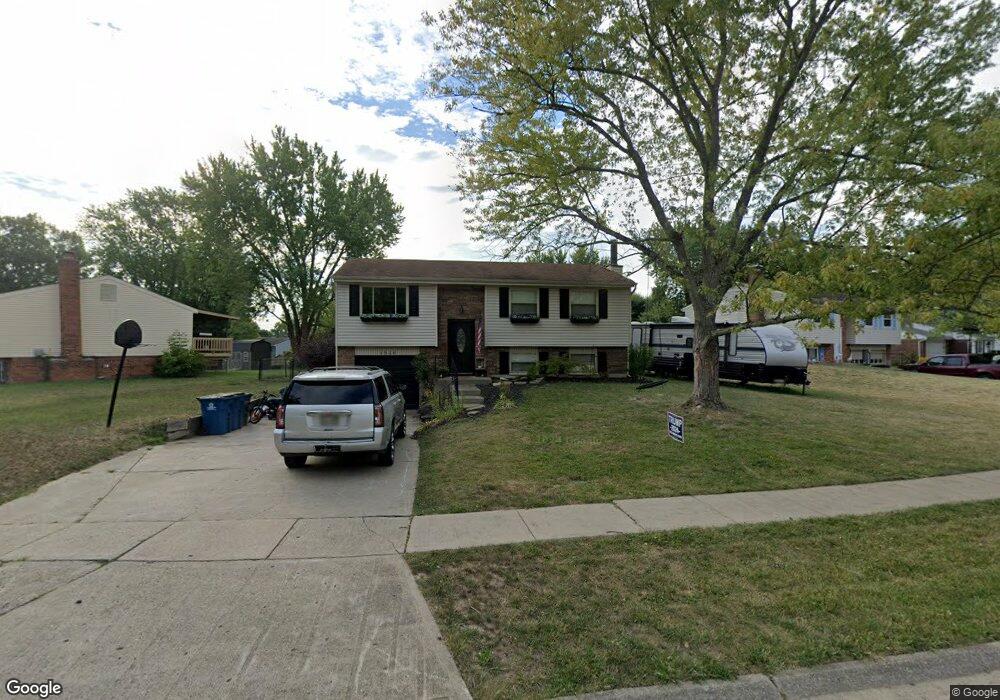

4546 Forest Haven Ln Batavia, OH 45103

Estimated Value: $252,000 - $278,000

3

Beds

2

Baths

1,606

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 4546 Forest Haven Ln, Batavia, OH 45103 and is currently estimated at $260,633, approximately $162 per square foot. 4546 Forest Haven Ln is a home located in Clermont County with nearby schools including Willowville Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 30, 2010

Sold by

Merz Sharon

Bought by

Morris Bryan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,239

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

May 22, 2003

Sold by

Pittillo Jack W and Pittillo Laura A

Bought by

Merz Sharon

Purchase Details

Closed on

Jun 9, 1995

Sold by

Mclemore Roy D

Bought by

Pittillo Jack W and Pittillo Laura A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,276

Interest Rate

8.26%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morris Bryan | $124,900 | Real Estate Title Solutions | |

| Merz Sharon | $122,500 | -- | |

| Pittillo Jack W | $85,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Morris Bryan | $123,239 | |

| Previous Owner | Pittillo Jack W | $85,276 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,509 | $69,590 | $14,110 | $55,480 |

| 2023 | $3,515 | $69,590 | $14,110 | $55,480 |

| 2022 | $2,814 | $48,300 | $9,800 | $38,500 |

| 2021 | $2,826 | $48,300 | $9,800 | $38,500 |

| 2020 | $2,829 | $48,300 | $9,800 | $38,500 |

| 2019 | $2,248 | $44,880 | $11,660 | $33,220 |

| 2018 | $2,271 | $44,880 | $11,660 | $33,220 |

| 2017 | $2,260 | $44,880 | $11,660 | $33,220 |

| 2016 | $2,260 | $40,430 | $10,500 | $29,930 |

| 2015 | $2,193 | $40,430 | $10,500 | $29,930 |

| 2014 | $2,193 | $40,430 | $10,500 | $29,930 |

| 2013 | $2,086 | $38,050 | $11,200 | $26,850 |

Source: Public Records

Map

Nearby Homes

- 4503 Eva Ln

- 4579 Wood Forest Ln

- 4466 Eva Ln

- 4571 Carnoustie

- 1278 McGuffey Ln

- 4455 Dogwood Dr

- 4690 Tealtown Rd

- 4442 Meese Dr

- 4449 Glendale Dr

- 4420 Dogwood Dr

- 1260 Timber Ridge Ct

- 4450 Schoolhouse Rd

- 4597 Muirridge Ct

- 4448 Springfield Ct

- 4601 Shephard Rd

- 1016 Glen Este Ln

- 246 R Bridgewater Dr

- 1364 Grandstand Ln

- 4536 Treeview Ct

- 4566 Clermont Ln

- 4548 Forest Haven Ln

- 4544 Forest Haven Ln

- 4550 Forest Haven Ln

- 4542 Forest Haven Ln

- 4549 S Park Forest Cir

- 4541 Forest Haven Ln

- 4543 Forest Haven Ln

- 4545 Forest Haven Ln

- 4547 S Park Forest Cir

- 4552 Forest Haven Ln

- 4547 Forest Haven Ln

- 4540 Forest Haven Ln

- 4551 S Park Forest Cir

- 1181 Farmwood Cir

- 4549 Forest Haven Ln

- 1182 Farmwood Cir

- 4538 Forest Haven Ln

- 4551 Forest Haven Ln

- 4548 S Park Forest Cir

- 1223 Village Glen Dr