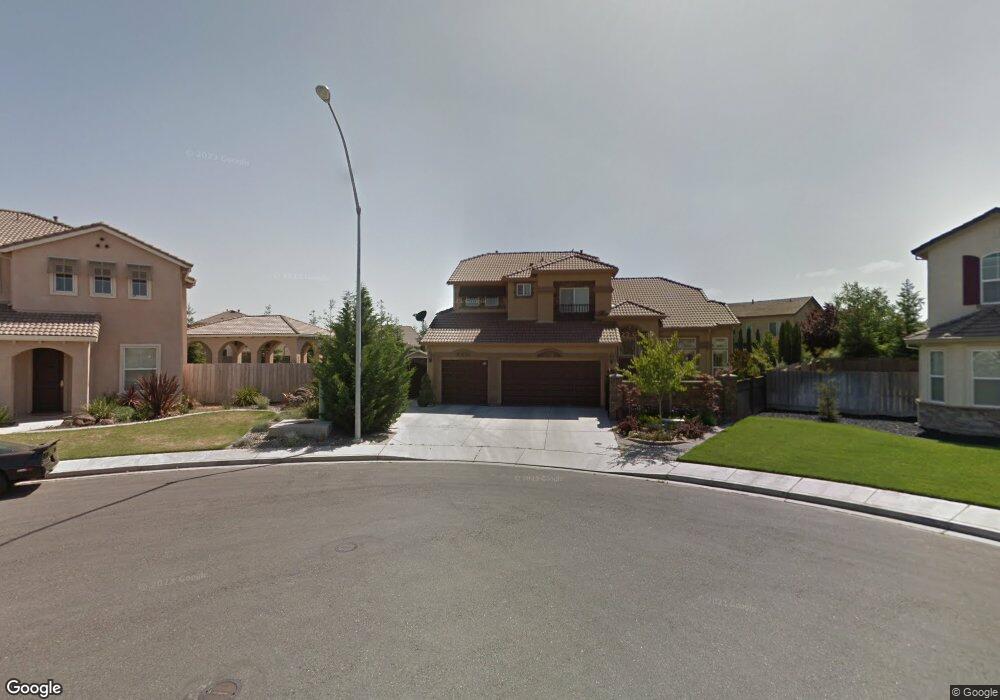

4404 Mt Bullion St Denair, CA 95316

Estimated Value: $604,000 - $697,000

5

Beds

2

Baths

2,532

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 4404 Mt Bullion St, Denair, CA 95316 and is currently estimated at $660,396, approximately $260 per square foot. 4404 Mt Bullion St is a home located in Stanislaus County with nearby schools including Denair Elementary School, Denair Middle School, and Denair High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2015

Sold by

Wagoner Michael L

Bought by

Wagoner 2015 Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Jan 8, 2008

Sold by

Williford Kevin Michael

Bought by

Wagoner Michael L and Wagoner Patricia R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Outstanding Balance

$189,918

Interest Rate

6.05%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$470,478

Purchase Details

Closed on

Mar 29, 2006

Sold by

Jkb Homes Norcal Inc

Bought by

Williford Kevin Michael and Williford Melanie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$382,482

Interest Rate

6.62%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wagoner 2015 Revocable Trust | -- | None Available | |

| Wagoner Michael L | $380,000 | North American Title Company | |

| Williford Kevin Michael | $478,500 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wagoner Michael L | $304,000 | |

| Previous Owner | Williford Kevin Michael | $382,482 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,011 | $508,783 | $164,183 | $344,600 |

| 2024 | $5,874 | $498,808 | $160,964 | $337,844 |

| 2023 | $5,704 | $489,028 | $157,808 | $331,220 |

| 2022 | $5,577 | $479,440 | $154,714 | $324,726 |

| 2021 | $5,557 | $470,040 | $151,681 | $318,359 |

| 2020 | $5,506 | $465,221 | $150,126 | $315,095 |

| 2019 | $5,226 | $456,100 | $147,183 | $308,917 |

| 2018 | $5,256 | $447,158 | $144,298 | $302,860 |

| 2017 | $4,571 | $391,500 | $120,000 | $271,500 |

| 2016 | $4,641 | $392,500 | $100,000 | $292,500 |

| 2015 | $4,394 | $383,500 | $75,500 | $308,000 |

| 2014 | $4,143 | $355,000 | $70,000 | $285,000 |

Source: Public Records

Map

Nearby Homes

- 4423 E Tuolumne Rd

- 4513 E Tuolumne Rd

- 2912 Marazan St

- 4625 E Monte Vista Ave

- 3100 Liquid Amber Dr

- 3209 Berg Ave

- 3620 E Monte Vista Ave

- 3541 Fresno St

- 3306 Story Rd

- 3600 E Hawkeye Ave

- 3749 San Joaquin Ave

- 2791 E Tuolumne Rd

- 3418 N Waring Rd Unit 71

- 1119 N Verduga Rd

- 4910 E Zeering Rd

- 2127 Bristol Park Cir

- 2880 N Quincy Rd

- 1440 Sherwood Dr

- 2375 Alborough Ct

- 716 N Daubenberger Rd

- 4408 Mt Bullion St

- 2414 Deborah Dr

- 2501 Salluce Dr

- 2410 Deborah Dr

- 2418 Deborah Dr

- 4403 E Tuolumne Rd

- 4407 E Tuolumne Rd

- 2406 Deborah Dr

- 4412 Mt Bullion St

- 2505 Salluce Dr

- 4411 E Tuolumne Rd

- 4315 Pimentel Dr

- 2402 Deborah Dr

- 4409 Mt Bullion St

- 4415 E Tuolumne Rd

- 4409 Mount Bullion St

- 4416 Mt Bullion St

- 2509 Salluce Dr

- 2413 Deborah Dr

- 4311 Pimentel Dr