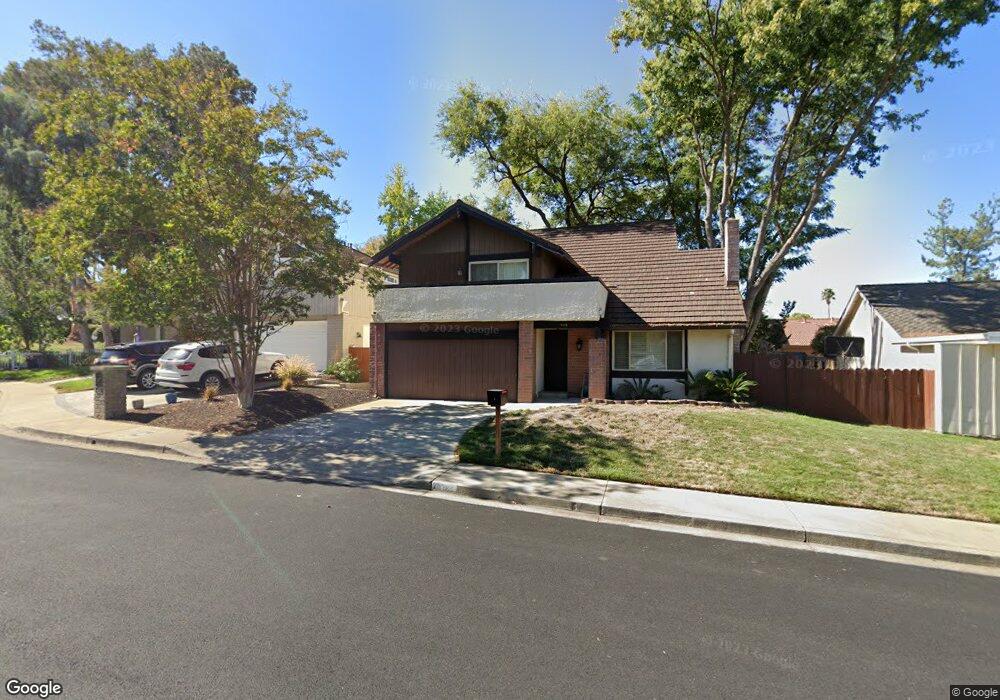

4416 Shellbark Ct Concord, CA 94521

Midtown Concord NeighborhoodEstimated Value: $1,027,000 - $1,099,000

4

Beds

3

Baths

2,130

Sq Ft

$498/Sq Ft

Est. Value

About This Home

This home is located at 4416 Shellbark Ct, Concord, CA 94521 and is currently estimated at $1,061,499, approximately $498 per square foot. 4416 Shellbark Ct is a home located in Contra Costa County with nearby schools including Highlands Elementary School, Mt. Diablo Elementary School, and Foothill Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2002

Sold by

Rule Robert C and Rule Belinda B

Bought by

Young Canon Troy and Young Pamela Felicia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$406,400

Outstanding Balance

$171,928

Interest Rate

6.03%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$889,571

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Young Canon Troy | $508,000 | Old Republic Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Young Canon Troy | $406,400 | |

| Closed | Young Canon Troy | $76,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,054 | $735,733 | $318,624 | $417,109 |

| 2024 | $8,662 | $721,308 | $312,377 | $408,931 |

| 2023 | $8,662 | $707,165 | $306,252 | $400,913 |

| 2022 | $8,550 | $693,300 | $300,248 | $393,052 |

| 2021 | $8,343 | $679,707 | $294,361 | $385,346 |

| 2019 | $8,185 | $659,548 | $285,631 | $373,917 |

| 2018 | $7,877 | $646,617 | $280,031 | $366,586 |

| 2017 | $7,617 | $633,940 | $274,541 | $359,399 |

| 2016 | $7,416 | $621,510 | $269,158 | $352,352 |

| 2015 | $7,342 | $612,175 | $265,115 | $347,060 |

| 2014 | $6,294 | $517,500 | $224,114 | $293,386 |

Source: Public Records

Map

Nearby Homes

- 1272 Chelsea Way

- 4413 Marsh Elder Ct

- 4495 Wildberry Ct

- 4501 Shellflower Ct

- 4317 Cowell Rd

- 4380 Saint Charles Place

- 4362 Lynn Dr

- 1331 Waterfall Way

- 4040 Davenport Ln

- 4058 Treat Blvd

- 4252 El Cerrito Rd

- 4520 Melody Dr Unit A

- 4632 Melody Dr Unit E

- 1431 Bel Air Dr Unit D

- 1455 Latour Ln Unit 43

- 1337 Cape Cod Way

- 4044 Cowell Rd

- 4185 Huckleberry Dr

- 1170 Green Gables Ct

- 1544 Bailey Rd Unit 30

- 4418 Shellbark Ct

- 4414 Shellbark Ct

- 4417 Red Maple Ct

- 4419 Red Maple Ct

- 4415 Red Maple Ct

- 4421 Red Maple Ct

- 4417 Shellbark Ct

- 4412 Shellbark Ct

- 4419 Shellbark Ct

- 4415 Shellbark Ct

- 4413 Red Maple Ct

- 4413 Shellbark Ct

- 4474 Silverberry Ct

- 4411 Red Maple Ct

- 4416 Prairie Willow Ct

- 4416 Red Maple Ct

- 4418 Prairie Willow Ct

- 4414 Prairie Willow Ct

- 4418 Red Maple Ct