4369 Willow Pond Cir Unit 14D West Palm Beach, FL 33417

Lakeside Green NeighborhoodEstimated Value: $228,000 - $280,000

2

Beds

2

Baths

1,153

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 4369 Willow Pond Cir Unit 14D, West Palm Beach, FL 33417 and is currently estimated at $259,741, approximately $225 per square foot. 4369 Willow Pond Cir Unit 14D is a home located in Palm Beach County with nearby schools including Seminole Trails Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 18, 2016

Sold by

Boychuck Harrison Michael and Boychuck Harrison Abbey

Bought by

Bedard Kali M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,000

Outstanding Balance

$81,997

Interest Rate

3.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$177,744

Purchase Details

Closed on

May 22, 2013

Sold by

Marshall Clive and Marshall Jan

Bought by

Harrison Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,641

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 26, 1993

Sold by

Bishop Palmer Glenn E and Bishop Palmer Patricia Ann

Bought by

Marshall Clive

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Interest Rate

6.9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bedard Kali M | $95,000 | First Intl Title Inc | |

| Harrison Michael | $75,000 | None Available | |

| Marshall Clive | $60,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bedard Kali M | $105,000 | |

| Previous Owner | Harrison Michael | $73,641 | |

| Previous Owner | Marshall Clive | $20,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,586 | $120,575 | -- | -- |

| 2024 | $1,586 | $117,177 | -- | -- |

| 2023 | $1,531 | $113,764 | $0 | $0 |

| 2022 | $1,495 | $110,450 | $0 | $0 |

| 2021 | $1,459 | $107,233 | $0 | $0 |

| 2020 | $1,422 | $105,752 | $0 | $0 |

| 2019 | $1,404 | $103,374 | $0 | $0 |

| 2018 | $1,307 | $101,447 | $0 | $0 |

| 2017 | $1,273 | $99,360 | $0 | $0 |

| 2016 | $772 | $64,314 | $0 | $0 |

| 2015 | $790 | $63,867 | $0 | $0 |

| 2014 | $793 | $63,360 | $0 | $0 |

Source: Public Records

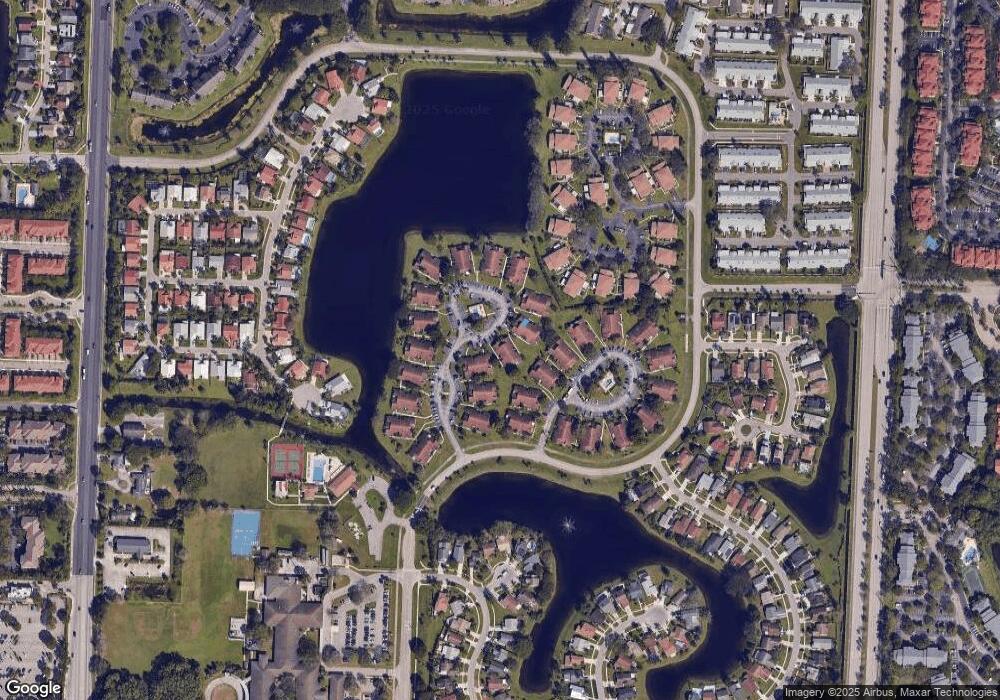

Map

Nearby Homes

- 4289 Willow Pond Cir

- 4255 Willow Pond Cir Unit 3A

- 4371 Willow Pond Rd Unit 5C

- 4327 Willow Brook Cir Unit C

- 4443 Willow Pond Rd Unit 13A

- 4491 Willow Pond Rd Unit B

- 4105 Clearview Terrace

- 4451 Willow Pond Rd Unit 14B

- 4085 Clearview Terrace

- 4969 Broadstone Cir

- 4631 Brook Dr

- 5018 Ellery Terrace

- 4197 N Haverhill Rd Unit 212

- 4570 Brook Dr

- 4582 Brook Dr

- 4149 N Haverhill Rd Unit 1619

- 4561 Discovery Ln Unit 14

- 5114 Ashley River Rd

- 4580 Discovery Ln Unit 23

- 4520 Feivel Rd Unit 49

- 4371 Willow Pond Cir

- 4363 Willow Pond Cir Unit 14A

- 4375 Willow Pond Cir

- 4367 Willow Pond Cir Unit 14C

- 4459 Willow Pond Cir Unit C

- 4365 Willow Pond Cir Unit 14B

- 4377 Willow Pond Cir Unit 15c

- 4377 Willow Pond Cir

- 4359 Willow Pond Cir Unit 13D

- 4373 Willow Pond Cir Unit A

- 4357 Willow Pond Cir

- 4379 Willow Pond Cir Unit 15d

- 4379 Willow Pond Cir Unit B

- 4379 Willow Pond Cir Unit D

- 4353 Willow Pond Cir Unit 13A

- 4355 Willow Pond Cir Unit D

- 4355 Willow Pond Cir Unit 13-B

- 4355 Willow Pond Cir

- 4385 Willow Pond Cir Unit LOT 16

- 4385 Willow Pond Cir Unit 16B