4404 Kittiwake Way Unit 2 Oceanside, CA 92057

San Luis Rey NeighborhoodEstimated Value: $494,000 - $524,239

2

Beds

2

Baths

1,050

Sq Ft

$487/Sq Ft

Est. Value

About This Home

This home is located at 4404 Kittiwake Way Unit 2, Oceanside, CA 92057 and is currently estimated at $511,060, approximately $486 per square foot. 4404 Kittiwake Way Unit 2 is a home located in San Diego County with nearby schools including Ivey Ranch Elementary School, Martin Luther King Jr. Middle School, and El Camino High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2003

Sold by

Dorso Mary M

Bought by

Dorso Mary M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,000

Outstanding Balance

$44,505

Interest Rate

5.71%

Estimated Equity

$466,555

Purchase Details

Closed on

Apr 22, 2002

Sold by

Dorso Mary M

Bought by

Dorso Mary M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

6.78%

Purchase Details

Closed on

Mar 26, 2002

Sold by

Va

Bought by

Marken Ida Ruth and Marken John Ward

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

6.78%

Purchase Details

Closed on

Mar 7, 2002

Sold by

Marken John W and Marken Ida R

Bought by

Dorso Mary M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

6.78%

Purchase Details

Closed on

Apr 20, 1999

Sold by

Jacob Ida R

Bought by

Marken John W and Marken Ida R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dorso Mary M | -- | First American Title | |

| Dorso Mary M | -- | Fidelity National Title Co | |

| Marken Ida Ruth | -- | California Title Company | |

| Dorso Mary M | $172,000 | California Title Company | |

| Marken John W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dorso Mary M | $103,000 | |

| Closed | Dorso Mary M | $90,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,752 | $254,080 | $132,949 | $121,131 |

| 2024 | $2,752 | $249,099 | $130,343 | $118,756 |

| 2023 | $2,665 | $244,216 | $127,788 | $116,428 |

| 2022 | $2,623 | $239,429 | $125,283 | $114,146 |

| 2021 | $2,632 | $234,735 | $122,827 | $111,908 |

| 2020 | $2,551 | $232,329 | $121,568 | $110,761 |

| 2019 | $2,476 | $227,775 | $119,185 | $108,590 |

| 2018 | $2,448 | $223,310 | $116,849 | $106,461 |

| 2017 | $71 | $218,932 | $114,558 | $104,374 |

| 2016 | $2,322 | $214,640 | $112,312 | $102,328 |

| 2015 | $2,254 | $211,416 | $110,625 | $100,791 |

| 2014 | $2,036 | $195,000 | $100,000 | $95,000 |

Source: Public Records

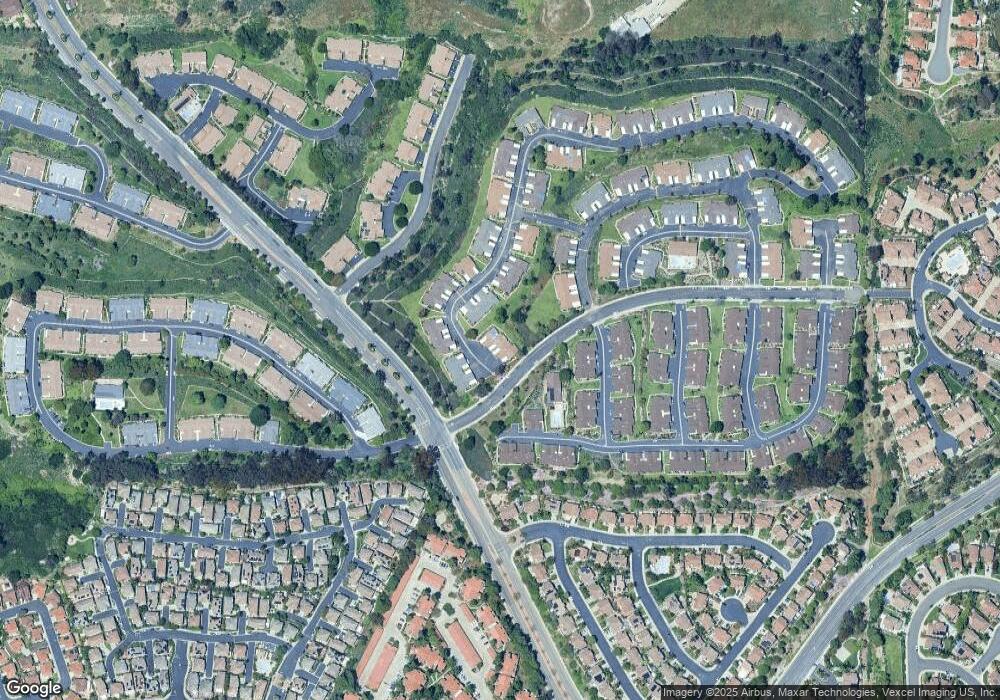

Map

Nearby Homes

- 4395 Albatross Way

- 4428 Skimmer Way

- 4369 Dowitcher Way

- 1024 Eider Way

- 1018 Plover Way

- 1014 Plover Way

- 1137 Avenida Sobrina

- 942 Royal Tern Way

- 4402 Chickadee Way

- 4320 Black Duck Way

- 1275 Natoma Way Unit B

- 4620 Los Alamos Way Unit D

- 4082 Ivey Vista Way

- 508 Dakota Way

- 4372 Pacifica Way Unit 6

- 4384 Nautilus Way Unit 8

- 4321 Star Path Way Unit 3

- 4347 Harbor Way Unit 4

- 4302 Pacifica Way Unit 2

- 343 La Purisma Way

- 4406 Kittiwake Way

- 4402 Kittiwake Way

- 4408 Kittiwake Way Unit 2

- 4405 Kittiwake Way

- 4403 Kittiwake Way

- 4422 Kittiwake Way

- 4407 Kittiwake Way

- 4424 Kittiwake Way

- 4401 Kittiwake Way

- 4426 Kittiwake Way

- 4428 Kittiwake Way

- 4411 Kittiwake Way

- 4413 Kittiwake Way

- 4415 Kittiwake Way

- 4432 Kittiwake Way

- 4417 Kittiwake Way

- 4434 Kittiwake Way

- 1125 Turnstone Way

- 1123 Turnstone Way

- 4436 Kittiwake Way