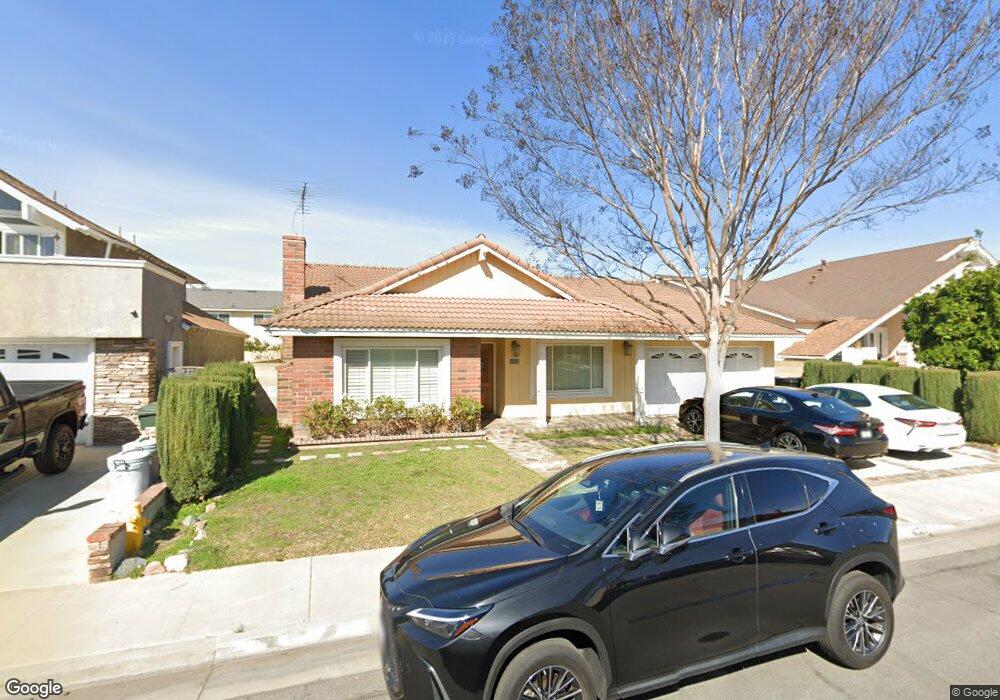

4567 Everest Cir Cypress, CA 90630

Estimated Value: $1,210,000 - $1,396,000

4

Beds

2

Baths

1,988

Sq Ft

$667/Sq Ft

Est. Value

About This Home

This home is located at 4567 Everest Cir, Cypress, CA 90630 and is currently estimated at $1,326,732, approximately $667 per square foot. 4567 Everest Cir is a home located in Orange County with nearby schools including A.E. Arnold Elementary School, Margaret Landell Elementary School, and Lexington Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2005

Sold by

Mancenido Manuel L and Mancenido Deanna M

Bought by

Choi Young Jo and Han Sung Won

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$550,000

Outstanding Balance

$283,242

Interest Rate

5.55%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$1,043,490

Purchase Details

Closed on

Apr 23, 2003

Sold by

Wilms Jurgen and Wilms Leticia

Bought by

Wilms Jurgen

Purchase Details

Closed on

Mar 25, 2003

Sold by

Choe Susie

Bought by

Wilms Jurgen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$348,500

Interest Rate

7.9%

Purchase Details

Closed on

Feb 10, 2003

Sold by

Wilms Jurgen

Bought by

Mancenido Manuel L and Mancenido Deanna M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$348,500

Interest Rate

7.9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Choi Young Jo | $750,000 | Alliance Title | |

| Wilms Jurgen | -- | Security Union Title | |

| Wilms Jurgen | -- | Security Union Title | |

| Mancenido Manuel L | $410,000 | Security Union Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Choi Young Jo | $550,000 | |

| Previous Owner | Mancenido Manuel L | $348,500 | |

| Closed | Mancenido Manuel L | $61,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,492 | $1,042,717 | $880,666 | $162,051 |

| 2024 | $11,492 | $1,022,272 | $863,398 | $158,874 |

| 2023 | $10,092 | $896,824 | $768,463 | $128,361 |

| 2022 | $9,981 | $879,240 | $753,395 | $125,845 |

| 2021 | $9,851 | $862,000 | $738,622 | $123,378 |

| 2020 | $8,940 | $774,180 | $650,802 | $123,378 |

| 2019 | $8,684 | $759,000 | $638,041 | $120,959 |

| 2018 | $8,732 | $759,000 | $638,041 | $120,959 |

| 2017 | $8,123 | $716,000 | $595,041 | $120,959 |

| 2016 | $8,211 | $716,000 | $595,041 | $120,959 |

| 2015 | $7,575 | $653,000 | $532,041 | $120,959 |

| 2014 | $6,163 | $546,000 | $425,041 | $120,959 |

Source: Public Records

Map

Nearby Homes

- 4823 Fieldbrook Ln Unit 24

- 9051 Cobblestone Ln Unit 40

- 4617 Alekona Ct

- 4842 Sapphire Way

- 9080 Bloomfield Ave Unit 31

- 9080 Bloomfield Ave Unit 237

- 9080 Bloomfield Ave Unit 223

- 9080 Bloomfield Ave Unit 79

- 9080 Bloomfield Ave Unit 126

- 9080 Bloomfield Ave Unit 33

- 9080 Bloomfield Ave Unit 72

- 9080 Bloomfield Ave Unit 209

- 9080 Bloomfield Ave Unit 77

- 9080 Bloomfield Ave Unit 135

- 9080 Bloomfield St Unit 231

- 9080 Bloomfield St Unit 145

- 4790 Montefino Dr

- 4326 Via Verde

- 9122 Windsor Cir

- 5000 Clementine Ln

- 4577 Everest Cir

- 4557 Everest Cir

- 4564 Shasta Cir

- 4554 Shasta Cir

- 4574 Shasta Cir

- 4587 Everest Cir

- 4547 Everest Cir

- 4566 Everest Cir

- 4584 Shasta Cir

- 4544 Shasta Cir

- 4576 Everest Cir

- 4556 Everest Cir

- 4537 Everest Cir

- 4597 Everest Cir

- 4586 Everest Cir

- 4546 Everest Cir

- 4534 Shasta Cir

- 4594 Shasta Cir

- 4596 Everest Cir

- 4536 Everest Cir