4526 Oak Brook Dr SE Unit 516 Smyrna, GA 30082

Estimated Value: $792,819 - $895,000

5

Beds

4

Baths

3,536

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 4526 Oak Brook Dr SE Unit 516, Smyrna, GA 30082 and is currently estimated at $851,955, approximately $240 per square foot. 4526 Oak Brook Dr SE Unit 516 is a home located in Cobb County with nearby schools including Nickajack Elementary School, Griffin Middle School, and Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2014

Sold by

Fowler Monica Denise

Bought by

Walker Patrica R and Walker Kindu A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$366,800

Outstanding Balance

$279,440

Interest Rate

4.32%

Mortgage Type

New Conventional

Estimated Equity

$572,515

Purchase Details

Closed on

Jan 31, 2006

Sold by

Gajc Hms Inc

Bought by

Fowler Monica D and Willis Andrew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$282,500

Interest Rate

6.21%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Walker Patrica R | $458,500 | -- | |

| Fowler Monica D | $534,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Walker Patrica R | $366,800 | |

| Closed | Walker Patrica R | $45,804 | |

| Previous Owner | Fowler Monica D | $282,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,748 | $285,284 | $70,000 | $215,284 |

| 2024 | $7,748 | $285,284 | $70,000 | $215,284 |

| 2023 | $6,250 | $230,132 | $54,000 | $176,132 |

| 2022 | $6,296 | $230,132 | $54,000 | $176,132 |

| 2021 | $6,326 | $230,132 | $54,000 | $176,132 |

| 2020 | $5,583 | $203,080 | $54,000 | $149,080 |

| 2019 | $5,583 | $203,080 | $54,000 | $149,080 |

| 2018 | $5,498 | $200,000 | $54,000 | $146,000 |

| 2017 | $5,158 | $200,000 | $54,000 | $146,000 |

| 2016 | $5,242 | $203,268 | $54,000 | $149,268 |

| 2015 | $3,961 | $150,056 | $54,000 | $96,056 |

| 2014 | $3,737 | $150,056 | $0 | $0 |

Source: Public Records

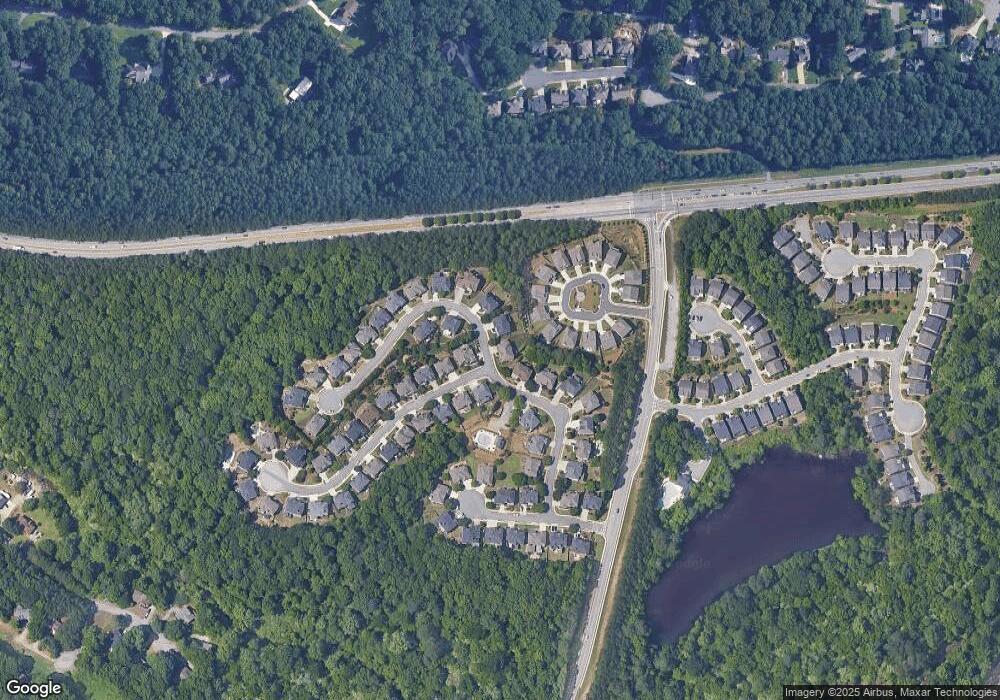

Map

Nearby Homes

- 0 East-West Connector Unit 11589710

- 4461 Derby Ln SE

- 416 Nickajack Retreat Ln

- 3910 W Cooper Lake Dr SE

- 4700 Legacy Cove Ln

- 5020 Hickory Mill Dr SE

- 0 Nickajack Rd SE Unit 7594642

- 4204 Hardy Ave

- 4246 Antler Trail SE

- 4195 Antler Trail SE

- 465 Willowbrook Dr SE

- 4724 Warrior Way SE Unit II

- 51 Queen Anne Dr SE

- 1106 Queensgate Dr SE Unit 3

- 576 N Thomas Ln SE

- 4559 Wilkerson Place SE

- 4094 Norton Place SE

- 4025 Benell Ct SE

- 4135 Fawn Ln SE

- 4526 Oak Brook Dr SE

- 4528 Oak Brook Dr SE

- 4524 Oak Brook Dr SE

- 305 Conner Cir

- 309 Conner Cir

- 300 Conner Cir

- 4527 Oak Brook Dr SE

- 4530 Oak Brook Dr SE

- 4523 Oak Brook Dr SE

- 0 Oak Brook Dr SE

- 4522 Oak Brook Dr SE

- 304 Conner Cir

- 313 Conner Cir

- 4532 Oak Brook Dr SE

- 449 Oak Valley Cir SE

- 448 Oak Valley Cir SE

- 4520 Oak Brook Dr SE

- 4515 Oak Brook Dr SE

- 308 Conner Cir

- 317 Conner Cir