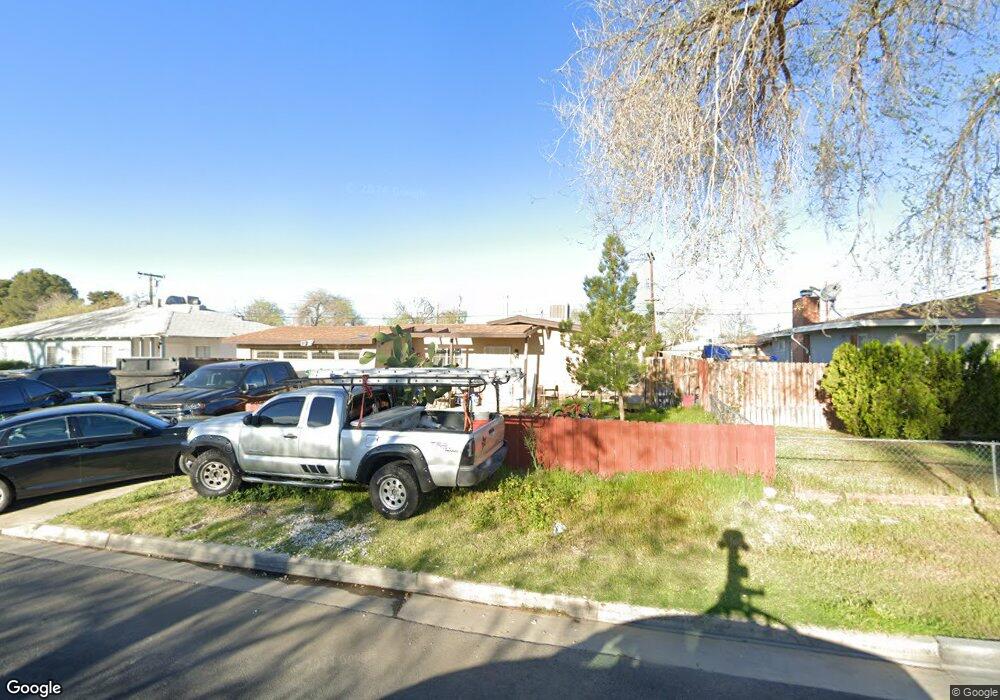

44153 Elm Ave Lancaster, CA 93534

Central Lancaster NeighborhoodEstimated Value: $380,277 - $435,000

4

Beds

2

Baths

1,364

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 44153 Elm Ave, Lancaster, CA 93534 and is currently estimated at $401,569, approximately $294 per square foot. 44153 Elm Ave is a home located in Los Angeles County with nearby schools including Sierra Elementary School, Endeavour Middle School, and Antelope Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 1, 2014

Sold by

Habibi Joseph S

Bought by

The Habibi Family Trust

Current Estimated Value

Purchase Details

Closed on

Jun 26, 2010

Sold by

Federal National Mortgage Association

Bought by

Habibi Joseph Steven

Purchase Details

Closed on

Mar 10, 2010

Sold by

Marron Guillermo

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

May 24, 2005

Sold by

Bradley Phyllis J

Bought by

Marron Guillermo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,800

Interest Rate

4.83%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 9, 2000

Sold by

Bradley Phyllis J

Bought by

Bradley Phyllis J and The Phyllis J Bradley Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Habibi Family Trust | -- | None Available | |

| Habibi Joseph Steven | $71,000 | Lawyers Title | |

| Federal National Mortgage Association | $241,394 | Landsafe Title | |

| Marron Guillermo | $242,000 | Lawyers Title | |

| Bradley Phyllis J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Marron Guillermo | $217,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,459 | $91,631 | $18,321 | $73,310 |

| 2024 | $2,459 | $89,835 | $17,962 | $71,873 |

| 2023 | $2,411 | $88,074 | $17,610 | $70,464 |

| 2022 | $2,239 | $86,348 | $17,265 | $69,083 |

| 2021 | $1,866 | $84,656 | $16,927 | $67,729 |

| 2020 | $1,849 | $83,789 | $16,754 | $67,035 |

| 2019 | $1,823 | $82,147 | $16,426 | $65,721 |

| 2018 | $1,793 | $80,537 | $16,104 | $64,433 |

| 2016 | $1,707 | $77,412 | $15,480 | $61,932 |

| 2015 | $1,690 | $76,250 | $15,248 | $61,002 |

| 2014 | $1,701 | $74,758 | $14,950 | $59,808 |

Source: Public Records

Map

Nearby Homes

- 44152 Elm Ave

- 44209 Date Ave

- 521 W Avenue j5

- 44054 Elm Ave

- 44048 Elm Ave

- 44054 Fern Ave

- 4 Gadsden Ave

- 0 Gadsden Ave

- 44108 Gadsden Ave

- 428 W Avenue j5 Unit 21

- 433 W Avenue j5 Unit 13

- 44036 Cedar Ave

- 44309 Hardwood Ave

- 830 W Avenue j4

- 0 Cedar Avenue Vic Ave Unit J

- 6717 6999 Avenue J

- 517 W Avenue j10

- 835 W Avenue j1

- 719 W Avenue j10

- 44043 Hoban Ave