4555 Adam Rd Simi Valley, CA 93063

East Simi Valley NeighborhoodEstimated Value: $885,000 - $1,047,997

3

Beds

2

Baths

1,922

Sq Ft

$490/Sq Ft

Est. Value

About This Home

This home is located at 4555 Adam Rd, Simi Valley, CA 93063 and is currently estimated at $942,249, approximately $490 per square foot. 4555 Adam Rd is a home located in Ventura County with nearby schools including Santa Susana Elementary School, Valley View Middle School, and Simi Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2020

Sold by

Staples Stephen M

Bought by

Stapies Stephen M and Staples Sharon Marie

Current Estimated Value

Purchase Details

Closed on

Feb 23, 2005

Sold by

Staples Sharon

Bought by

Staples Stephen M

Purchase Details

Closed on

Sep 15, 2004

Sold by

Staples Sharon

Bought by

Staples Stephen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$203,044

Interest Rate

6.25%

Mortgage Type

New Conventional

Estimated Equity

$739,205

Purchase Details

Closed on

Sep 8, 2004

Sold by

Rosellini Hubert L and Rosellini Renee L

Bought by

Staples Stephen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$203,044

Interest Rate

6.25%

Mortgage Type

New Conventional

Estimated Equity

$739,205

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stapies Stephen M | -- | Chicago Title Company | |

| Staples Stephen M | -- | Alliance Title Company | |

| Staples Stephen M | -- | Fidelity National Title | |

| Staples Stephen M | $565,000 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Staples Stephen M | $400,000 | |

| Closed | Staples Stephen M | $136,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,886 | $841,135 | $627,256 | $213,879 |

| 2024 | $9,886 | $824,643 | $614,957 | $209,686 |

| 2023 | $9,301 | $808,474 | $602,899 | $205,575 |

| 2022 | $9,296 | $792,622 | $591,077 | $201,545 |

| 2021 | $8,879 | $743,000 | $552,000 | $191,000 |

| 2020 | $8,333 | $701,000 | $521,000 | $180,000 |

| 2019 | $7,547 | $649,000 | $482,000 | $167,000 |

| 2018 | $7,560 | $642,000 | $477,000 | $165,000 |

| 2017 | $7,563 | $644,000 | $478,000 | $166,000 |

| 2016 | $6,958 | $606,000 | $450,000 | $156,000 |

| 2015 | $6,481 | $565,000 | $420,000 | $145,000 |

| 2014 | $6,498 | $563,000 | $419,000 | $144,000 |

Source: Public Records

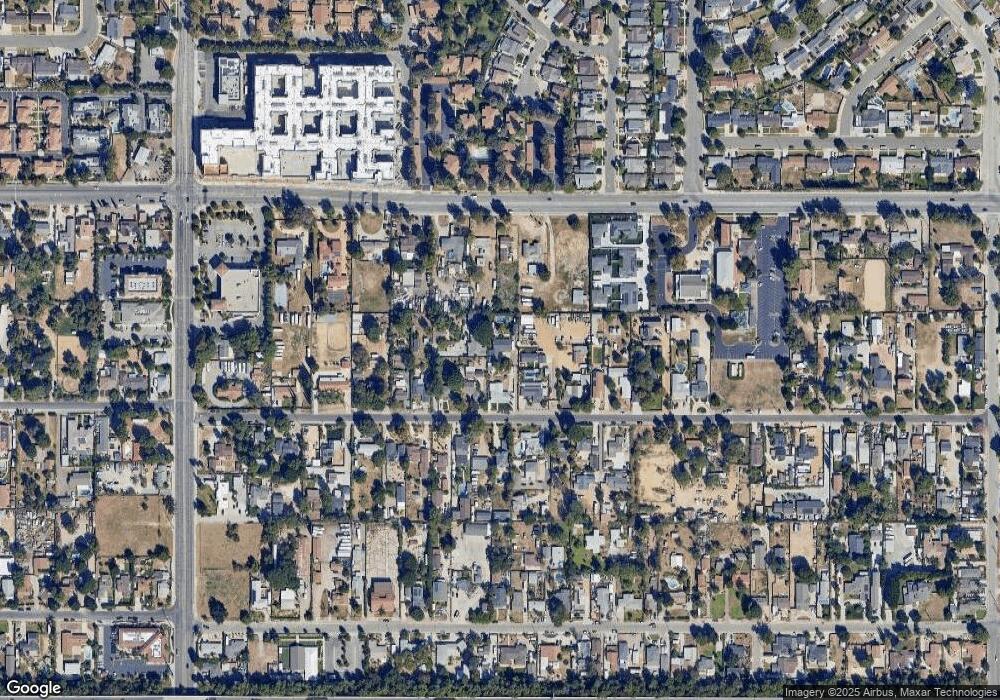

Map

Nearby Homes

- 4421 Adam Rd

- 4553 Alamo St Unit F

- 4581 Lubbock Dr

- 4460 Lubbock Dr Unit B

- 4448 Lubbock Dr Unit C

- 4759 Del Rio Dr

- 4790 Adam Rd

- 3005 Mineral Wells Dr

- 4676 Kleberg St

- 4508 Apricot Rd Unit B

- 2945 Dalhart Ave

- 4321 Apricot Rd

- 4759 Cochran St

- 2918 Estilita Way Unit C

- 2948 Texas Ave

- 3109 Arlington Ave

- 3024 Cicero Ct

- 3194 Granville Ave

- 5054 Alta St

- 2255 Fig St