456 Devonshire Glen Escondido, CA 92027

East Grove NeighborhoodEstimated Value: $585,759 - $642,000

2

Beds

2

Baths

1,185

Sq Ft

$513/Sq Ft

Est. Value

About This Home

This home is located at 456 Devonshire Glen, Escondido, CA 92027 and is currently estimated at $608,190, approximately $513 per square foot. 456 Devonshire Glen is a home located in San Diego County with nearby schools including Orange Glen Elementary School, Hidden Valley Middle School, and Orange Glen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2022

Sold by

Maus Mark E

Bought by

Mark E Maus 2022 Trust

Current Estimated Value

Purchase Details

Closed on

Sep 21, 2000

Sold by

Sally Holmen

Bought by

Maus Mark E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,500

Interest Rate

7.89%

Mortgage Type

Unknown

Purchase Details

Closed on

Dec 18, 1998

Sold by

Holman Nils

Bought by

Holmen Sally

Purchase Details

Closed on

Oct 19, 1998

Sold by

Holmen Sally F and Brown Robert S

Bought by

Holmen Sally

Purchase Details

Closed on

Aug 27, 1996

Sold by

Brown Olive Blanche

Bought by

Brown Robert Stanford and Brown Olive Blanche

Purchase Details

Closed on

Sep 30, 1983

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mark E Maus 2022 Trust | -- | None Listed On Document | |

| Maus Mark E | $152,000 | Fidelity National Title Co | |

| Holmen Sally | -- | Fidelity National Title Co | |

| Holmen Sally | -- | -- | |

| Brown Robert Stanford | -- | -- | |

| -- | $84,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Maus Mark E | $111,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,510 | $228,748 | $43,671 | $185,077 |

| 2024 | $2,510 | $224,264 | $42,815 | $181,449 |

| 2023 | $2,451 | $219,868 | $41,976 | $177,892 |

| 2022 | $2,423 | $211,332 | $40,347 | $170,985 |

| 2021 | $2,383 | $211,332 | $40,347 | $170,985 |

| 2020 | $2,368 | $209,166 | $39,934 | $169,232 |

| 2019 | $2,310 | $205,065 | $39,151 | $165,914 |

| 2018 | $2,245 | $201,045 | $38,384 | $162,661 |

| 2017 | $41 | $197,104 | $37,632 | $159,472 |

| 2016 | $2,163 | $193,241 | $36,895 | $156,346 |

| 2015 | $2,143 | $190,339 | $36,341 | $153,998 |

| 2014 | $2,054 | $186,612 | $35,630 | $150,982 |

Source: Public Records

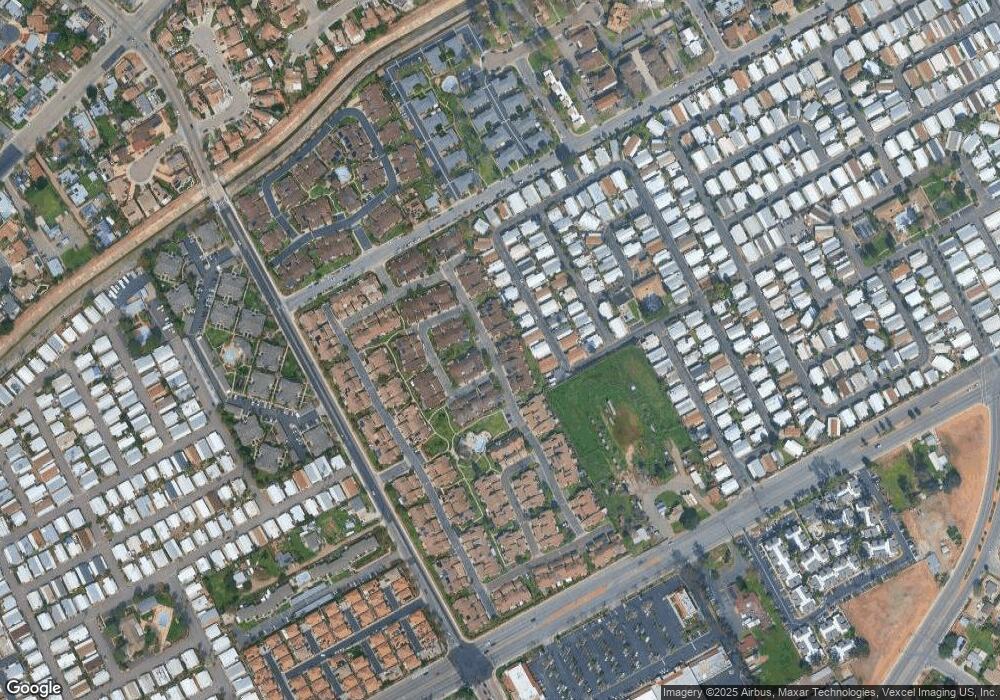

Map

Nearby Homes

- 2550 E Valley Pkwy Unit 122

- 2550 E Valley Pkwy Unit 44

- 2528 White Oak Place Unit 3

- 454 Ashbourne Glen

- 2536 White Oak Place Unit 5

- 2536 White Oak Place Unit 2

- 2536 White Oak Place Unit 1

- 465 Ashbourne Glen

- 417 Swansea Glen

- 2375 Campbell Place

- 2700 E Valley Pkwy Unit Spc 81

- 2700 E Valley Pkwy Unit 64

- 2700 E Valley Pkwy Unit 189

- 2700 E Valley Pkwy Unit 315

- 2700e Valley Pkwy Unit 81

- 2300 E Valley Pkwy Unit 109

- 2300 E Valley Pkwy Unit 187

- 544 Veronica Place

- 521 Sandalwood Place Unit 8

- 529 Sandalwood Place Unit 7

- 454 Devonshire Glen

- 452 Devonshire Glen

- 460 Devonshire Glen

- 450 Devonshire Glen

- 462 Devonshire Glen

- 448 Devonshire Glen

- 464 Devonshire Glen

- 450 Bancroft Glen

- 446 Devonshire Glen

- 466 Devonshire Glen

- 452 Bancroft Glen

- 494 Bancroft Glen

- 451 Bancroft Glen

- 454 Bancroft Glen

- 440 Devonshire Glen

- 492 Bancroft Glen

- 453 Bancroft Glen

- 456 Bancroft Glen

- 490 Bancroft Glen

- 455 Bancroft Glen

Your Personal Tour Guide

Ask me questions while you tour the home.