4340 S Creekhaven Rd Auburn, CA 95602

Estimated Value: $614,000 - $796,000

3

Beds

2

Baths

1,798

Sq Ft

$387/Sq Ft

Est. Value

About This Home

This home is located at 4340 S Creekhaven Rd, Auburn, CA 95602 and is currently estimated at $696,312, approximately $387 per square foot. 4340 S Creekhaven Rd is a home located in Placer County with nearby schools including Placer High School and St. Joseph Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 9, 2024

Sold by

Kahn William L and Kahn Deborah J

Bought by

Kahn Family Revocable Trust and Kahn

Current Estimated Value

Purchase Details

Closed on

Nov 9, 2023

Sold by

William Lloyd Kahn Trust

Bought by

Kahn William L and Kahn Deborah J

Purchase Details

Closed on

Dec 2, 2011

Sold by

Kahn Bill L and Carter Kahn Andriea L

Bought by

Kahn William L and Kahn William Lloyd

Purchase Details

Closed on

Jun 10, 2008

Sold by

Indymac Bank Fsb

Bought by

Kahn Bill L and Carter Kahn Andriea L

Purchase Details

Closed on

Apr 28, 2008

Sold by

Sarrett Paul R and Sarrett Roselle E

Bought by

Indymac Bank Fsb

Purchase Details

Closed on

Feb 23, 1995

Sold by

Stratton Darrell D and Stratton Anita L

Bought by

Sarrett Paul R and Sarrett Roselle E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

9.09%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kahn Family Revocable Trust | -- | None Listed On Document | |

| Kahn William L | -- | None Listed On Document | |

| Kahn William L | -- | None Available | |

| Kahn Bill L | $430,000 | None Available | |

| Indymac Bank Fsb | $391,516 | None Available | |

| Sarrett Paul R | $280,000 | Sierra Valley Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sarrett Paul R | $224,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,814 | $564,792 | $328,370 | $236,422 |

| 2023 | $5,814 | $542,863 | $315,620 | $227,243 |

| 2022 | $5,722 | $532,220 | $309,432 | $222,788 |

| 2021 | $5,518 | $521,785 | $303,365 | $218,420 |

| 2020 | $5,478 | $516,436 | $300,255 | $216,181 |

| 2019 | $5,377 | $506,311 | $294,368 | $211,943 |

| 2018 | $5,087 | $496,385 | $288,597 | $207,788 |

| 2017 | $4,996 | $486,653 | $282,939 | $203,714 |

| 2016 | $4,891 | $477,112 | $277,392 | $199,720 |

| 2015 | $4,772 | $469,947 | $273,226 | $196,721 |

| 2014 | $4,560 | $447,000 | $259,900 | $187,100 |

Source: Public Records

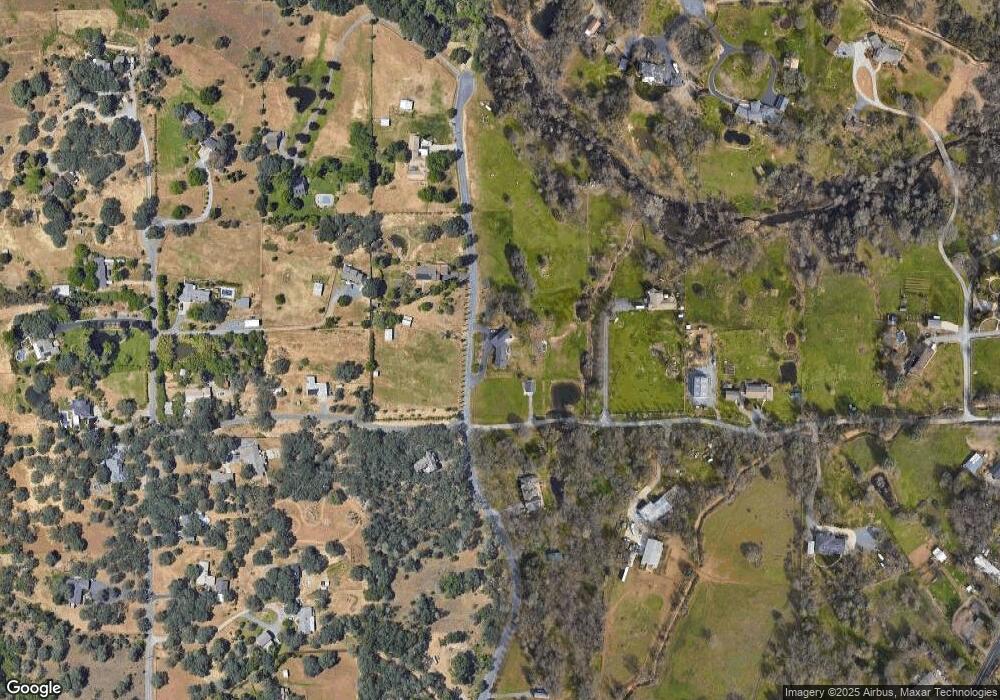

Map

Nearby Homes

- 10490 Hubbard Rd

- 11131 Dry Creek Rd

- 11085 Joeger Rd

- 11290 Dry Creek Rd

- 4203 Richardson Dr

- 11614 Sherwood Way

- 11441 White Doe Ct

- 11761 Graeagle Ln

- 4721 Grass Valley Hwy

- 3970 Foothill Oaks Dr

- 5215 Meadow View Ln

- 3620 Rancho Sierra Rd

- 3775 Bell Rd

- 3765 Grass Valley Hwy Unit 282

- 3765 Grass Valley Hwy Unit 263

- 3765 Grass Valley Hwy Unit 14

- 3765 Grass Valley Hwy Unit 271

- 3765 Grass Valley Hwy Unit 117

- 3765 Grass Valley Hwy Unit 226

- 11325 Tahoe St

- 4373 S Creekhaven Rd

- 4291 S Creekhaven Rd

- 11211 Pickle Barrel Rd

- 10925 Pickle Barrel Rd

- 4294 Creekhaven Rd

- 11005 Pickle Barrel Rd

- 4489 S Creekhaven Rd

- 11300 Pickle Barrel Rd

- 11331 Pickle Barrel Rd

- 4570 Miller Oak Dr

- 4530 Miller Oak Dr

- 10955 Pickle Barrel Rd

- 10800 Pickle Barrel Rd

- 10905 Pickle Barrel Rd

- 11180 Creekhaven Ct

- 4520 Miller Oak Dr

- 11200 Creekhaven Ct

- 4560 Miller Oak Dr

- 11140 Creekhaven Ct

- 4164 Creekhaven Rd