4432 Withrowwood Ct Orlando, FL 32837

Estimated Value: $505,698 - $543,000

3

Beds

5

Baths

2,688

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 4432 Withrowwood Ct, Orlando, FL 32837 and is currently estimated at $517,175, approximately $192 per square foot. 4432 Withrowwood Ct is a home located in Orange County with nearby schools including Hunters Creek Elementary School, Hunters Creek Middle School, and Freedom High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2010

Sold by

Rodriguez Catherine E and Rodriguez Raymond

Bought by

Cao Yajun and Wang Meisheng

Current Estimated Value

Purchase Details

Closed on

Mar 26, 2004

Sold by

Ciambriello Paul J and Ciambriello Allesa M

Bought by

Rodriguez Raymond and Rodriguez Catherine E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,400

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 29, 1994

Sold by

M I Schottenstein Homes Inc

Bought by

Ciambriello Paul J and Ciambriello Allesa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

9.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cao Yajun | $175,000 | Equitable Title Dr Phil | |

| Rodriguez Raymond | $218,000 | Greater Florida Title Co Ii | |

| Ciambriello Paul J | $156,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rodriguez Raymond | $174,400 | |

| Previous Owner | Ciambriello Paul J | $140,000 | |

| Closed | Rodriguez Raymond | $43,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,883 | $449,360 | $80,000 | $369,360 |

| 2024 | $6,142 | $424,324 | -- | -- |

| 2023 | $6,142 | $404,415 | $80,000 | $324,415 |

| 2022 | $5,514 | $355,801 | $80,000 | $275,801 |

| 2021 | $4,901 | $289,819 | $65,000 | $224,819 |

| 2020 | $4,477 | $273,078 | $46,000 | $227,078 |

| 2019 | $4,755 | $275,337 | $46,000 | $229,337 |

| 2018 | $4,652 | $270,416 | $46,000 | $224,416 |

| 2017 | $4,293 | $246,636 | $46,000 | $200,636 |

| 2016 | $4,122 | $241,724 | $46,000 | $195,724 |

| 2015 | $3,895 | $223,617 | $46,000 | $177,617 |

| 2014 | $3,638 | $201,785 | $40,000 | $161,785 |

Source: Public Records

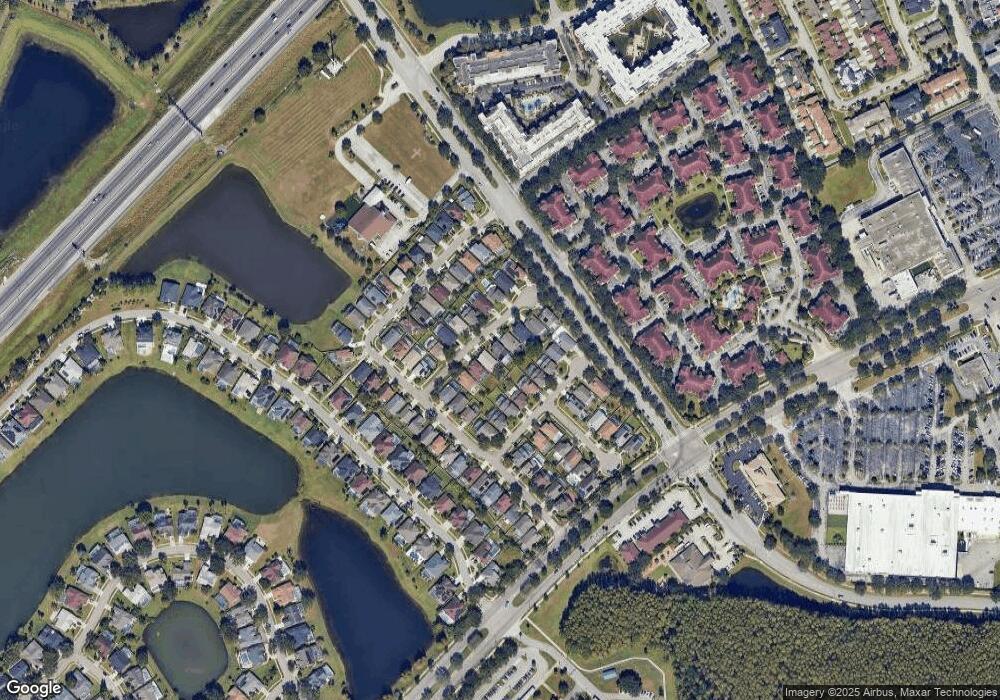

Map

Nearby Homes

- 13908 Huntwick Dr

- 13923 Tallowridge Ct

- 12020 Villanova Dr Unit 103

- 13944 Huntwick Dr

- 3815 Brookmyra Dr

- 12031 Villanova Dr Unit 110

- 12008 Villanova Dr Unit 112

- 12307 Lantana Park Ln Unit 110

- 12107 Poppy Field Ln Unit 105

- 12107 Poppy Field Ln Unit 109

- 12107 Poppy Field Ln Unit 110

- 12311 Lantana Park Ln Unit 108

- 12414 Baleria Cove Unit 106

- 12204 Wild Iris Way Unit 109

- 12204 Wild Iris Way Unit 108

- 12204 Wild Iris Way Unit 110

- 13673 Beauregard Place

- 13669 Beauregard Place

- 4012 Brookmyra Dr

- 14311 Jabot Ln

- 4426 Withrowwood Ct

- 4438 Withrowwood Ct

- 4420 Withrowwood Ct

- 4427 Gwyndale Ct

- 4421 Gwyndale Ct

- 4450 Withrowwood Ct

- 4408 Withrowwood Ct

- 4433 Gwyndale Ct

- 4415 Gwyndale Ct

- 4431 Withrowwood Ct

- 4437 Withrowwood Ct

- 4439 Gwyndale Ct

- 4419 Withrowwood Ct

- 4409 Gwyndale Ct

- 4443 Withrowwood Ct

- 4413 Court

- 4402 Withrowwood Ct

- 4413 Withrowwood Ct

- 13825 Huntwick Dr

- 4445 Gwyndale Ct