442 Oak Haven Dr Unit 34B Altamonte Springs, FL 32701

Estimated Value: $201,000 - $261,000

2

Beds

3

Baths

1,614

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 442 Oak Haven Dr Unit 34B, Altamonte Springs, FL 32701 and is currently estimated at $224,225, approximately $138 per square foot. 442 Oak Haven Dr Unit 34B is a home located in Seminole County with nearby schools including Lake Orienta Elementary School, Lyman High School, and Milwee Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2017

Sold by

Richardson Gerald R

Bought by

Nagy Monika

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

5.5%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 22, 2015

Sold by

Wells Fargo Bank National Association

Bought by

Richardson Gerald R

Purchase Details

Closed on

May 4, 2015

Sold by

Axley Leigh

Bought by

Wells Fargo Bank National Association

Purchase Details

Closed on

Mar 14, 2003

Sold by

Considine Michael D and Considine Linda K

Bought by

Axley Leigh A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,500

Interest Rate

6.32%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 9, 2001

Sold by

Nancy L Bork I

Bought by

Considine Michael D and Considine Linda K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$19,200

Interest Rate

7.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 31, 2000

Sold by

Ham Norlin L and Ham Myrna R

Bought by

Bork Nancy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,200

Interest Rate

8.23%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 17, 1996

Sold by

Woltering Dorothy J

Bought by

Ham Norliny L

Purchase Details

Closed on

Nov 20, 1995

Sold by

Beverly B Steel Trust

Bought by

Woltering Dorothy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,700

Interest Rate

7.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 1, 1992

Bought by

Richardson Gerald R

Purchase Details

Closed on

Sep 1, 1991

Bought by

Richardson Gerald R

Purchase Details

Closed on

May 1, 1991

Bought by

Richardson Gerald R

Purchase Details

Closed on

Jul 1, 1978

Bought by

Richardson Gerald R

Purchase Details

Closed on

Jan 1, 1977

Bought by

Richardson Gerald R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nagy Monika | $110,000 | Attorney | |

| Richardson Gerald R | $110,000 | First Intl Title Lighthouse | |

| Wells Fargo Bank National Association | $65,000 | None Available | |

| Axley Leigh A | $148,500 | First American Title Ins Co | |

| Considine Michael D | $128,000 | -- | |

| Bork Nancy L | $114,000 | -- | |

| Ham Norliny L | $86,000 | -- | |

| Woltering Dorothy J | $73,000 | -- | |

| Richardson Gerald R | $73,000 | -- | |

| Richardson Gerald R | $100 | -- | |

| Richardson Gerald R | $63,900 | -- | |

| Richardson Gerald R | $48,200 | -- | |

| Richardson Gerald R | $45,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Nagy Monika | $110,000 | |

| Previous Owner | Axley Leigh A | $148,500 | |

| Previous Owner | Woltering Dorothy J | $19,200 | |

| Previous Owner | Woltering Dorothy J | $91,200 | |

| Previous Owner | Woltering Dorothy J | $65,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,813 | $148,293 | -- | -- |

| 2023 | $1,666 | $143,974 | $0 | $0 |

| 2021 | $1,584 | $135,710 | $0 | $0 |

| 2020 | $1,565 | $133,836 | $0 | $0 |

| 2019 | $1,537 | $130,827 | $0 | $0 |

| 2018 | $1,515 | $128,388 | $0 | $0 |

| 2017 | $2,062 | $117,276 | $0 | $0 |

| 2016 | $2,129 | $117,276 | $0 | $0 |

| 2015 | $1,652 | $117,276 | $0 | $0 |

| 2014 | $1,652 | $90,885 | $0 | $0 |

Source: Public Records

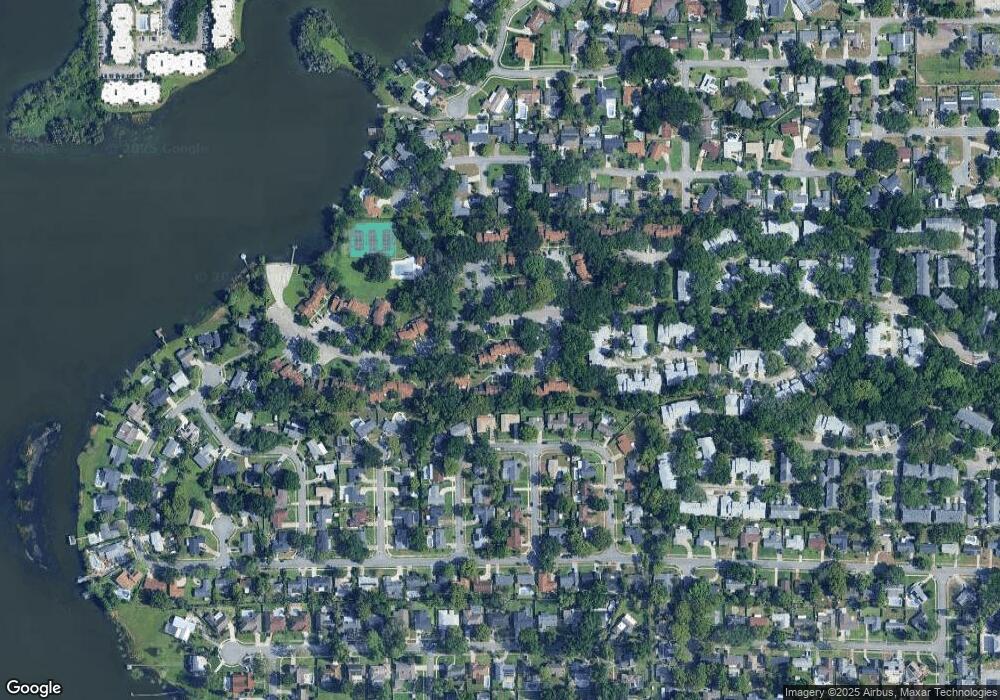

Map

Nearby Homes

- 470 Oak Haven Dr

- 610 Chestnut Oak Cir Unit 110

- 497 Oak Haven Dr

- 624 Maple Oak Cir Unit 108

- 617 Red Oak Cir Unit 121

- 630 Maple Oak Cir Unit 114

- 611 Bryan Ct

- 415 Oak Haven Dr Unit C

- 623 Red Oak Cir Unit 121

- 632 Red Oak Cir Unit 104

- 406 Oak Haven Dr

- 610 Martin Ave

- 525 Oak Terrace Unit 117

- 613 Marshall St

- 672 Post Oak Cir Unit 106

- 670 Post Oak Cir Unit 118

- 665 Oak Harbour Dr Unit 115

- 617 Newport Ave

- 625 Newport Ave

- 532 Orange Dr Unit 23

- 440 Oak Haven Dr Unit A

- 444 Oak Haven Dr

- 446 Oak Haven Dr

- 448 Oak Haven Dr Unit E

- 448 Oak Haven Dr

- 456 Oak Haven Dr

- 456 Oak Haven Dr Unit 456

- 458 Oak Haven Dr Unit E

- 458 Oak Haven Dr Unit 35E

- 454 Oak Haven Dr

- 452 Oak Haven Dr

- 442-B Oak Haven Dr Unit 442B

- 436 Oak Haven Dr

- 436 Oak Haven Dr Unit 436

- 436 Oak Haven Dr Unit D BLD 33

- 450 Oak Haven Dr

- 450 Oak Haven Dr Unit 450

- 434 Oak Haven Dr

- 460 Oak Haven Dr

- 474 Oak Haven Dr Unit 474