4391 Remsen Rd Medina, OH 44256

Estimated Value: $418,000 - $491,000

3

Beds

3

Baths

2,828

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 4391 Remsen Rd, Medina, OH 44256 and is currently estimated at $452,985, approximately $160 per square foot. 4391 Remsen Rd is a home located in Medina County with nearby schools including Eliza Northrop Elementary School, Claggett Middle School, and Medina High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 2016

Sold by

Stearns Adam P and Stearns Susan M

Bought by

Stearns Susan M and Stearns Adam P

Current Estimated Value

Purchase Details

Closed on

Jun 12, 2014

Sold by

Karr Kevin M and Karr Jill M

Bought by

Stearns Adam P and Stearns Susan M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,800

Outstanding Balance

$168,449

Interest Rate

4.28%

Mortgage Type

New Conventional

Estimated Equity

$284,536

Purchase Details

Closed on

Sep 30, 2009

Sold by

Norton Medina Holdings Llc

Bought by

Karr Kevin M

Purchase Details

Closed on

Oct 3, 2008

Sold by

Norton Robert L and Norton Lexie J

Bought by

Norton Medina Holdings Llc

Purchase Details

Closed on

Jun 29, 2006

Sold by

Mangan Mark J and Mangan Norah

Bought by

Norton Robert L

Purchase Details

Closed on

Nov 29, 2004

Sold by

Kubasta Kent W and Kubasta Mary E

Bought by

Mangan Mark J and Mangan Norah

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stearns Susan M | -- | Guardian Title | |

| Stearns Adam P | $279,500 | None Available | |

| Karr Kevin M | $266,000 | -- | |

| Norton Medina Holdings Llc | -- | -- | |

| Norton Robert L | $295,000 | -- | |

| Mangan Mark J | $264,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stearns Adam P | $220,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,526 | $107,960 | $32,580 | $75,380 |

| 2023 | $5,526 | $107,960 | $32,580 | $75,380 |

| 2022 | $4,765 | $107,960 | $32,580 | $75,380 |

| 2021 | $4,557 | $87,060 | $26,270 | $60,790 |

| 2020 | $4,594 | $87,060 | $26,270 | $60,790 |

| 2019 | $4,603 | $87,060 | $26,270 | $60,790 |

| 2018 | $4,890 | $85,830 | $26,070 | $59,760 |

| 2017 | $4,956 | $85,830 | $26,070 | $59,760 |

| 2016 | $5,070 | $85,830 | $26,070 | $59,760 |

| 2015 | $4,710 | $75,950 | $23,070 | $52,880 |

| 2014 | $4,698 | $75,950 | $23,070 | $52,880 |

| 2013 | $4,705 | $75,950 | $23,070 | $52,880 |

Source: Public Records

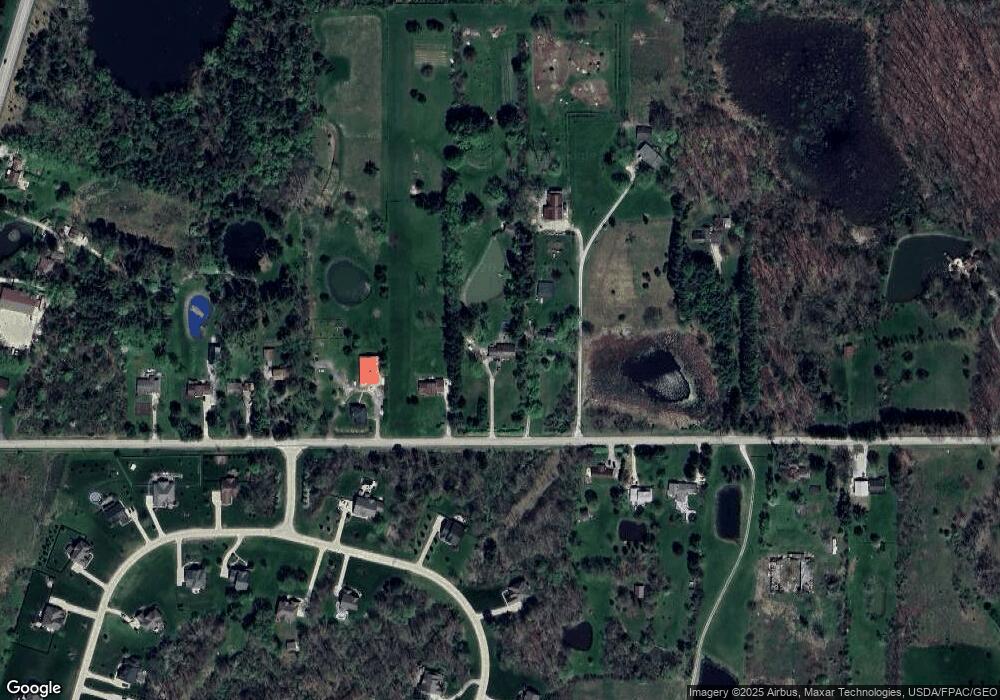

Map

Nearby Homes

- 3949 Remsen Rd

- 4396 Gladden Place

- 4525 Fenn Rd

- 2988 Sutton Ln

- 3676 Huffman Rd

- 2976 Sutton Ln

- 3840 Deer Lake Dr

- 3997 Stonegate Dr

- 3085 Hamlin Rd

- 4001 Twin Fawn Ct

- 3722 Watkins Rd

- 4137 Foskett Rd

- 4105 Sacramento Blvd

- 2483 Substation Rd

- 3674 Fenn Rd

- 5035 Red Maple Ct

- 3135 Crooked Creek Cir

- 3874 Crimson Harvest Ln

- 1168 N Jefferson St Unit U18

- 3313 Hamilton Rd

- 4387 Remsen Rd

- 4411 Remsen Rd

- 4433 Remsen Rd

- 4324 Maggie Marie Blvd

- 4376 Remsen Rd

- 4385 Remsen Rd

- 4302 Maggie Marie Blvd

- Maggie Marie Blvd

- 4364 Remsen Rd

- 4350 Remsen Rd

- 4383 Remsen Rd

- 4342 Maggie Marie Blvd

- 4335 Remsen Rd

- 4471 Remsen Rd

- 4264 Maggie Marie Blvd

- 4481 Remsen Rd

- 4309 Maggie Marie Blvd

- 4364 Maggie Marie Blvd

- 4364 Maggie Marie Blvd

- 4347 Maggie Marie Blvd