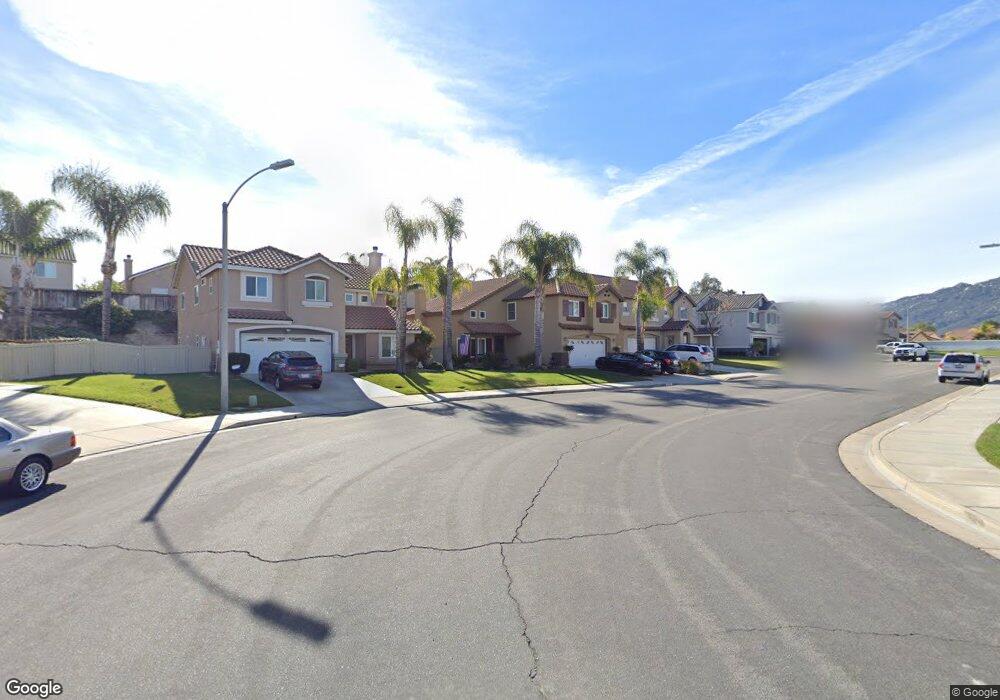

45302 Corte Palmito Temecula, CA 92592

Redhawk NeighborhoodEstimated Value: $657,000 - $728,000

4

Beds

3

Baths

1,867

Sq Ft

$374/Sq Ft

Est. Value

About This Home

This home is located at 45302 Corte Palmito, Temecula, CA 92592 and is currently estimated at $698,654, approximately $374 per square foot. 45302 Corte Palmito is a home located in Riverside County with nearby schools including Red Hawk Elementary, Erle Stanley Gardner Middle School, and Great Oak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2017

Sold by

Alvarez Jesus A and Alvarez Gail L

Bought by

Alvarez Jesus A and Alvarez Gail L

Current Estimated Value

Purchase Details

Closed on

Feb 15, 2007

Sold by

Alvarez Jesus A and Alvarez Gail L

Bought by

Alvarez Jesus A and Alvarez Gail L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Outstanding Balance

$7,097

Interest Rate

6.21%

Mortgage Type

Stand Alone Second

Estimated Equity

$691,557

Purchase Details

Closed on

Oct 4, 2006

Sold by

Alvarez Jesus A and Alvarez Gail L

Bought by

Alvarez Jesus A and Alvarez Gail L

Purchase Details

Closed on

Nov 3, 1998

Sold by

Overland Redhawk Llc

Bought by

Alvarez Jesus A and Alvarez Gail L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,729

Outstanding Balance

$29,832

Interest Rate

6.84%

Estimated Equity

$668,822

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alvarez Jesus A | -- | None Available | |

| Alvarez Jesus A | -- | Southland Title Company | |

| Alvarez Jesus A | -- | None Available | |

| Alvarez Jesus A | $167,500 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alvarez Jesus A | $60,000 | |

| Open | Alvarez Jesus A | $133,729 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,166 | $295,089 | $70,533 | $224,556 |

| 2023 | $4,166 | $283,632 | $67,795 | $215,837 |

| 2022 | $4,024 | $278,071 | $66,466 | $211,605 |

| 2021 | $3,935 | $272,619 | $65,163 | $207,456 |

| 2020 | $3,878 | $269,824 | $64,495 | $205,329 |

| 2019 | $3,823 | $264,534 | $63,231 | $201,303 |

| 2018 | $3,743 | $259,348 | $61,992 | $197,356 |

| 2017 | $6,541 | $254,264 | $60,777 | $193,487 |

| 2016 | $6,470 | $249,280 | $59,586 | $189,694 |

| 2015 | $5,419 | $245,538 | $58,692 | $186,846 |

| 2014 | $3,429 | $240,731 | $57,544 | $183,187 |

Source: Public Records

Map

Nearby Homes

- 45418 Seagull Way

- 31938 Calle Tiara S

- 31941 Calle Tiara S

- 45495 Peacock Place

- 32122 Corte Eldorado

- 32095 Via Cordoba

- 45463 Moose Ct

- 45798 Cloudburst Ln

- 45422 Camino Monzon

- 32137 Sycamore Ct

- 31579 Mendocino Ct

- 32169 Corte Daroca

- 45360 Vista Verde

- 31814 Murdock Ln

- 45743 Calle Ayora

- 44904 Linalou Ranch Rd

- 44984 Hawthorn St Unit 208

- 31593 Calle Los Padres

- 31210 Strawberry Tree Ln Unit 52

- 44921 Bellflower Ln Unit 111

- 45320 Corte Palmito

- 45284 Corte Palmito

- 45338 Corte Palmito

- 45345 Corte Progresso

- 45345 Corte Progreso

- 45359 Corte Progresso

- 45333 Corte Progreso

- 45333 Corte Progresso

- 45266 Corte Palmito

- 45371 Corte Progresso

- 45356 Corte Palmito

- 45321 Corte Progresso

- 45313 Corte Palmito

- 45383 Corte Progresso

- 45251 Corte Palmito

- 45383 Corte Progreso

- 45303 Corte Progreso

- 45303 Corte Progresso

- 45258 Corte Palmito

- 45329 Corte Palmito