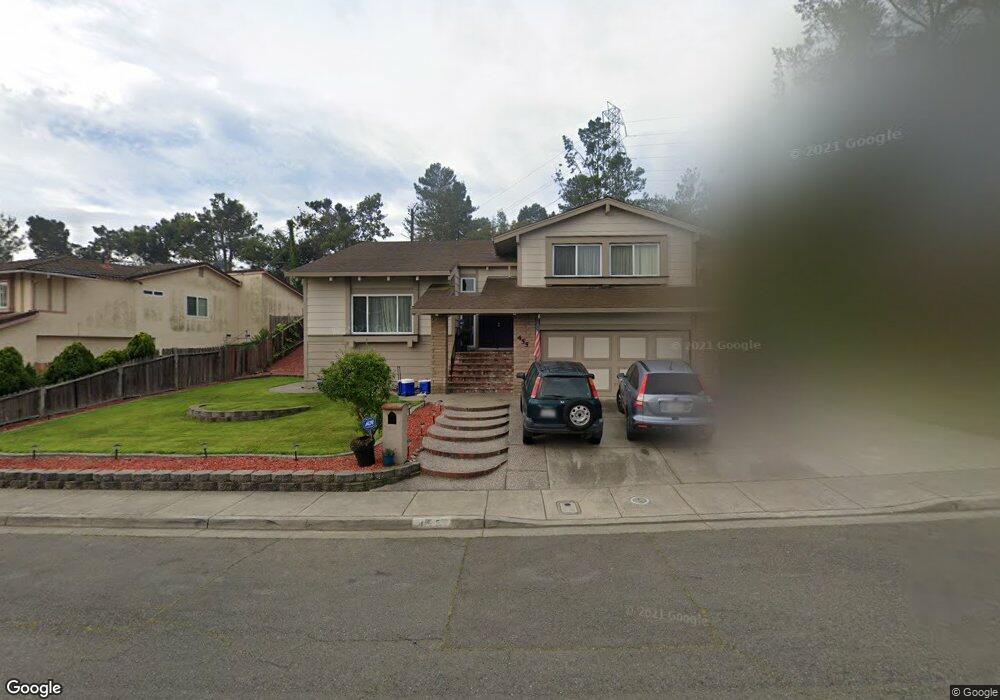

455 Temple Way Vallejo, CA 94591

Estimated Value: $616,714 - $685,000

4

Beds

2

Baths

2,159

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 455 Temple Way, Vallejo, CA 94591 and is currently estimated at $652,679, approximately $302 per square foot. 455 Temple Way is a home located in Solano County with nearby schools including Joseph H. Wardlaw Elementary School, Hogan Middle School, and Jesse M. Bethel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 23, 2013

Sold by

Fannie Mae

Bought by

Sandino Joseph and Bolds Mercedes

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$318,861

Outstanding Balance

$237,440

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$415,239

Purchase Details

Closed on

Jan 24, 2013

Sold by

Struble David and Struble Michele

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Sep 5, 1997

Sold by

Struble David C and Struble Michele A

Bought by

Struble David and Struble Michele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.34%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sandino Joseph | $290,000 | Old Republic Title Company | |

| Federal National Mortgage Association | $382,882 | None Available | |

| Struble David | -- | United Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sandino Joseph | $318,861 | |

| Previous Owner | Struble David | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,333 | $355,366 | $91,933 | $263,433 |

| 2024 | $5,333 | $348,399 | $90,131 | $258,268 |

| 2023 | $5,046 | $341,568 | $88,364 | $253,204 |

| 2022 | $4,949 | $334,872 | $86,633 | $248,239 |

| 2021 | $4,840 | $328,307 | $84,935 | $243,372 |

| 2020 | $4,861 | $324,942 | $84,065 | $240,877 |

| 2019 | $4,721 | $318,571 | $82,417 | $236,154 |

| 2018 | $4,435 | $312,325 | $80,801 | $231,524 |

| 2017 | $4,249 | $306,202 | $79,217 | $226,985 |

| 2016 | $3,661 | $300,199 | $77,664 | $222,535 |

| 2015 | $3,611 | $295,691 | $76,498 | $219,193 |

| 2014 | $3,575 | $289,900 | $75,000 | $214,900 |

Source: Public Records

Map

Nearby Homes

- 155 White Pine Dr

- 134 Nashville Ln

- N/A N A

- 453 Knights Cir

- 223 Wedgewood Ct

- 1407 Eucalyptus Dr

- 880 Knights Cir

- 136 Evergreen Way

- 102 Avian Dr

- 841 Knights Cir

- 103 Sandalwood Ct

- 367 Darley Dr

- 272 Woodridge Dr

- 2500 Springs Rd Unit 121

- 2500 Springs Rd Unit 116

- 121 Jackson Way

- 730 Britannia Dr

- 111 Harris Way

- 1324 Delwood St

- 236 Corkwood St