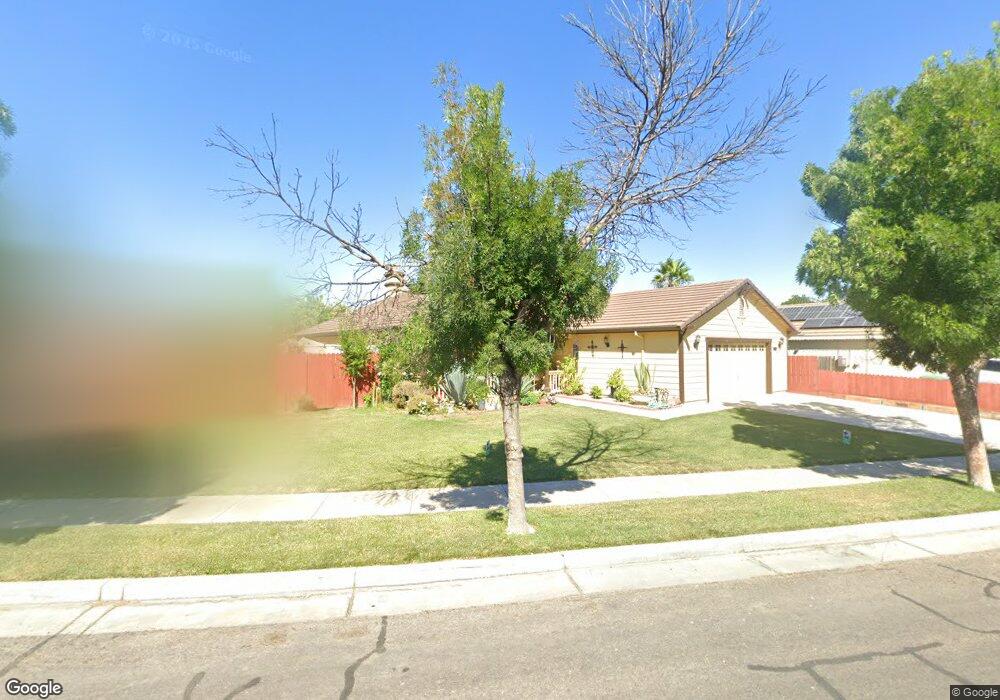

433 Somerset Ave Los Banos, CA 93635

Estimated Value: $350,000 - $493,000

4

Beds

2

Baths

1,833

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 433 Somerset Ave, Los Banos, CA 93635 and is currently estimated at $436,901, approximately $238 per square foot. 433 Somerset Ave is a home located in Merced County with nearby schools including Grasslands Elementary School, Los Banos Junior High School, and Pacheco High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2020

Sold by

Sandoval Heriberto

Bought by

Sandoval Robles Francisco and Sandoval Raquel Raquel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Outstanding Balance

$137,240

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$299,661

Purchase Details

Closed on

Feb 14, 2014

Sold by

Gonzalez Andrew

Bought by

Sandoval Francisco and Sandoval Raquel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,920

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

May 19, 2003

Sold by

Bonanza Development Inc

Bought by

Gonzalez Andrew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,100

Interest Rate

4.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sandoval Robles Francisco | -- | First American Title | |

| Sandoval Francisco | $170,000 | First American Title Company | |

| Gonzalez Andrew | $246,500 | Transcounty Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sandoval Robles Francisco | $155,000 | |

| Previous Owner | Sandoval Francisco | $166,920 | |

| Previous Owner | Gonzalez Andrew | $197,100 | |

| Closed | Gonzalez Andrew | $49,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,151 | $208,386 | $30,641 | $177,745 |

| 2024 | $3,151 | $204,301 | $30,041 | $174,260 |

| 2023 | $2,978 | $200,296 | $29,452 | $170,844 |

| 2022 | $2,895 | $196,370 | $28,875 | $167,495 |

| 2021 | $2,832 | $192,520 | $28,309 | $164,211 |

| 2020 | $2,795 | $190,547 | $28,019 | $162,528 |

| 2019 | $2,743 | $186,812 | $27,470 | $159,342 |

| 2018 | $2,668 | $183,150 | $26,932 | $156,218 |

| 2017 | $2,633 | $179,559 | $26,404 | $153,155 |

| 2016 | $2,646 | $176,039 | $25,887 | $150,152 |

| 2015 | $2,596 | $173,396 | $25,499 | $147,897 |

| 2014 | $2,533 | $170,000 | $30,000 | $140,000 |

Source: Public Records

Map

Nearby Homes

- 418 Rockport Dr

- 1447 Nottingham Cir

- 1416 San Rafael St

- 343 San Bernardino St

- 436 N Mercey Springs Rd Unit 69

- 436 N Mercey Springs Rd Unit 16

- 436 N Mercey Springs Rd Unit 93

- 436 N Mercey Springs Rd Unit 154

- 510 Stonehaven Dr

- 1236 Santa Cruz Way

- The Argent Plan at Southpointe

- The Florencia Plan at Southpointe

- The Stella Plan at Southpointe

- The Santa Cruz Plan at Southpointe

- The Monterey Plan at Southpointe

- The Fasano Plan at Southpointe

- The Caledonia Plan at Southpointe

- The Ashington Plan at Southpointe

- 405 N Santa Ana St

- 2038 Casey Ln

- 427 Somerset Ave

- 439 Somerset Ave

- 436 Rockport Dr

- 421 Somerset Ave

- 430 Rockport Dr

- 1459 Windmere Ct Unit 1

- 1459 Windmere Ct

- 438 Somerset Ave

- 432 Somerset Ave

- 444 Somerset Ave

- 442 Rockport Dr

- 426 Somerset Ave

- 415 Somerset Ave

- 424 Rockport Dr

- 420 Somerset Ave

- 1457 Windmere Ct

- 417 San Fernando St

- 421 San Fernando St

- 448 Rockport Dr

- 414 Somerset Ave