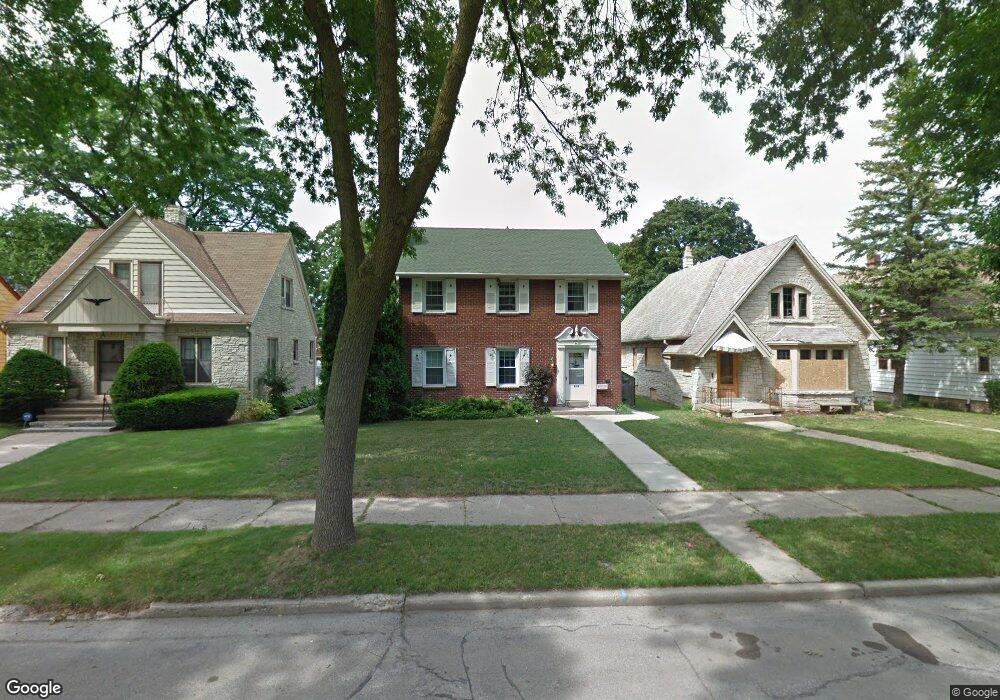

4426 W Melvina St Milwaukee, WI 53216

Roosevelt Grove NeighborhoodEstimated Value: $210,000 - $248,000

3

Beds

2

Baths

1,788

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 4426 W Melvina St, Milwaukee, WI 53216 and is currently estimated at $227,029, approximately $126 per square foot. 4426 W Melvina St is a home located in Milwaukee County with nearby schools including Craig Montessori School, Milwaukee German Immersion School, and Milwaukee Spanish Immersion School - Upper Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2002

Sold by

Turk Brian D and Riley Turk Barbara A

Bought by

Waid Jean M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,900

Outstanding Balance

$40,248

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$186,781

Purchase Details

Closed on

Jan 16, 2001

Sold by

Opus Investments Llc

Bought by

Turk Brian D and Riley Turk Barbara A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,250

Interest Rate

11.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 28, 1999

Sold by

Dechambre Renee

Bought by

Opus Investments Llc

Purchase Details

Closed on

Dec 3, 1996

Sold by

Estes Earl Joann

Bought by

Dechambre Renee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Interest Rate

7.54%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Waid Jean M | $129,900 | -- | |

| Turk Brian D | $112,500 | -- | |

| Opus Investments Llc | $55,100 | -- | |

| Dechambre Renee | $60,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Waid Jean M | $103,900 | |

| Previous Owner | Turk Brian D | $101,250 | |

| Previous Owner | Dechambre Renee | $48,000 | |

| Closed | Turk Brian D | $5,625 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,775 | $212,100 | $7,200 | $204,900 |

| 2023 | $4,041 | $171,000 | $7,200 | $163,800 |

| 2022 | $3,998 | $171,000 | $7,200 | $163,800 |

| 2021 | $2,918 | $113,700 | $7,200 | $106,500 |

| 2020 | $2,900 | $113,700 | $7,200 | $106,500 |

| 2019 | $2,656 | $113,100 | $7,200 | $105,900 |

| 2018 | $3,377 | $113,100 | $7,200 | $105,900 |

| 2017 | $3,199 | $113,100 | $6,200 | $106,900 |

| 2016 | $3,611 | $110,600 | $6,200 | $104,400 |

| 2015 | $3,406 | $110,600 | $6,200 | $104,400 |

| 2014 | $3,531 | $110,600 | $6,200 | $104,400 |

| 2013 | -- | $106,400 | $6,200 | $100,200 |

Source: Public Records

Map

Nearby Homes

- 4435 W Capitol Dr

- 4024 N 44th St

- 4044 N 44th St

- 3910 N Sherman Blvd

- 4073 N 45th St

- 3947 N 42nd St

- 4715 W Capitol Dr

- 3853 N 42nd St

- 4041 N 47th St

- 3811 N Sherman Blvd

- 4623 W Fond du Lac Ave

- 4006 N 41st St Unit 4008

- 3925 N 40th St Unit 3927

- 4642 W Medford Ave Unit 4644

- 4466 W Hope Ave

- 3758 N 41st St Unit 3760

- 3838 W Capitol Dr

- 4640 W Scranton Place Unit 4642

- 4139 N 50th St

- 4047 N 38th St Unit 4049

- 4430 W Melvina St

- 4420 W Melvina St

- 4436 W Melvina St

- 4414 W Melvina St

- 4408 W Melvina St

- 4442 W Melvina St

- 4427 W Melvina St

- 4413 W Capitol Dr Unit 4415

- 4400 W Melvina St

- 4419 W Melvina St

- 4446 W Melvina St

- 4461 W Howie Place

- 4467 W Howie Place

- 4502 W Melvina St

- 4403 W Capitol Dr

- 3933 N 44th St

- 4421 W Capitol Dr

- 4436 W Howie Place

- 4427 W Capitol Dr

- 4407 W Capitol Dr Unit 4409