443 Twist Cir Mauldin, SC 29662

Estimated Value: $210,000 - $236,000

3

Beds

3

Baths

1,458

Sq Ft

$152/Sq Ft

Est. Value

About This Home

This home is located at 443 Twist Cir, Mauldin, SC 29662 and is currently estimated at $221,528, approximately $151 per square foot. 443 Twist Cir is a home located in Greenville County with nearby schools including Greenbrier Elementary School, Hillcrest Middle School, and Mauldin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2015

Sold by

Jaramillo Henao Hernan

Bought by

Jaramillo Henao Hernan and Jaramillo Claudia X

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,100

Outstanding Balance

$29,818

Interest Rate

3.75%

Mortgage Type

New Conventional

Estimated Equity

$191,710

Purchase Details

Closed on

Apr 21, 2011

Sold by

Westberg Joseph P and Westberg Kristin Z

Bought by

Jaramillo Henao Hernan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,731

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 26, 2006

Sold by

Eastwood Construction Co Inc

Bought by

Westberg Joseph P and Westberg Kristin Z

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,946

Interest Rate

6.48%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 23, 2006

Sold by

Cobblestone Cove Llc

Bought by

Eastwood Construction Co Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jaramillo Henao Hernan | -- | -- | |

| Jaramillo Henao Hernan | $91,040 | -- | |

| Westberg Joseph P | $125,995 | None Available | |

| Eastwood Construction Co Inc | $105,900 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jaramillo Henao Hernan | $87,100 | |

| Closed | Jaramillo Henao Hernan | $88,731 | |

| Previous Owner | Westberg Joseph P | $124,946 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $904 | $5,420 | $890 | $4,530 |

| 2024 | $904 | $4,710 | $760 | $3,950 |

| 2023 | $866 | $4,710 | $760 | $3,950 |

| 2022 | $816 | $4,710 | $760 | $3,950 |

| 2021 | $817 | $4,710 | $760 | $3,950 |

| 2020 | $760 | $4,100 | $660 | $3,440 |

| 2019 | $760 | $4,100 | $660 | $3,440 |

| 2018 | $759 | $4,100 | $660 | $3,440 |

| 2017 | $759 | $4,100 | $660 | $3,440 |

| 2016 | $725 | $102,480 | $16,500 | $85,980 |

| 2015 | $725 | $102,480 | $16,500 | $85,980 |

| 2014 | -- | $91,890 | $14,000 | $77,890 |

Source: Public Records

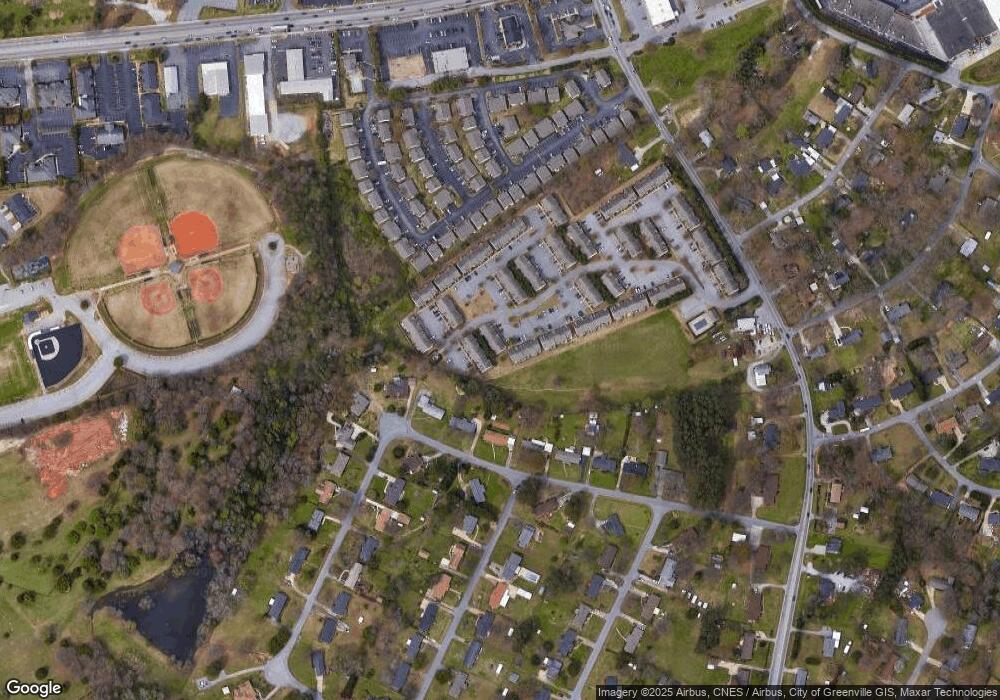

Map

Nearby Homes

- 66 Sikes Cir

- 413 Twist Cir

- 515 Fagin Cir

- 26 Sikes Cir

- 311 Whatley Cir

- 305 Crestwood Dr

- 147 Trailside Ln

- 103 Teal Ln

- 123 Trailside Ln

- 117 Wood Creek Rd

- 20 Golden Apple Trail

- 207 Nantallah Trail

- 120 Cambie Place

- 407 Fielder Way

- 905 Goldendale Ct

- 113 Carlton Dr

- 3 Mercy Dr

- 416 Fielder Way

- 412 Fielder Way

- 202 N Main St

Your Personal Tour Guide

Ask me questions while you tour the home.