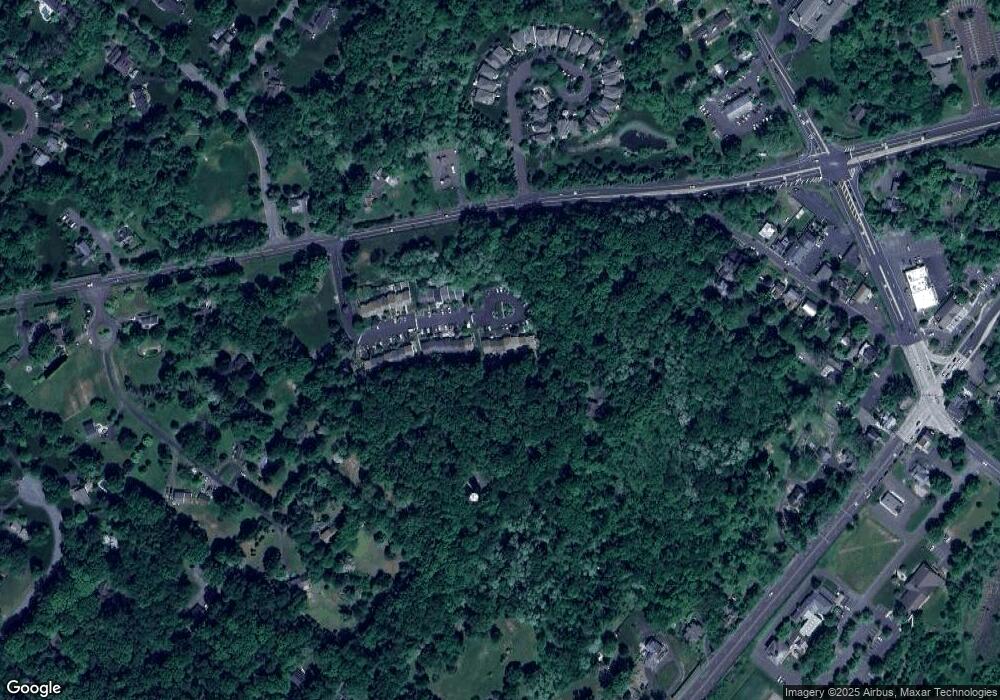

4633 Sands Way Buckingham, PA 18912

Estimated Value: $360,000 - $390,267

2

Beds

1

Bath

1,588

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 4633 Sands Way, Buckingham, PA 18912 and is currently estimated at $377,567, approximately $237 per square foot. 4633 Sands Way is a home with nearby schools including Buckingham Elementary School, Holicong Middle School, and Central Bucks High School - East.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2022

Sold by

Makara Linda A

Bought by

Roche Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,500

Outstanding Balance

$257,155

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$120,412

Purchase Details

Closed on

Jun 20, 2019

Sold by

Kroscavage Grace C

Bought by

Kroscavage Grace C and Makara Linda A

Purchase Details

Closed on

Nov 3, 2017

Sold by

Kroscavage Thomas E

Bought by

Kroscavage Thomas E and Kroscavage Grace C

Purchase Details

Closed on

Dec 23, 1987

Sold by

Cano Antonio and Marie Luisa

Bought by

Kroscavage Thomas E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roche Elizabeth | $305,000 | Cross Keys Abstract & Assuranc | |

| Kroscavage Grace C | -- | Doylestown Abstract Llc | |

| Kroscavage Thomas E | -- | Doylestown Abstract Llc | |

| Kroscavage Thomas E | $87,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Roche Elizabeth | $274,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,367 | $20,680 | $3,000 | $17,680 |

| 2024 | $3,367 | $20,680 | $3,000 | $17,680 |

| 2023 | $3,253 | $20,680 | $3,000 | $17,680 |

| 2022 | $3,214 | $20,680 | $3,000 | $17,680 |

| 2021 | $3,175 | $20,680 | $3,000 | $17,680 |

| 2020 | $3,175 | $20,680 | $3,000 | $17,680 |

| 2019 | $3,155 | $20,680 | $3,000 | $17,680 |

| 2018 | $3,155 | $20,680 | $3,000 | $17,680 |

| 2017 | $3,129 | $20,680 | $3,000 | $17,680 |

| 2016 | $3,160 | $20,680 | $3,000 | $17,680 |

| 2015 | -- | $20,680 | $3,000 | $17,680 |

| 2014 | -- | $20,680 | $3,000 | $17,680 |

Source: Public Records

Map

Nearby Homes

- 4604 Sands Way

- 2565 Bogarts Tavern Rd

- 2728 Red Gate Dr

- 2880 Snake Hill Rd

- 2799 Manion Way

- 5025 Anderson Rd

- 4350 Church Rd

- 3111 Burnt House Hill Rd

- 4871 E Blossom Dr

- 3146 Mill Rd

- 2479 Wheatfield Ln

- 3196 Mill Rd

- 4245 Mechanicsville Rd

- 1908 Durham Rd

- 3889 Robin Rd

- 5358 York Rd

- 5110 Harmony Ct W

- lot #3 next to 3739 York Rd

- 4928 Edgewood Rd

- 3772 Powder Horn Dr