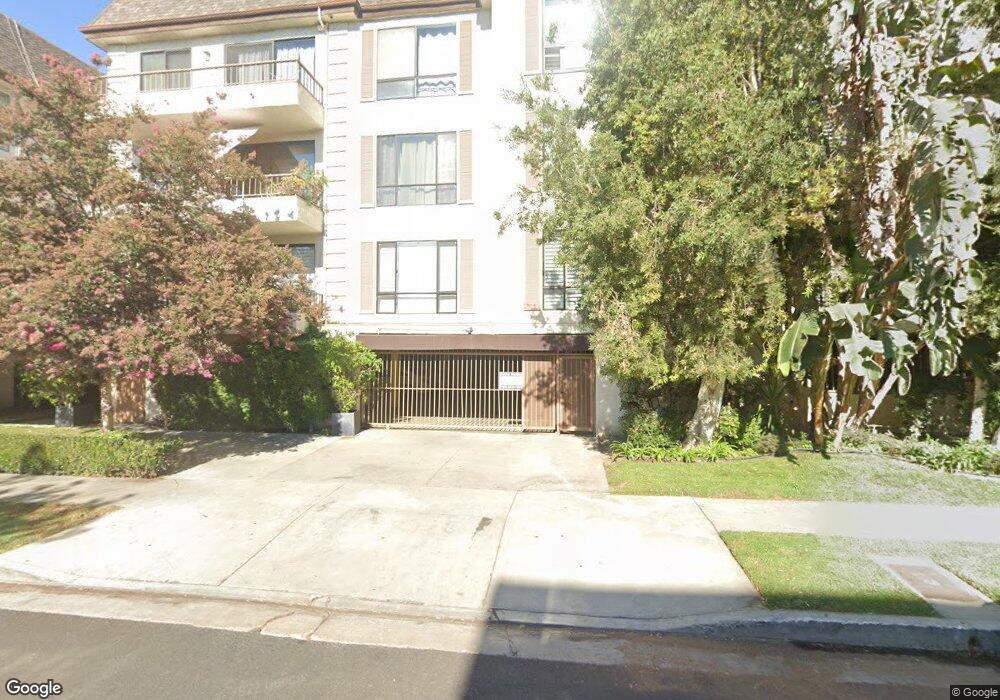

4454 Vntra Cyn Ave Unit 306 Sherman Oaks, CA 91423

Estimated Value: $737,473 - $998,000

1

Bed

2

Baths

1,837

Sq Ft

$447/Sq Ft

Est. Value

About This Home

This home is located at 4454 Vntra Cyn Ave Unit 306, Sherman Oaks, CA 91423 and is currently estimated at $820,368, approximately $446 per square foot. 4454 Vntra Cyn Ave Unit 306 is a home located in Los Angeles County with nearby schools including Ulysses S. Grant Senior High School, Dixie Canyon Avenue Elementary School, and Riverside Drive Charter Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2023

Sold by

Poston Ryan and Akazawa Aimee

Bought by

Poston Family Trust and Poston

Current Estimated Value

Purchase Details

Closed on

Aug 9, 2016

Sold by

Somberg Bonnie

Bought by

Poston Ryan and Akazawa Aimee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$465,500

Interest Rate

3.45%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 22, 1995

Sold by

Dulawa Kathryn

Bought by

Somberg Bonnie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,500

Interest Rate

7.18%

Purchase Details

Closed on

Oct 9, 1995

Sold by

Dulawa Kathryn

Bought by

Dulawa Leopoldo Begnigno and Dulawa Kathryn Estella

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Poston Family Trust | -- | None Listed On Document | |

| Poston Ryan | $495,000 | Progressive Title Company | |

| Somberg Bonnie | $145,000 | Equity Title | |

| Dulawa Leopoldo Begnigno | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Poston Ryan | $465,500 | |

| Previous Owner | Somberg Bonnie | $130,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,969 | $574,484 | $342,370 | $232,114 |

| 2024 | $6,969 | $563,220 | $335,657 | $227,563 |

| 2023 | $6,835 | $552,177 | $329,076 | $223,101 |

| 2022 | $6,516 | $541,351 | $322,624 | $218,727 |

| 2021 | $6,430 | $530,738 | $316,299 | $214,439 |

| 2019 | $6,236 | $514,998 | $306,918 | $208,080 |

| 2018 | $6,205 | $504,900 | $300,900 | $204,000 |

| 2016 | $2,477 | $203,469 | $50,510 | $152,959 |

| 2015 | $2,441 | $200,414 | $49,752 | $150,662 |

| 2014 | $2,453 | $196,489 | $48,778 | $147,711 |

Source: Public Records

Map

Nearby Homes

- 4454 Ventura Canyon Ave Unit 105

- 4454 Ventura Canyon Ave Unit 304

- 36010 Ventura Canyon Ave

- 13543 Moorpark St Unit 7

- 4405 Ventura Canyon Ave

- 4381 Ventura Canyon Ave Unit 4

- 4545 Allott Ave

- 4477 Woodman Ave Unit 304

- 4546 Allott Ave

- 13453 Moorpark St

- 4358 Mammoth Ave Unit 26

- 13331 Moorpark St Unit 123

- 13331 Moorpark St Unit 206

- 4710 Ventura Canyon Ave

- 4226 Greenbush Ave

- 4321 Matilija Ave Unit 1

- 4321 Matilija Ave Unit 14

- 4216 Greenbush Ave

- 4455 Fulton Ave Unit 3

- 4637 Nagle Ave

- 4454 Ventura Canyon Ave Unit 308

- 4454 Ventura Canyon Ave Unit 301

- 4454 Ventura Canyon Ave Unit 207

- 4454 Ventura Canyon Ave

- 4454 Ventura Canyon Ave Unit 205

- 4454 Ventura Canyon Ave Unit 307

- 4454 Ventura Canyon Ave Unit 306

- 4454 Ventura Canyon Ave Unit 108

- 4454 Ventura Canyon Ave Unit 208

- 4454 Ventura Canyon Ave Unit 305

- 4454 Ventura Canyon Ave Unit 303

- 4454 Ventura Canyon Ave Unit 201

- 4454 Ventura Canyon Ave Unit 102

- 4454 Ventura Canyon Ave Unit 101

- 4454 Ventura Canyon Ave Unit 302

- 4454 Vntra Cyn Ave Unit 207

- 4454 Vntra Cyn Ave Unit 308

- 4454 Vntra Cyn Ave Unit 307

- 4454 Vntra Cyn Ave Unit 305

- 4454 Vntra Cyn Ave Unit 304